Macroeconomics and financial markets

In the US NY stock market on the 26th, the Dow rose by $205 (0.6%) from the previous day, rising for five consecutive days.

Amid growing fears of a recession due to monetary tightening, GDP (real gross domestic product) for the October-December quarter of 2020 was announced on the same day to grow at an annualized rate of 2.9% compared to the previous quarter, surpassing market expectations and easing fears of an economic slowdown. . Buying became dominant.

On the other hand, some are wary of strong economic data, which suggests room for the Fed to raise interest rates and potential inflationary risks.

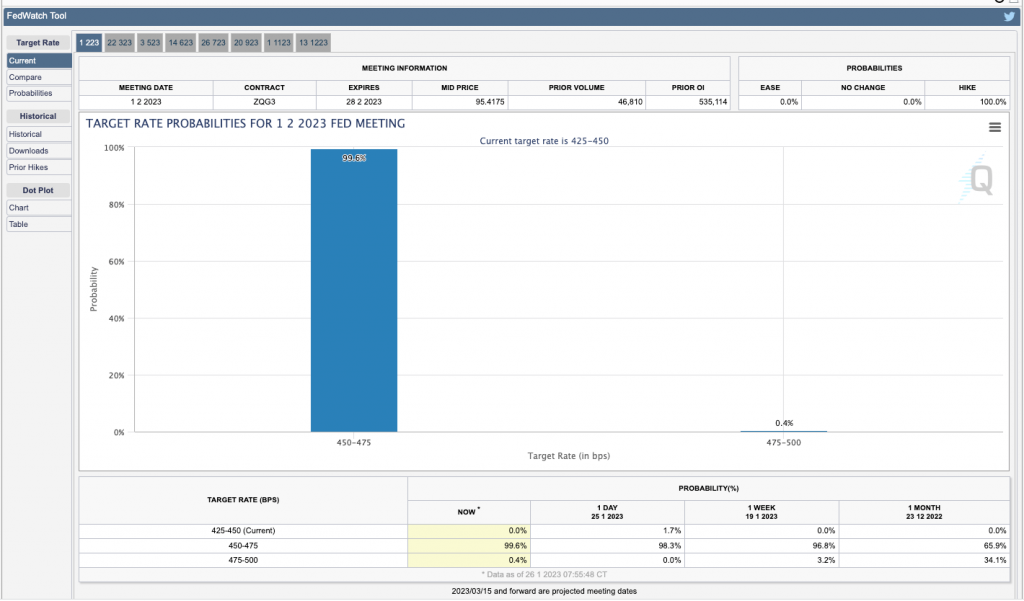

The market is 99.6% pricing in an increase of 25 basis points for the interest rate hike of the US Federal Open Market Committee (FOMC) announced on February 2, Japan time.

Fed

Relation:NY Dow continues to rise for 5 days Strong US GDP is also a sign of economic slowdown | 27th Financial Tankan

On the 27th, it was reported that US Amazon, the largest e-commerce company, is expected to start a new “Web3-related business.” As early as April this year, NFTs (non-fungible tokens) and blockchain game-related services may be launched.

detail:US Amazon launches new Web3 business NFT service may start in April = report

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 1.62% from the previous day to $22,820.

BTC/USD daily

Bitcoin hit $23,824 yesterday, but fell back after being pushed by profit-taking. Some stocks in the alt market soared, and a sense of overheating became apparent, and the US Federal Open Market Committee (FOMC) ahead of the US Federal Open Market Committee (FOMC), the Dow has continued to rise for five days.

The improvement in market sentiment was triggered by FTX and Alameda Research in November of last year, and led to the bankruptcy of Genesis Global Capital, a subsidiary of the Digital Currency Group (DCG), in January of this year. “Suggests a sense of weakness in the market, which is expected to go all out.

However, although there are signs of trend reversal, such as exceeding the 200MA (200-day moving average), there are still many skeptical views. There is also a strong view that it is premature to take this into consideration.

