The total amount of funds raised by startups using blockchain in Africa in 2022 was 474 million dollars (about 64 billion yen), more than five times higher than the previous year. The report was compiled by Switzerland-based venture capital firm CV VC.

According to the report “Africa Blockchain Report 2022”, the number of funds raised by blockchain-related startups was 29, a slight increase from 26 last year. The total amount raised has surged from $89.6 million in 2021. The research report covers publicly disclosed funding rounds of $100,000 or more.

Unlike Europe, the United States, and Japan, African countries do not have adequate financial and social infrastructure, and there are many unbanked populations who do not even have a bank account. The situation continues where it is not possible to freely settle in dollars at a low cost. In order to solve these major social issues, startups that make full use of blockchain are being born one after another, mainly in Nigeria, South Africa, and Kenya.

Seychelles ranked first by country, and “exchanges” ranked first by industry

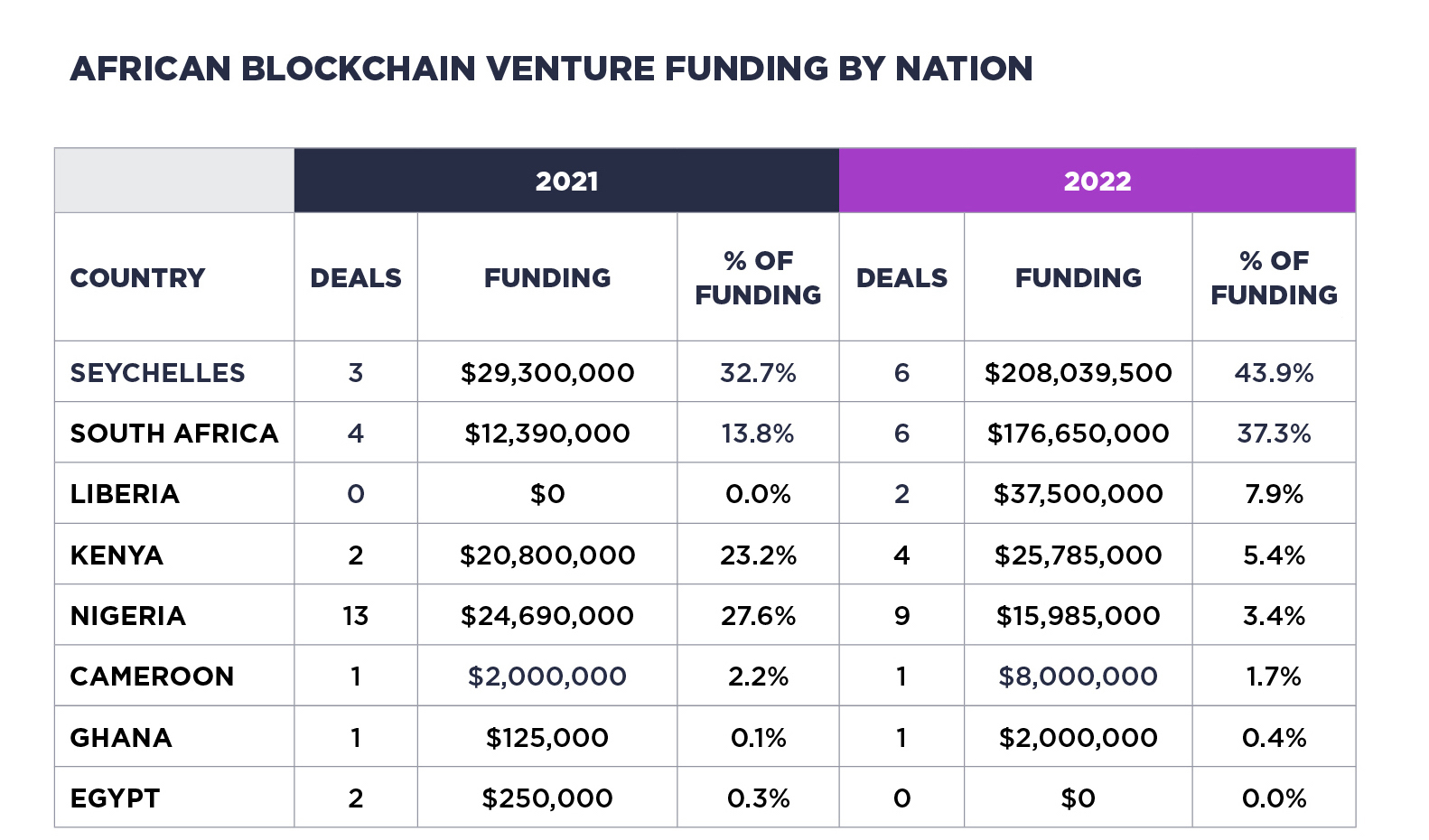

Blockchain Venture Investment: By Country / From CV VC Report

Blockchain Venture Investment: By Country / From CV VC ReportBy country, the Seychelles Islands, which have a zero corporate tax rate, raised the largest amount of $208 million, accounting for 43.9% of the total. South Africa followed with $177 million. West Africa’s Liberia came in third with $37.5 million. Nigeria, the second-largest fund-raiser in Africa last year, came in fifth, with $16 million in total funding, according to the report.

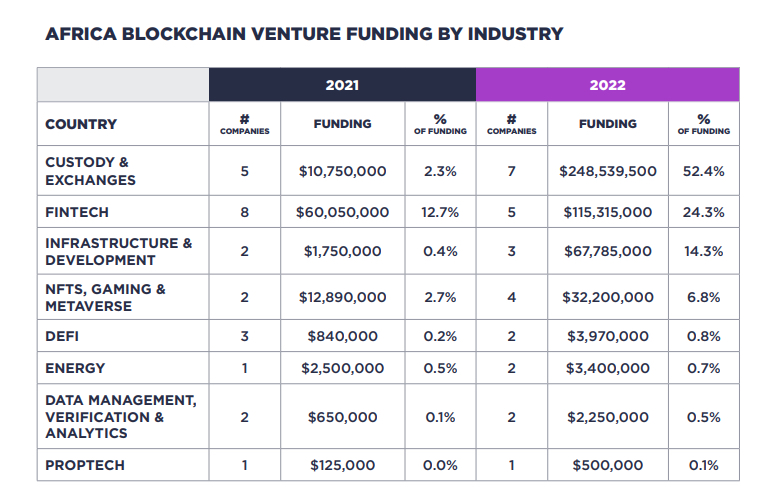

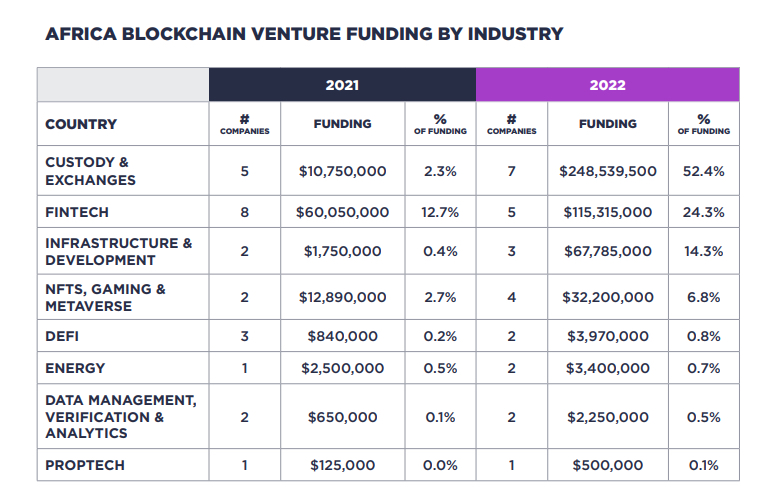

By industry, “crypto asset (virtual currency) exchange/custody (management/custody)” accounted for 52% of the total, raising $249 million. The “fintech” category, such as payments, was the second largest, attracting $115 million. The “Games/NFTs/Metaverse” segment attracted $32 million, accounting for 7% of the total.

