Bitcoin (BTC) and tech have risen even as the US Consumer Price Index (CPI) reignited concerns about the Fed’s hawkish policies, pushing US Treasury yields higher. Risk assets such as the stock-heavy Nasdaq Composite unexpectedly performed positively.

Rising bond yields make borrowing more expensive, so traders typically ditch risky assets in favor of fixed-income securities, as we saw in 2022. But on February 14, when the 10-year Treasury yield jumped more than 0.12% to its highest level in more than a month, bitcoin climbed about 2% above $22,000 and the Nasdaq also dropped to 0.7. %Rose.

Inflation slowed slightly in January from the previous month, but the cooling was moderate, according to CPI data. That pushes the 2-year yield to a two-month high of 4.64%, and traders expect a similar move in March and May, with the Fed raising rates by 0.25% in June. I strengthened my view.

After four consecutive 0.75% hikes in 2022, the Fed hiked rates by 0.5% in December and 0.25% in January. This fast-paced tightening cycle has greatly shook risk assets, including crypto assets (virtual currencies) in 2022.

QCP Capital’s market research team told CoinDesk that “risky assets have been linked to implied volatility, which fell sharply after the CPI was announced.” “Unless the Fed panics and returns to 0.5% rate hikes, it will be a slow rollout and will continue to benefit equities through higher earnings.”

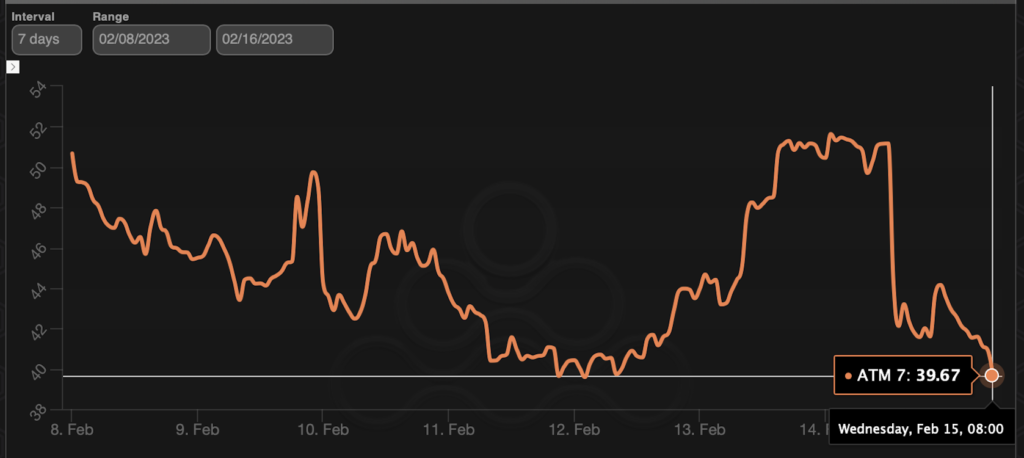

After the CPI announcement, the level of uncertainty indicated by the implied volatility decreased, paving the way for higher prices. (Amberdata)

After the CPI announcement, the level of uncertainty indicated by the implied volatility decreased, paving the way for higher prices. (Amberdata)Implied volatility is the period of price volatility expected by the options market and is often equated with uncertainty.

According to Amberdata, Bitcoin’s 7-day implied volatility dropped significantly from 50% to 40% annually after the CPI announcement, paving the way for crypto assets to follow the rise of tech stocks.

Moreover, while inflation remains stubbornly high, the economy remains resilient, which is another reason risk assets are rising. Goldman Sachs CEO David Solomon said on February 14 that the outlook for the U.S. economy had improved for a soft landing. A soft landing, meaning that economic activity deteriorates periodically but does not culminate in a full recession, is measured by successive contractions in growth from quarter to quarter.

According to Singapore-based QCP, “Bitcoin’s resilience may be fleeting if the Fed starts to look like it will raise the median dot plot at its March meeting.” At its December meeting, the median dotplot forecast rates at 5.125% at the end of 2023.

Noelle Acheson, author of the popular newsletter “Crypto Is Macro Now,” believes Bitcoin’s resilience will reduce volatility in the broader market and have a positive impact on liquidity. said to be due to

“Crypto represents the purest liquidity among risk assets,” Acheson told CoinDesk in a Telegram chat. “Liquidity does not depend solely on falling interest rates, but rather on volatility (low volatility tends to reduce collateral requirements, and both the VIX and fixed-income VIX MOVE indexes are headed lower) and oil prices (energy It will also be affected by factors such as lower spending on liquidity, which releases more liquidity,” he said.

Unlike stocks, crypto assets don’t have to worry about underperforming and aren’t affected by a surge in bond issuance and the resulting rise in yields, Acheson said.

Griffin Ardern, a volatility trader at crypto manager Blofin, said market maker actions pushed bitcoin higher after the release of CPI data.

A market maker is an individual or entity contractually obligated to maintain a healthy level of liquidity on an exchange. They typically stand on the other side of an investor’s trades and maintain a delta-neutral book that requires active management.

According to Ardern, investors were buying put options on BTC (i.e. betting that the price would go down) before the CPI announcement, so market makers sold puts and bitcoin on the spot and futures markets, Hedging the risk of falling prices. As a result, market makers had to buy back the bitcoin they sold when the price started to rise after the CPI announcement.

“That’s what pushed the price up even more,” Ardern told CoinDesk.

Bitcoin was trading above $22,200 at the time of writing.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

|Image: Amberdata

|Original: Explaining the Disconnect Between Bitcoin and Treasury Yields Post US Inflation Data

The post The reason why Bitcoin rose after the US CPI announcement ── Despite the rise in US bond yields | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

182

2 years ago

182

English (US) ·

English (US) ·