Liquid staking, the ability to lock crypto assets (virtual currencies) on blockchain networks for rewards while preserving liquidity, is now larger than DeFi lending and borrowing.

According to DeFi Llama, the total amount of crypto assets deposited in the Liquid Staking protocol was $14.1 billion as of February 27, making it the second largest crypto sector. The total amount locked in the DeFi lending protocol was $13.7 billion (approximately ¥1.868 trillion), ranked third, and decentralized exchanges with deposits of $19.4 billion (approximately ¥2.65 trillion) ranked first. rice field.

Investor interest in liquid staking has increased as Ethereum’s “Shanghai” upgrade is coming soon, allowing stakeholders to withdraw their first-ever staked Ethereum (ETH) and accumulated rewards. ing. Liquid staking is the best performer in the crypto space this year, with Total Value Lock (TVL) growth approaching 60%.

“The upgrade will revolutionize this space by enabling healthy competition among liquid staking solutions, strengthen ETH’s position by offering yields from staking/unstaking, and provide users with It will give you the security to maintain sovereignty over your assets,” Messari CEO Ryan Selkis said in a newsletter released Feb. 24.

Opening up the withdrawals is expected to improve overall liquidity. Since December 2020, more than 16.5 million ETH have been staked on Ethereum’s Beacon Chain, 42% of which is locked by the liquid staking protocol led by Lido Finance.

Users of liquid staking protocols like Lido can receive derivative tokens like staked Ethereum (stETH) at a 1:1 ratio. These derivative tokens represent a user’s stake and can be used to generate additional yield across DeFi protocols. Lido’s governance token, LDO, is up 220% this year, beating industry leaders Bitcoin (BTC) and Ethereum by a wide margin. Lido’s rivals Rocket Pool and Frax Finance’s governance tokens have also surged, according to CoinDesk data.

The popularity of liquid staking compared to decentralized lending may be due to the yield differential between the two sectors.

Lido, which controls over 75% of the liquid staking market, offers 4.8% APR (annualized yield) for staked Ethereum, 6% for Solana (SOL) and 6.3% for Polygon (MATIC). . This is higher than the interest rate for lending stablecoins USDT, USDC and DAI on DeFi giant Aave.

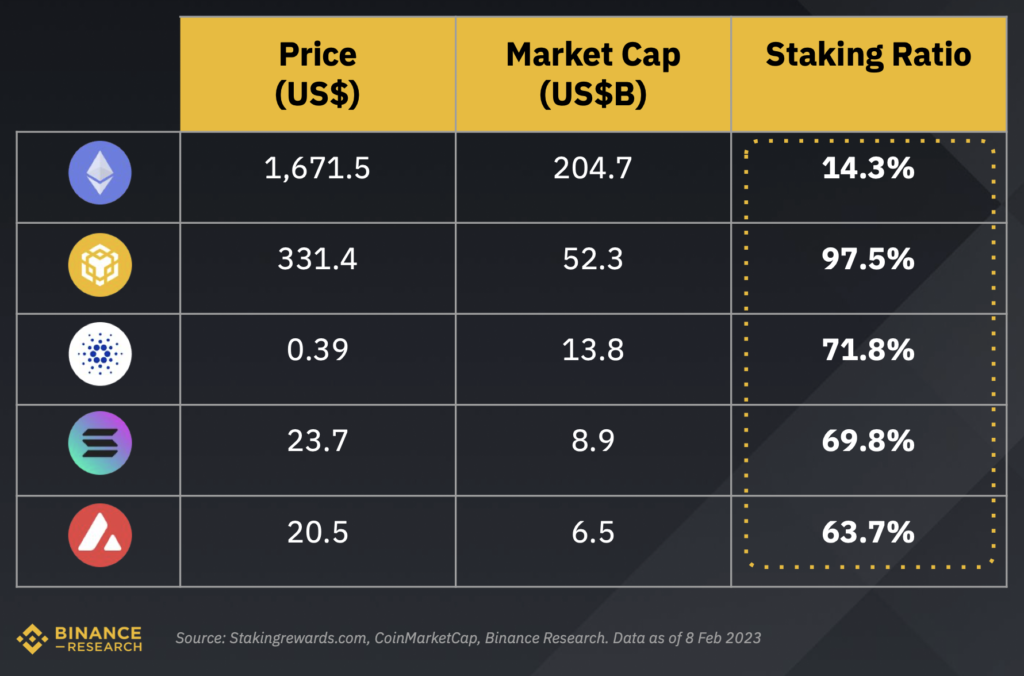

Liquid staking is expected to grow further as ETH’s staking ratio, which indicates the percentage of the cryptocurrency supply that is staked, is significantly lower than other layer 1 cryptocurrencies.

“Currently, only 14% of ETH is staked, compared to the average Layer 1 coin of 58%. Chief Markus Thielen told CoinDesk.

Ethereum’s staking ratio is significantly lower than other tokens. (Binance Research)

Ethereum’s staking ratio is significantly lower than other tokens. (Binance Research)Binance Research recently made a similar opinion, predicting more money flowing into the staking protocol after the Shanghai upgrade.

“We can say that many individuals and groups have been waiting for Shanghai to stake ETH as the withdrawal removes liquidity risk and the uncertainty of a hitherto undefined lockup period,” Binance Research said. said in a report in early February.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

| Image: DeFi Llama

|Original: Liquid Staking Replaces DeFi Lending as Second-Largest Crypto Sector

The post The scale of liquid staking expands to about 2 trillion yen ── second place, surpassing DeFi lending | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

143

2 years ago

143

English (US) ·

English (US) ·