Virtual currency market from 7/8 (Sat) to 7/14 (Fri) this week

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

table of contents

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

Weekly report from 7/8 (Sat) to 7/14 (Fri):

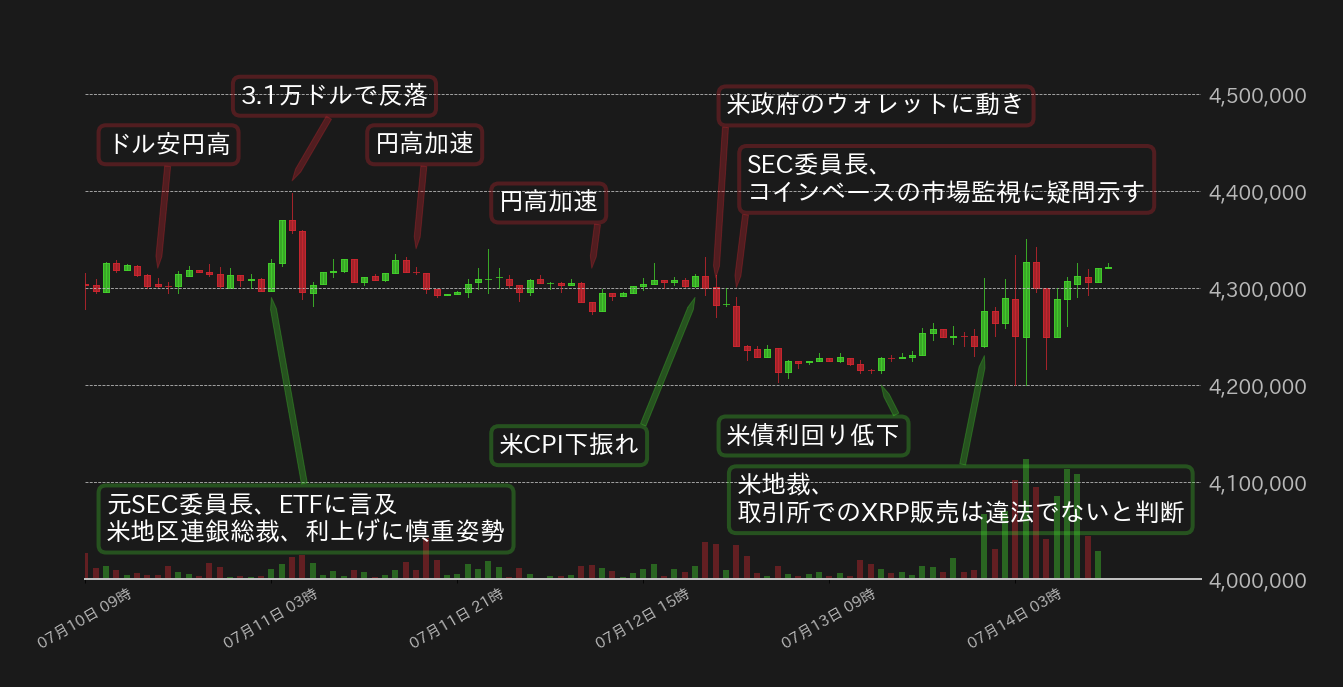

The Bitcoin (BTC) exchange rate against the yen this week has remained steady from beginning to end, and as of noon on the 14th, it is moving in the lower 4.3 million yen range.

At the beginning of the week, BTC in dollar terms began with a steady return from the milestone of $30,000, but as the dollar weakened and the yen strengthened in the foreign exchange market, the yen-denominated BTC market rose to support 4.3 million yen. started with heavy development.

On Monday, former US Securities and Exchange Commission (SEC) Chairman Jay Clayton said that it would be difficult to deny approval of a physical Bitcoin exchange-traded fund (ETF). Atlanta Federal Reserve Bank President Raphael Bostic showed a cautious stance on further interest rate hikes. rice field.

After that, BTC continued to trend higher against the dollar due to the June US consumer price index (CPI) deceleration forecast announced on the 12th. YYC) With the rapid depreciation of the dollar and the appreciation of the yen due to the correction observation, BTC against the yen continued to trade around 4.3 million yen with a heavy topside.

In the US CPI, both the headline and core indices fell short of market expectations, but there was movement in BTC seized from the Silk Road by the US government, and SEC Chairman Gensler told the media that Coinbase As a result of the remarks that doubted the ability of Bitcoin to monitor the market, expectations for the approval of the physical Bitcoin ETF receded, and the market price was temporarily pushed to 4.2 million yen.

On the other hand, on the 13th, after the U.S. federal district court ruled that the sale of XRP through exchanges did not violate federal securities laws, the XRP market suddenly surged, and BTC also increased.

