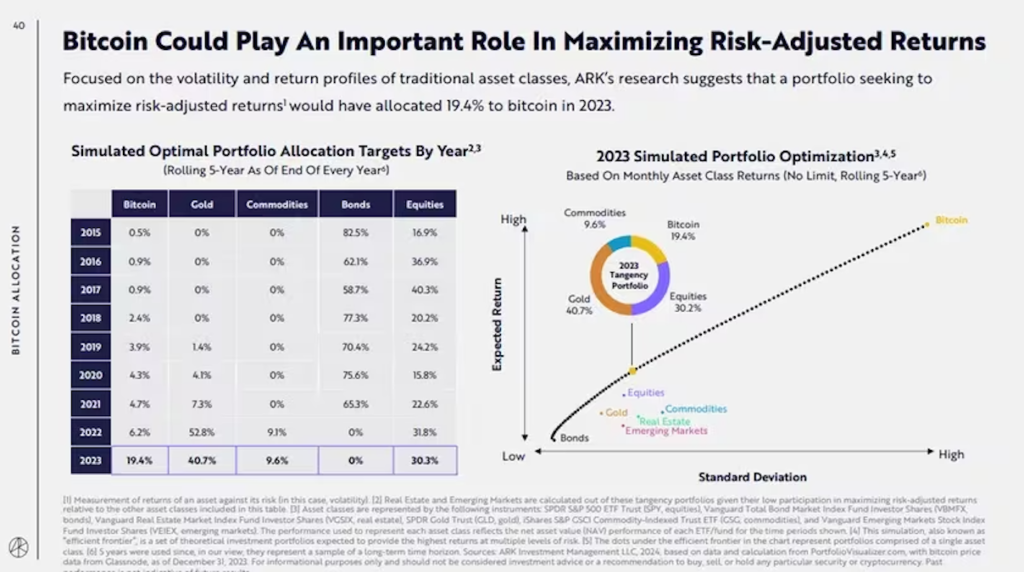

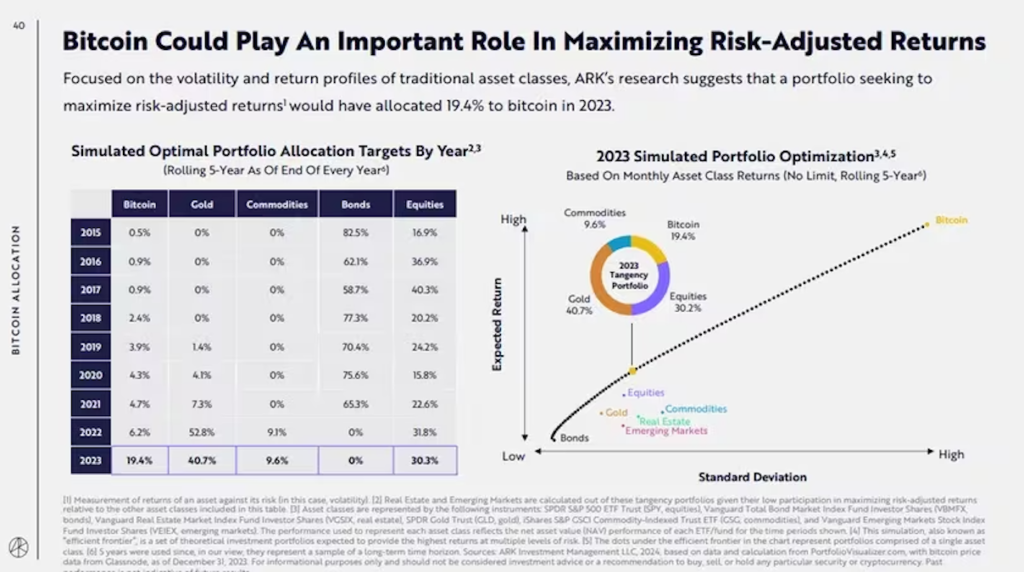

Cathie Wood’s ARK Invest says in its 2024 annual report that investing in Bitcoin (BTC) is an effective diversification option against traditional asset classes, and that investment The optimal allocation in a portfolio is just under 20%.

“Bitcoin has far outperformed major asset classes in annualized returns over the past seven years, with the optimal allocation rising to 19.4% in 2023,” says Ark’s annual report “ARK Invest Big Ideas 2024.” ” is written. “Based on our analysis, allocating 19.4% to Bitcoin in 2023 would have maximized the risk-adjusted return of the portfolio.”

The optimal allocation was 0.5% in 2015 and 6.2% in 2022.

“Bitcoin is not just a new investment option, it is an essential element for diversifying your investment portfolio, offering unprecedented growth potential among digital assets,” the company added.

(ARK Invest Big Ideas 2024)

(ARK Invest Big Ideas 2024)The low 5-year correlation between Bitcoin and traditional assets of 0.27 emphasizes the benefits of diversified investment, and the huge 250 trillion dollar (approximately 3,250 trillion yen, exchange rate of 1 dollar = 145 yen) Given the world’s investable assets, even minimal allocations by institutional investors can have a noticeable impact on their prices, Ark writes.

BTC, the top cryptocurrency by market capitalization, has risen 77.8% over the past year, according to data from CoinDesk Indices.

JPMorgan (JPMorgan) said in a recent report that Bitcoin’s recent outperformance and year-to-date highs are due to increased demand from institutional investors, which has seen significant capital flow into large wallets. This was highlighted by strong inflows and a sharp rise in Bitcoin futures on the Chicago Mercantile Exchange (CME), which is primarily used by institutional investors.

But this institutional investor-led rally may be nearing an end. The guppy indicator that triggered Bitcoin’s 70% rally in late 2023 is now signaling a possible bearish downturn.

The Ark report also points out that the “crypto asset winter” from 2022 to 2023 is almost over. FTX recently announced plans to fully repay creditors, and Celsius will distribute $3 billion and allocate stock to new ventures as part of its bankruptcy resolution.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Shutterstock

|Original text: ARK Invest Says Optimal Bitcoin Portfolio Allocation for 2023 Was 19.4%

The post The optimal Bitcoin allocation in 2023 was 19.4%: US Ark | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

77

1 year ago

77

English (US) ·

English (US) ·