Development of LSDfi

Liquid staking is a mechanism that allows you to receive derivative tokens (LSD) issued 1:1 through smart contracts and operate them in DeFi while receiving staking rewards for crypto assets (virtual currencies).

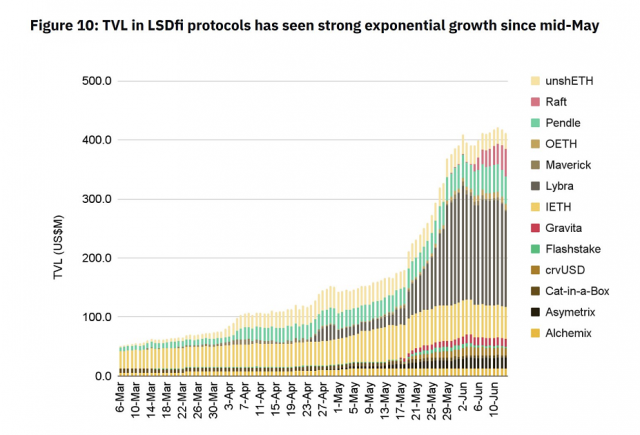

The DeFi ecosystem built for these liquid staking derivatives (LSDs), dubbed “LSDfi,” has seen rapid growth in total lock volume (TVL) over the past few months. According to Binance Research, TVL, which represents the total amount deposited in the protocol, has exceeded $ 400 million (as of June 14) for all LSDfi, and has more than doubled since mid-May 2023.

Source: Binance Research

connection:Liquid staking giant Lido uses NFTs to manage Ethereum withdrawals

Ethereum (ETH) currently dominates the market for LSDfi. While the total amount of ETH staked exceeds 22.8 million ETH (about 6 trillion yen), the total amount of liquid staking has also increased to 9.85 million ETH.

LidoFinance, one of ETH’s liquid staking providers, receives a liquid staking derivative “stETH” when users stake ETH, which can be used with LSDfi.

LSDfi ecosystem

LSDfi offers profit-seeking opportunities for LSD owners in a variety of ways. For example, there are basket-type index LSD of LSDs, CDP stablecoins issued with LSDs as backing assets, interest rate trading strategies, lending and borrowing money markets, etc.

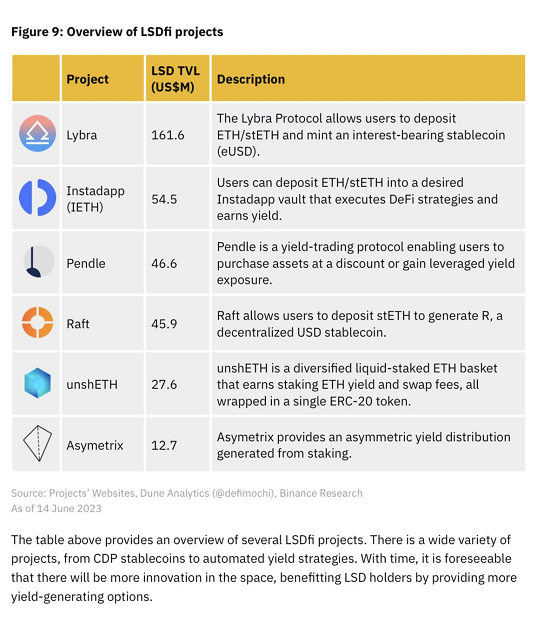

Among DeFi, the emerging LSDfi ecosystem sees the top five companies responsible for over 81% of TVL. Market leader Lybra just launched on the mainnet in April 2023. The main product features are as follows.

Source: Binance Research

- Lybra Protocol (TVL:161.6): Stablecoin (eUSD) issuance platform for depositing ETH/stETH and earning interest

- Instadapp (54.5): Choose a vault to deposit ETH/stETH and trade risk for returns from DeFi strategies

- Pendle (46.6): A decentralized exchange that can be operated by tokenizing only interest rates.You can operate with leverage on interest rates

- Raft (45.9): deposit stETH to generate decentralized USD stablecoin R

- unshETH (27.6): A protocol that aggregates all staking ETH into one unified asset, unshETH, for greater accessibility

- Asymetrix (12.7): Staking reward lottery with stETH pool

The LSDfi protocol’s total TVL is currently less than 3% of all DeFi, so the growth potential for LSDfi is huge.

As the adoption of liquid staking continues to grow, more LSDfi participants are expected. Notably, ETH’s staking ratio is currently at 16.1%, which is lower than the top 20 PoS chains’ average of 58.1%.

With the April 2023 upgrade of Chapela, a withdrawal function was implemented in ETH staking. ETH staking volume is increasing as it becomes easier for investors who have refrained from participating in the past. This trend is expected to contribute to further expansion of the market size of LSD and LSDfi.

On the other hand, LSDfi also has risks. One is “thrashing risk”, which is a penalty that occurs when staking requirements are neglected. Also, it should be noted that the price of the liquid staking token and the underlying asset may be de-pegged (dipeg) depending on smart contract risk and the regulatory environment.

connection:Ethereum Foundation Warns of Liquid Staking Risks for ETH

The post The market size of DeFi “LSDfi” for liquid staking has doubled from the previous month appeared first on Our Bitcoin News.

1 year ago

76

1 year ago

76

English (US) ·

English (US) ·