Since the final quarter of 2022, risk-taking has returned strongly to financial markets. The consensus is to continue, but some observers are calling for caution as key indicators point to looming liquidity pressures in fiat currencies.

Bitcoin (BTC), the crypto asset (virtual currency) with the highest market capitalization, bottomed out at around $15,500 in November and then doubled to $31,000. Fidelity and others have also applied for bitcoin spot ETFs.

The tech-heavy Nasdaq index also bottomed out in late 2022 and has since risen nearly 50%, while the broader S&P 500 has risen 25% over the same period.

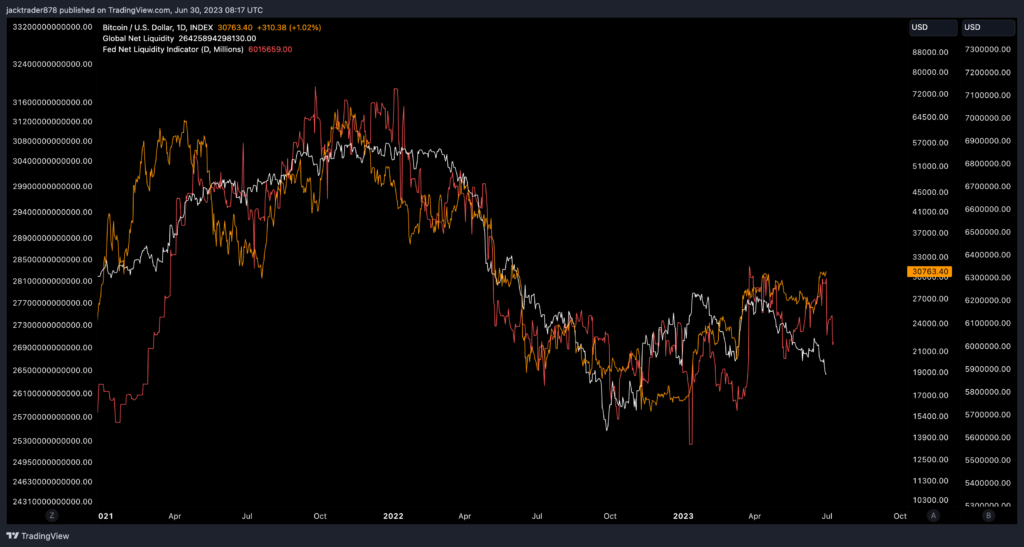

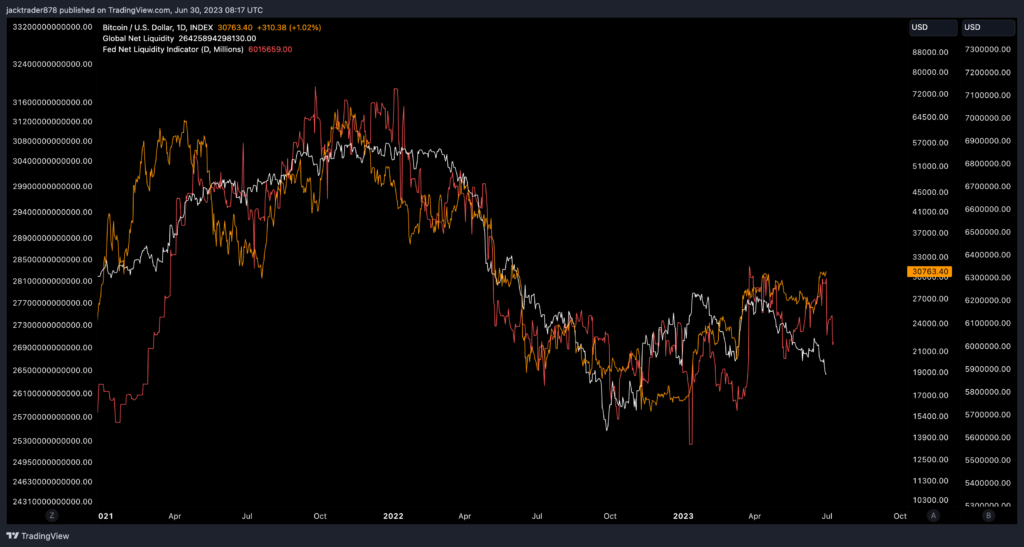

According to Lewis Harland, portfolio manager of crypto fund Decentral Park Capital, widely tracked statutory liquidity indicators such as the US Federal Reserve’s (Fed) net liquidity index and global net liquidity index The situation could get tricky as the currency’s liquidity indicators have fallen recently.