[Fig. 1: BTC vs Yen chart (1 hour)]

Source: Created from bitbank.cc

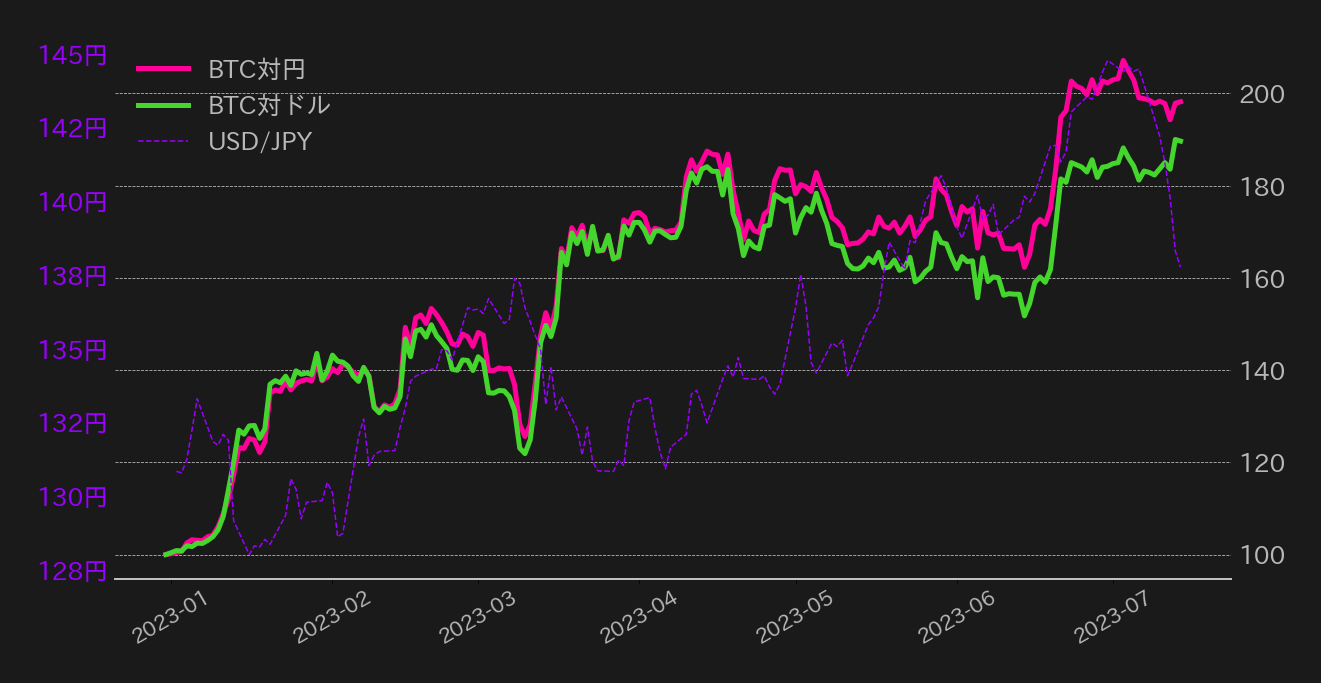

Ripple’s partial victory against the SEC (the direct sale of XRP to institutional investors was judged to be an investment contract), the downswing of the US CPI and the wholesale price index (PPI), and strong factors unique to the industry Although the macroeconomic tailwinds were confirmed during the week, BTC’s price movement against the yen was dull due to the rapid depreciation of the dollar against the yen (Fig. 2).

[Fig. 2: Indexed charts of BTC vs. Yen and vs. USD and USD/JPY chart (Daily BTC indexed to 100 at the end of 2022)]

Source: Created from bitbank.cc, Glassnode, FRED

On the other hand, on the 13th, BTC against the US dollar tried to break out from the high price range even though it failed to renew the year-to-date high at the closing price. Unlike the previous week, an increase in trading volume accompanied the $31,000 mark, so is the breakout momentum increasing?

On the other hand, amidst concerns over the acceleration of BTC cash sales by miners since last month, Bitcoin’s difficulty will exceed 230Z (Zeta) for the first time this week, and the hash rate will drop, so concerns about supply and demand cannot be dispelled.

Although no particular increase in BTC remittances from miners to exchanges has been confirmed compared to recent years, according to Glassnode data, more than 2,000 BTC are being remitted daily from miners to exchanges. there is

BTC/USD has been failing to make a clear breakout above $31,500 since last month. However, it has been pointed out that if the selling pressure at the same level is successfully shaken off, the market will follow the topside, and from a chart perspective, the next few days will be an important phase where we must keep an eye on the market.

connection:bitbank_markets official website

Last report:Fed’s interest rate hike heightened sense of caution, downside prospects

The post The next few days will be an important phase where you can’t take your eyes off the Bitcoin market|bitbank analyst contribution appeared first on Our Bitcoin News.

2 years ago

118

2 years ago

118

![Will Cardano [ADA] reach $1? – Examining KEY resistance levels ahead](https://ambcrypto.com/wp-content/uploads/2025/07/62336002-1096-4851-B274-A4EA1D45D138.webp)

English (US) ·

English (US) ·