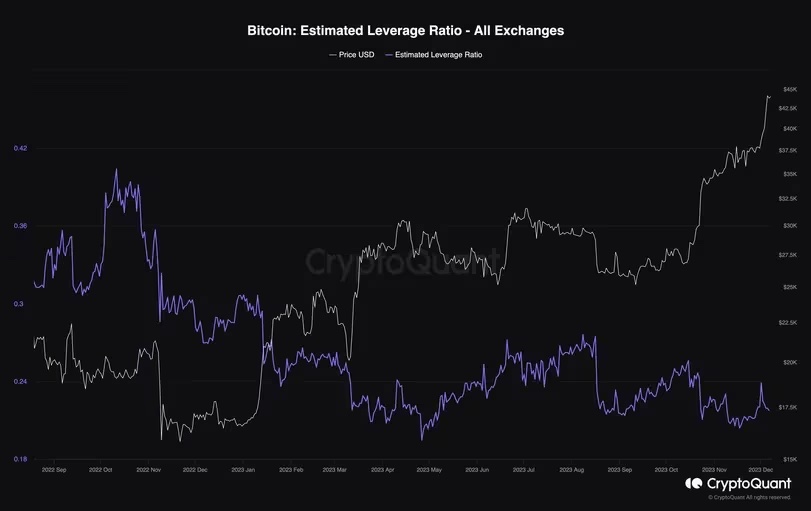

- Bitcoin’s bull market is characterized by step-like price movements, with repeated rises and sideways movements (consolidation).

- The familiar double-digit percentage pullbacks of bull markets have yet to occur due to spot market-driven rallies and low leverage.

At least half of Bitcoin (BTC)’s 160% year-to-date rise has occurred in the past eight weeks.

This trend is all the more impressive because it has a step-like structure, with prices repeatedly rising and then leveling off (consolidating). This contrasts with past gains, including the rally from late 2020 to early 2021, when pullbacks of 20% or more were common.

Spot-driven bull market

The pullbacks seen in the past have yet to occur this time. This is probably because buyers in the spot market are in control.

“The bull market is clearly a spot-driven bull market, with all major derivatives data relatively flat, futures premiums remaining around 10%, and option IV (implied volatility) not showing a significant increase.” , options data tracking site Greeks.Live posted on X (formerly Twitter).

“We have to put this rally and the news of impending ETF approval in perspective. This spot bull market is very healthy and the downside is limited. The bull market will continue.”

BTC’s Staircase Rise (CoinDesk/TradingView)

BTC’s Staircase Rise (CoinDesk/TradingView)According to CCData, spot and derivatives trading volume on centralized crypto exchanges rose to $3.61 trillion in November, an eight-month high, with the share of derivatives declining for the third consecutive month. It was 73%.

The ratio of Bitcoin’s spot trading volume to derivatives trading volume has increased to nearly 0.10 from 0.05 last month, according to data tracked by analytics firm CryptoQuant, indicating more activity in the spot market. .

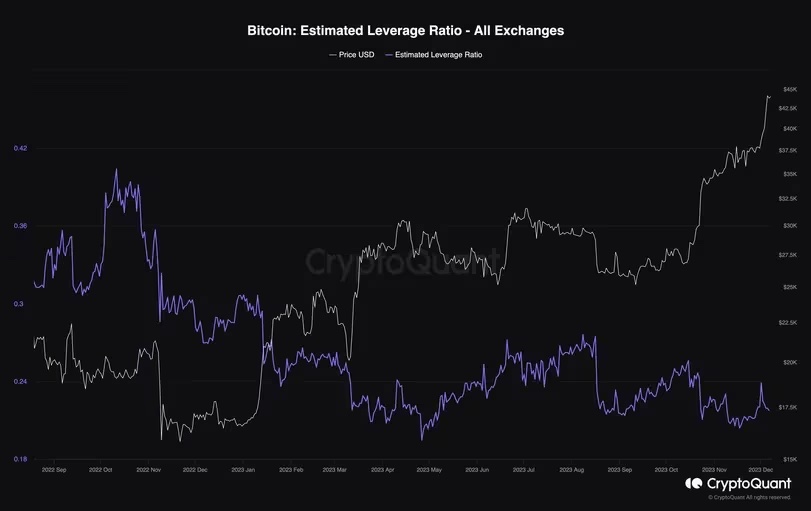

Leverage remains low

Derivatives still account for the majority of trading volume, but the degree of leverage remains low, supporting step-like price increases.

Derivatives are typically leveraged products that allow traders to take bullish (long) or bearish (short) positions greater than the amount they deposit with the exchange as margin.

Leverage is a double-edged sword, magnifying both profits and losses. Traders are also exposed to the risk of liquidation (forced cancellation of positions) due to insufficient margin. Furthermore, large volumes of liquidations often amplify bullish or bearish movements, so the more leverage you use, the more likely the liquidations will cause volatility in the market.

Bitcoin estimated leverage ratio (CryptoQuant)

Bitcoin estimated leverage ratio (CryptoQuant)According to CryptoQuant, the estimated leverage ratio, which is the dollar value locked in open interest in active perpetual futures divided by the total value of Bitcoin held by derivatives exchanges, has increased to 4.4% after peaking above 0.40 last year. It remains near the monthly low of 0.20.

Most major crypto exchanges, including Binance, currently offer less than 20x leverage in derivatives trading, allowing speculators to establish long positions of up to 20x the collateral value.

This is significantly lower than the 100x during the previous bull market. The use of high leverage had less staying power when things went south and was vulnerable to liquidation-induced downside volatility, as observed during the 2020-21 bull market.

And derivatives trading is now concentrated in standard futures on the highly regulated Chicago Mercantile Exchange (CME), where institutional investors and seasoned traders rarely take on extreme leverage.

Derivative trading volume at CME rose 18.4% to $67.9 billion in November, the highest in two years, according to CCData. CME also overtook Binance to become the largest derivatives exchange, with Bitcoin open interest increasing 21% to $4.11 billion.

Additionally, the use of Bitcoin as margin for trading peaked in 2021-22. Currently, the majority of open interest in Bitcoin futures is in contracts backed by physical or stablecoins. Transactions using Bitcoin as margin have a high liquidation risk because the collateral fluctuates in the same way as the trading position. On the other hand, with cash (or stablecoins), such risks are small.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Oporty786 / Shutterstock.com

|Original text: Here’s Why Bitcoin’s Famed Bull-Market Pullbacks Have Been Elusive During the Recent Price Surge

The post The well-known pullback of the Bitcoin bull market – why didn’t it occur during the recent rally? | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

93

1 year ago

93

English (US) ·

English (US) ·