“Market liquidity indicators (global, U.S.) are declining and it would be unusual to see positive conditions for BTC as both liquidity indicators decline over the next few weeks,” Harland said. It was mentioned in the July 3rd Market Update.

“We believe this is the single biggest reason we are wary of BTC, despite the market’s bullish consensus, and that it is overlooked by investors,” Harland added.

The liquidity situation of fiat currencies has a significant impact on risky assets like Bitcoin and stocks. Historically, that tipping point has marked important peaks and troughs in market valuations of risky assets.

Fiat liquidity indicators have turned downward, ushering in tough times for risk assets, including crypto. (Decentral Park Capital, Lewis Harland)

Fiat liquidity indicators have turned downward, ushering in tough times for risk assets, including crypto. (Decentral Park Capital, Lewis Harland)Global net liquidity indicator, which takes into account the fiat supply of several major countries, falls to $26.5 trillion, the lowest level since November 2022, according to data from charting platforms TradingView and Decentral Park Capital bottom.

The Fed’s net liquidity indicator, which measures the amount of U.S. dollars available in the system, has fallen to $6 trillion from $6.3 trillion a few weeks ago.

Reserves held by the Fed are also declining, NorthmanTrader founder and lead market strategist Sven Henrich and Endeavor Equity Strategy founder Douglas Orr tweeted.

Banks use reserves to extend credit. A reduction in reserves therefore means tightening and could lead to risk aversion.

— Douglas Orr, CFA (@EquitOrr) June 30, 2023

The tweet shows the Fed’s holdings of bank reserves have been declining over the past few weeks, casting doubt on the sustainability of the S&P 500’s rally. So is Bitcoin.