Blockchain Investment: By Industry / From CV VC Report

Blockchain Investment: By Industry / From CV VC ReportAccording to an interview with Africa’s Web3 News Data “NODO”, among the owners of micro businesses that use services developed by blockchain startups in Nigeria’s largest city, Lagos, US dollars are used for settlements with overseas companies. The number of cases of using the linked stable coin “USDT (Tether)” is increasing.

In addition, the consumer price index (CPI) announced by the country’s statistics bureau stood at 22.04% as of March, showing no signs of slowing down inflation. The instability of Nigeria’s legal currency “Naira” is constant, and there are a certain number of individuals who try to protect their assets by replacing Naira with crypto assets such as Tether and Bitcoin.

Compiled by Singapore’s Triple AdataAccording to the report, the United States has the most cryptocurrency holders in the world, with 46 million people. Nigeria, with a population of 210 million, is the fourth largest, with 22 million using crypto assets.

South African startups and the crypto landscape

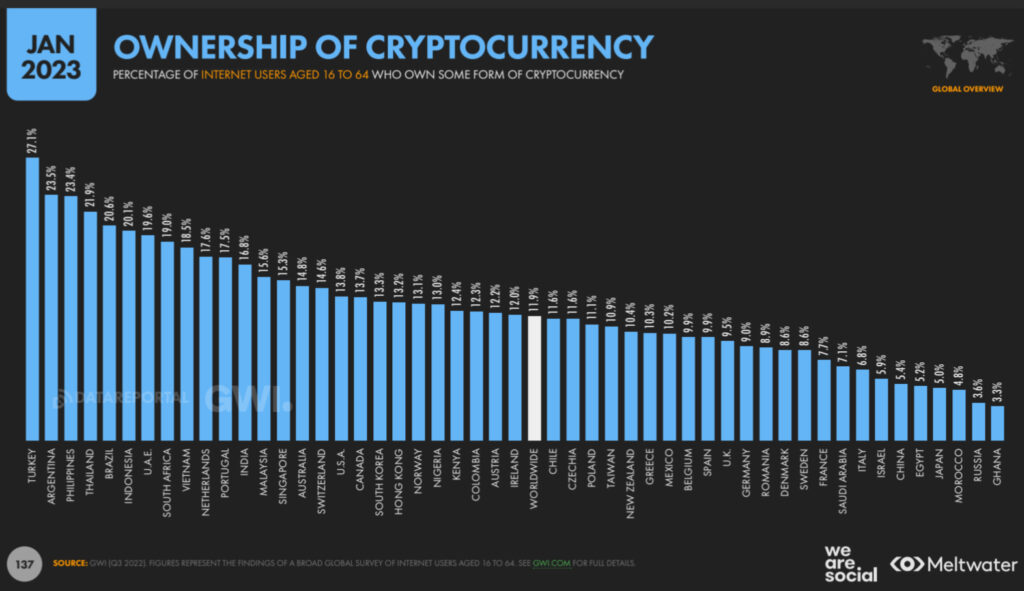

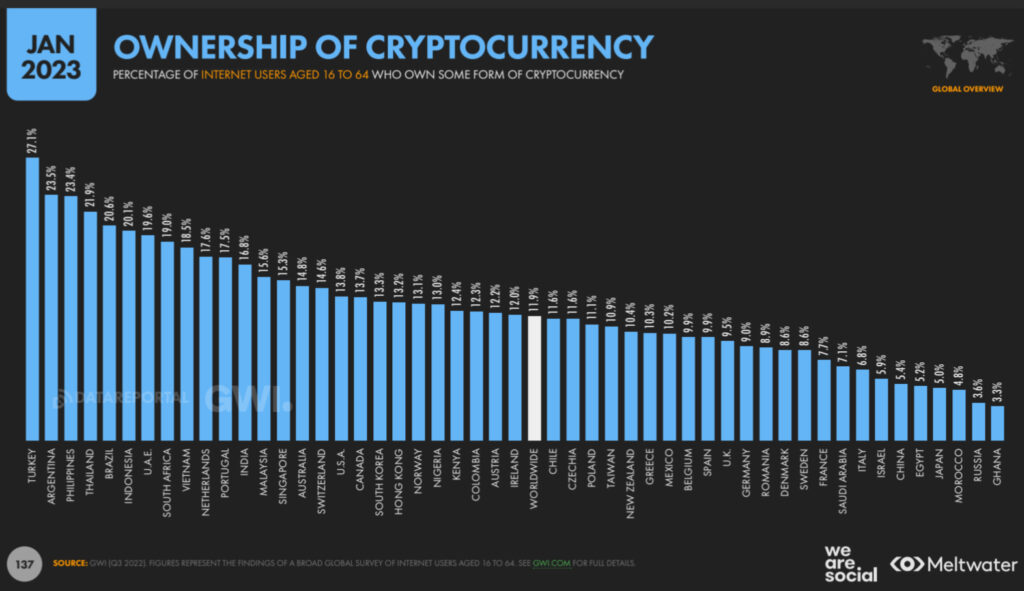

Percentage of Internet Users Holding Crypto Assets / From Meltwater Report

Percentage of Internet Users Holding Crypto Assets / From Meltwater ReportMeanwhile, according to Meltwater’s Global Digital Report 2023, released this year, South Africa has 19% of internet users aged 16-64 holding crypto assets, making it the country’s highest value on the African continent. is the highest. This is followed by Nigeria at 13% and Kenya in East Africa at 12.4%. America is 13.8%, Japan is 5%.

