- The purchasing power of stablecoins is rising.

- Stablecoins sent to cryptocurrency exchanges are also increasing.

- Stablecoin movements can hint at Bitcoin and Ethereum price movements.

As Bitcoin (BTC) and Ethereum (ETH) continue their rally, stablecoins may provide powerful hints about the duration and extent of the rally.

Bitcoin and Ethereum’s gains paused on the 22nd, but have risen 18% and 14% respectively since the 15th.

Of the several macroeconomic data, the number of initial unemployment claims released on Wednesday could have had the most impact on the market, but it was only marginally higher than expected and not enough to move the market. . The number of initial unemployment claims filed for the week ended March 17 was 264,000, slightly above the 260,000 expected.

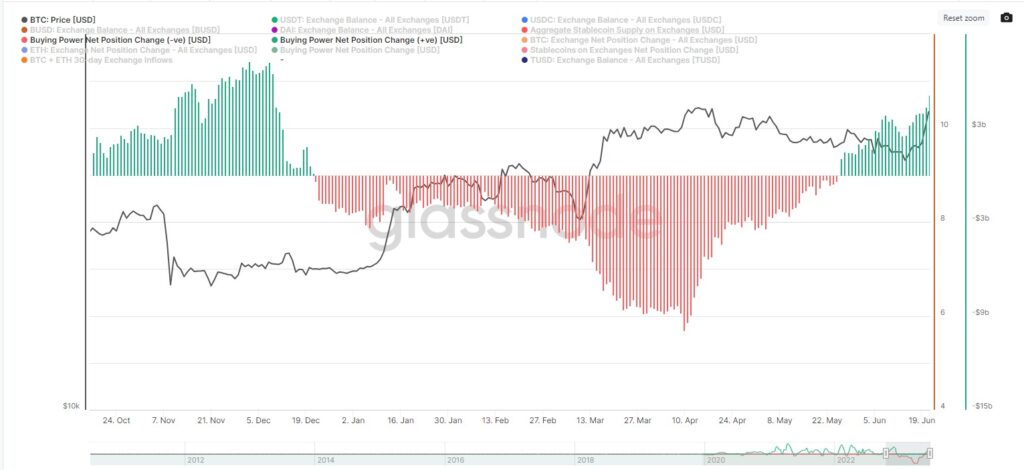

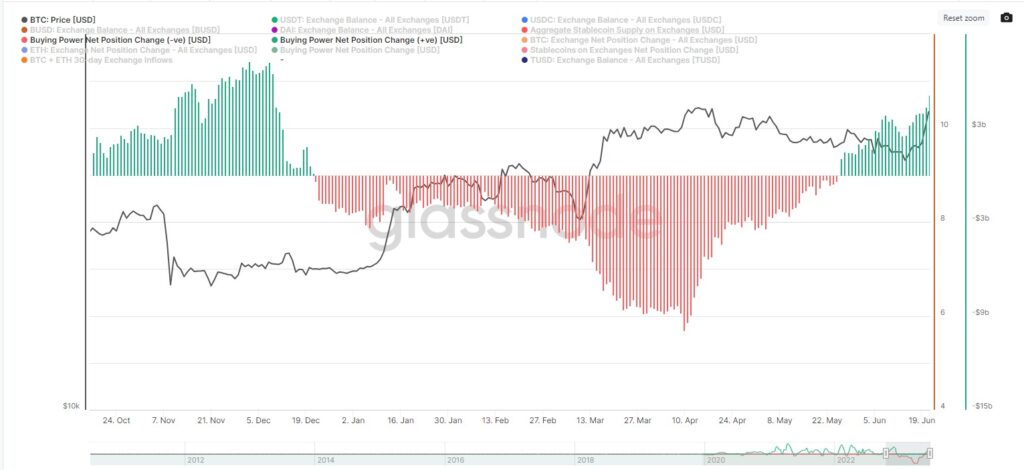

Increased travel to exchanges

Stablecoin movements usually give hints of market movements, but they can have a more direct impact and portend cryptocurrency price movements.

Stablecoins held by exchange addresses have increased 5.6% since June 14, according to blockchain analytics firm Glassnode. This increase ends a sharp decline that began in December 2022.

Stablecoins are often used to purchase crypto assets. The increase in stablecoins sent to exchanges represents increased purchasing power and bullish sentiment.