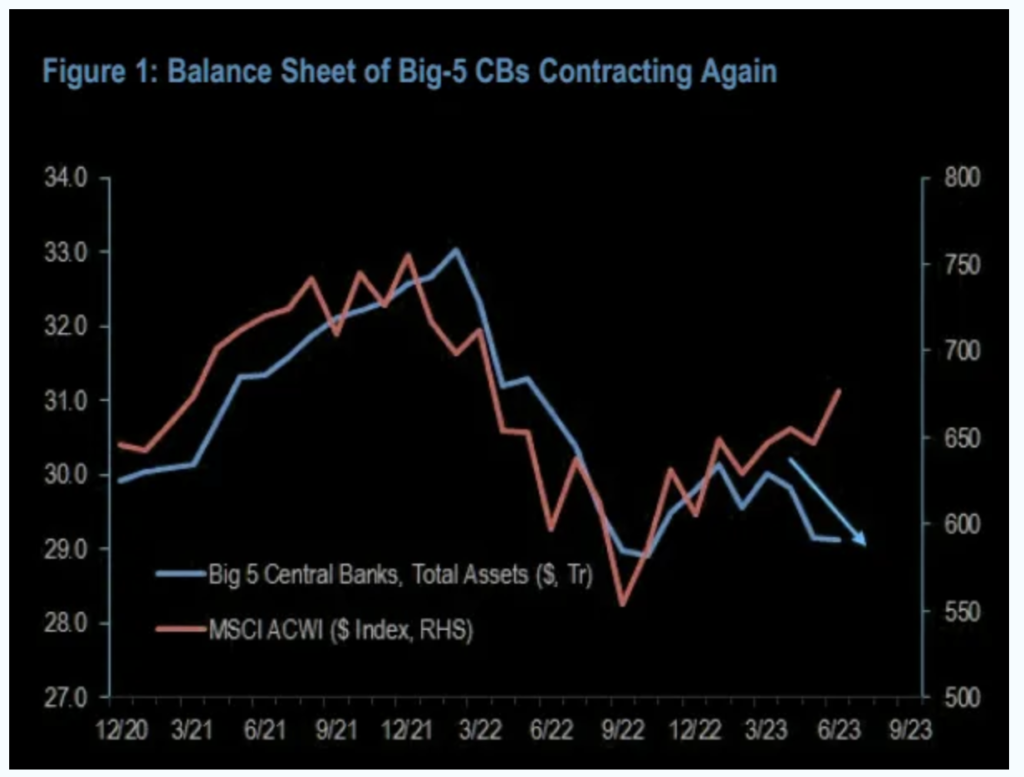

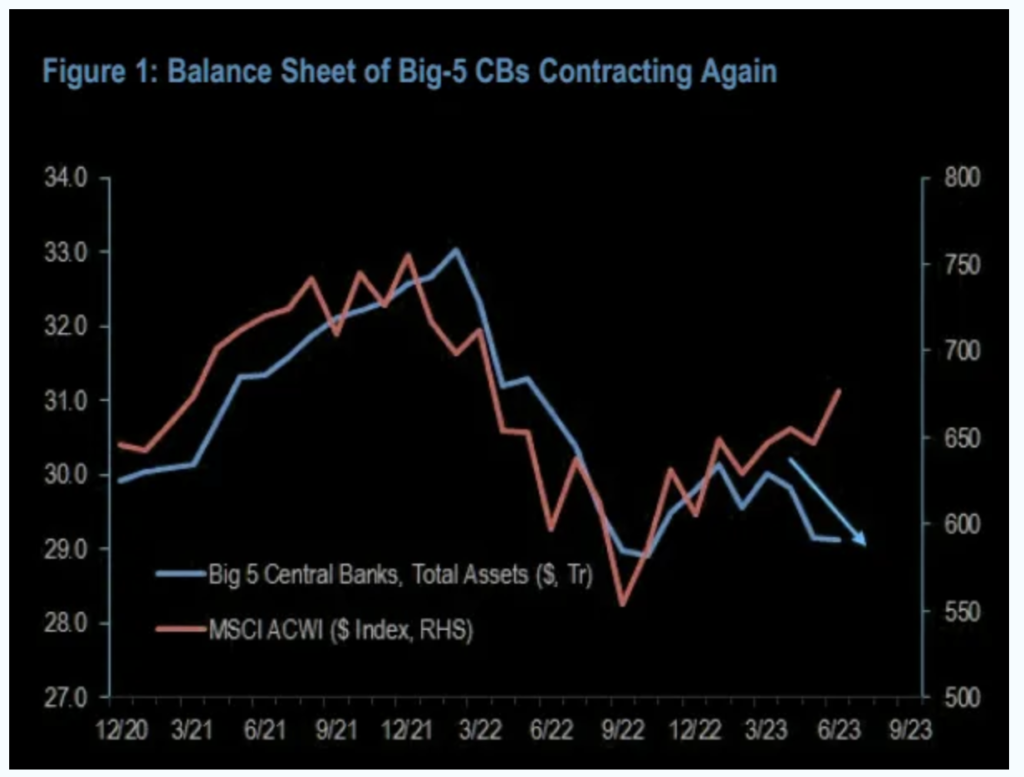

The same applies to the total assets of the MSCI All Country World Index (ACWI) and the five largest central banks (Fed, ECB, Bank of Japan, People’s Bank of China, Bank of England), which are measures of fiat liquidity. A divergence can be seen.

The MSCI All Country World Index (ACWI) is a stock index designed to measure broadly the performance of the global equity markets. (Markets & Mayhem)

The MSCI All Country World Index (ACWI) is a stock index designed to measure broadly the performance of the global equity markets. (Markets & Mayhem)Aggregate balances of the big five central banks are shrinking again, indicating liquidity pressure on risky assets.

“Central bank liquidity has started to decline and is likely to be a headwind going forward due to market correlations, especially (U.S.) Treasury issuance pulling liquidity out of the market,” said Anonymous Macro. Trader and investor Markets & Mayhem said in a Sunday newsletter that he pointed to the divergence between stocks and central bank balance sheets.

|Translation: CoinDesk JAPAN

|Editing: Toshihiko Inoue

| Image: Decentral Park Capital

|Original: Crypto Traders Cautious on Bitcoin as Fiat Liquidity Measures Point Lower

The post The liquidity of the world’s legal currencies is declining ──Is it a headwind for crypto assets | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

1 year ago

195

1 year ago

195

English (US) ·

English (US) ·