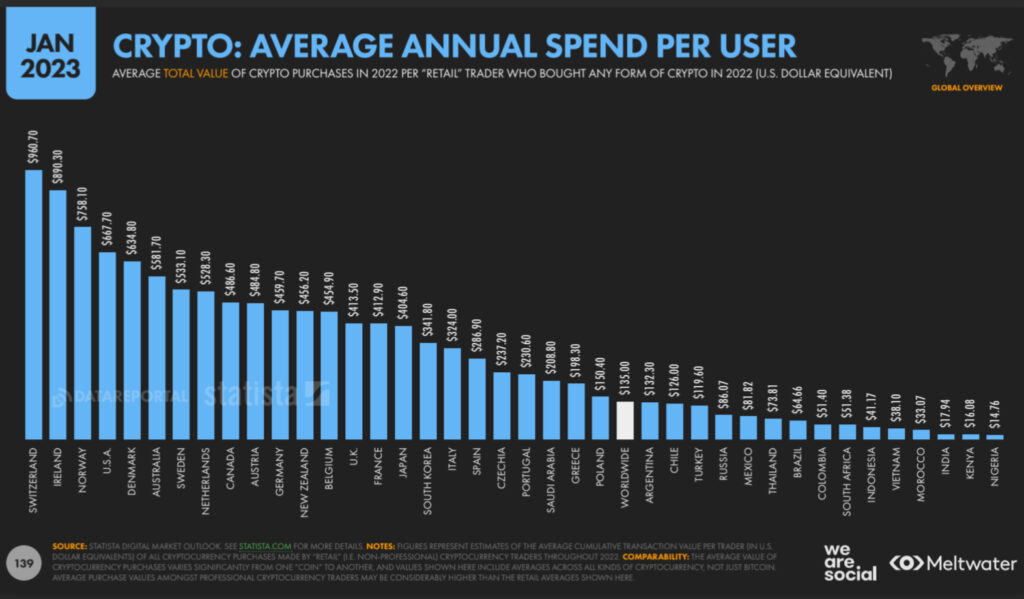

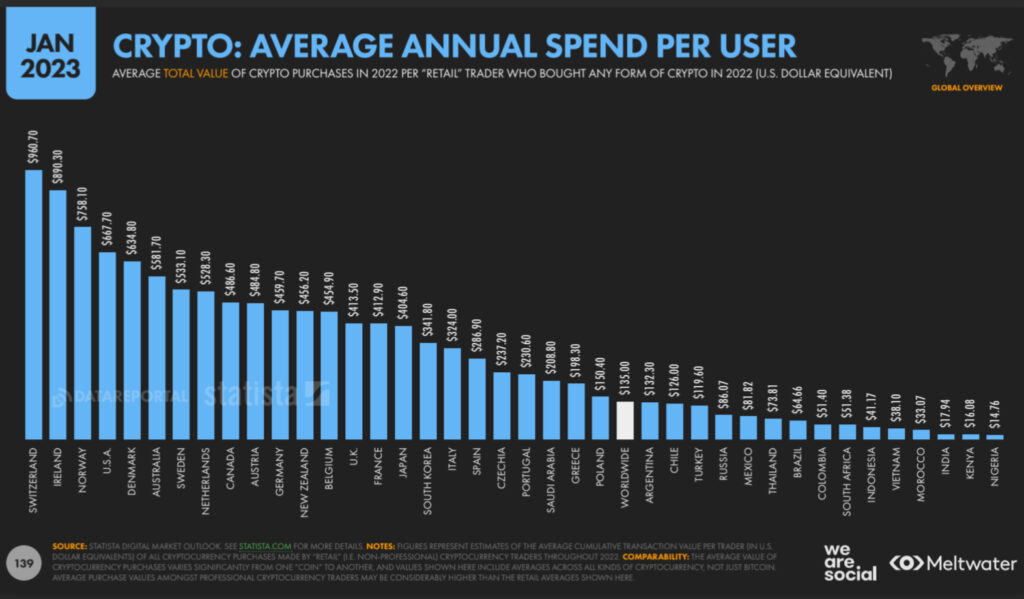

Also, looking at the average amount of crypto assets purchased by individual traders by country last year, South Africa was the highest in Africa at $341.8, far ahead of second place Morocco ($33.07). This is followed by Kenya at $16.08 and Nigeria at $14.76.

The highest average annual purchase was $960.70 in Switzerland, where the government backs blockchain and crypto assets (Global Digital Report).

Average amount of crypto assets purchased by individual traders in 2022 / Meltwater report

Average amount of crypto assets purchased by individual traders in 2022 / Meltwater reportDriving from the suburban airport to the business district of Cape Town, South Africa, you will see a large signboard for the cryptocurrency trading service “LUNO” at the top of a skyscraper. In addition to trading services, in Cape Town, which suffers from a constant power shortage, there are startups that develop a mechanism that allows them to invest in solar power using NFTs.

Under the economic and social infrastructure that is unimaginable in Japan, in Africa, which has a population of 1.4 billion people, startups that are trying to promote leapfrogging economic growth by making full use of blockchain continue to be born. . In addition, the spread of smartphones on this continent is relatively fast, so the spread of the token economy may accelerate further in the future.

Shigeru Sato: Currently serves as Chief Content Officer at Africa Web3 News & Discovery Platform “NODO”. After working as a financial and business reporter at Bloomberg and Dow Jones, she became deputy editor-in-chief of Business Insider Japan before becoming editor-in-chief of coindesk JAPAN in 2019. He will participate in the establishment of NODO in January 2023. Graduated from California State University.

|Text: Shigeru Sato

| Image: CV VC, Meltwater, shutterstock

The post The reason why blockchain startup funding has increased fivefold in Africa | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

100

2 years ago

100

English (US) ·

English (US) ·