Glassnode

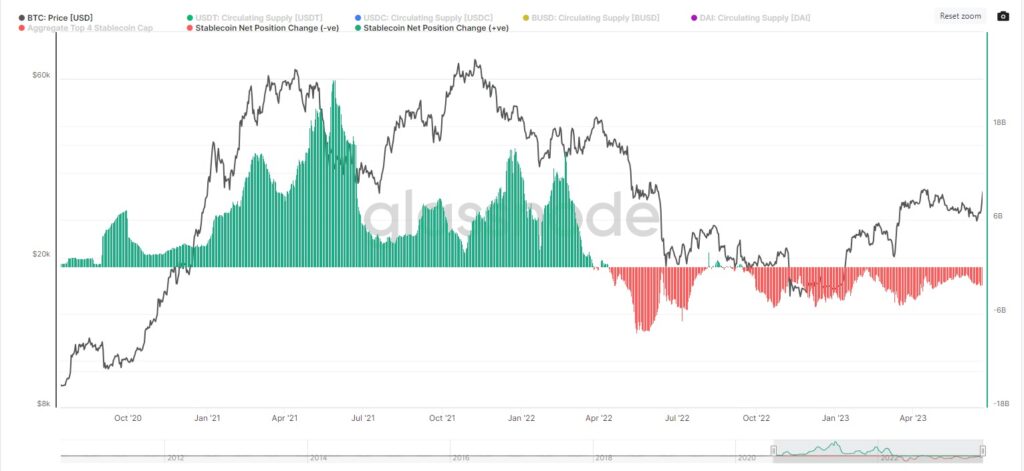

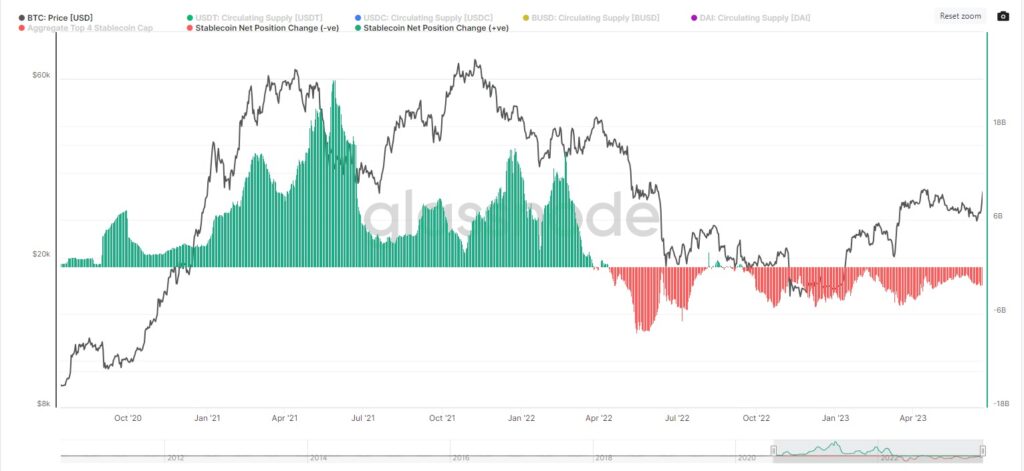

Glassnodenet position change

Stablecoin net position change remains negative. Net Position Change is a 30-day measurement of stablecoin changes across blockchains.

If investors acquire a lot of stablecoins, the numbers will go up and become something that investors should stop.

Stablecoin net position change has been negative since April 2022 after 20 months of positive growth.

Glassnode

GlassnodeIncreased purchasing power

Purchasing power on stablecoin exchanges turned positive, ending a six-month negative trend. The metric measures changes in stablecoin flows on exchanges relative to Bitcoin and Ethereum flows.

A return to positive indicates that the purchasing power of the stablecoin is rising.

The first and third indicators show a gradual increase in demand for Bitcoin and Ethereum. If the second metric rises, it would indicate more capital to invest in Bitcoin and Ethereum.

Glassnode

Glassnode|Translation: coindesk JAPAN

|Editing: Takayuki Masuda

| Image: Glassnode

|Original: Stablecoin Movement May Hint Strongly at Asset Prices’ Path Forward

The post The movement of stable coins is a hint for price movements of Bitcoin and Ethereum | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

2 years ago

100

2 years ago

100

English (US) ·

English (US) ·