For the time being, the test will be whether the price can stay above the weekly 200 MA at $24,738 and the major resistance line near $30,000.

on-chain data

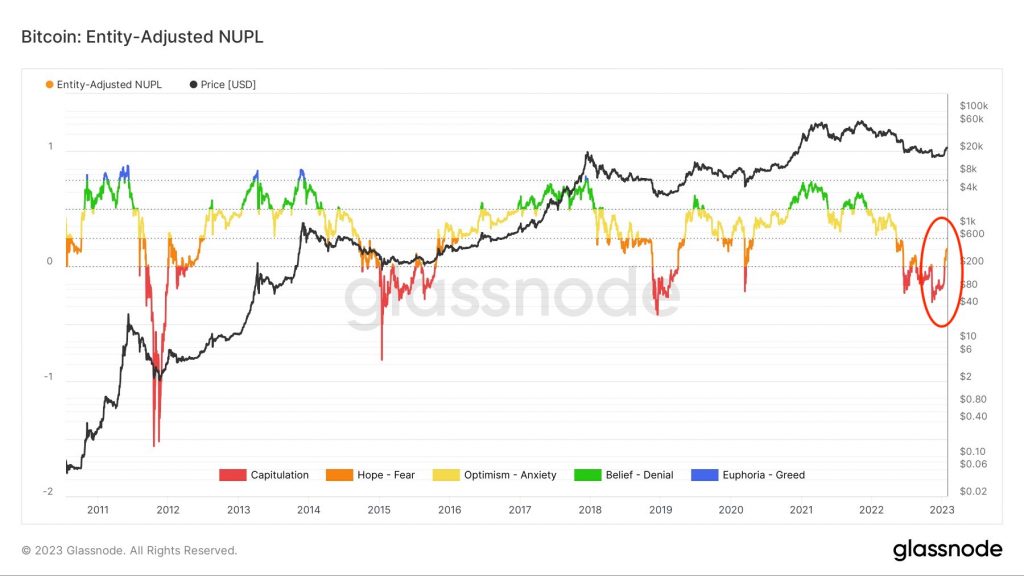

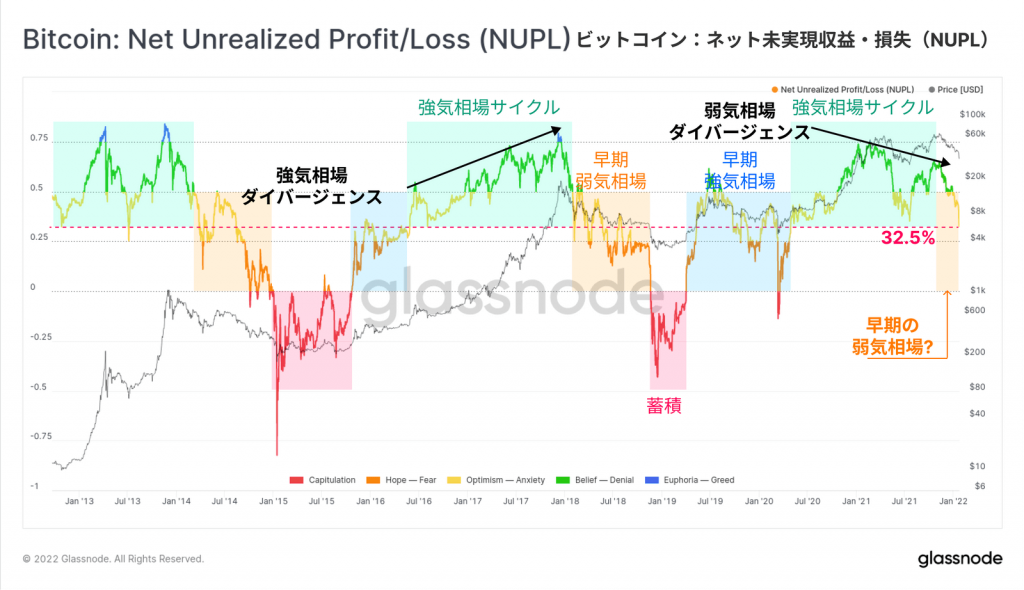

Checking the NUPL (Net Unrealized Profit/Loss), which shows the difference between Bitcoin’s unrealized profit and unrealized loss, suggests that it is starting to break out of the red negative zone (yield level).

NUPL

NUPL indicates the “profitability (profit rate)” of the entire Bitcoin market as a percentage of market capitalization. A NUPL of 0.325 means that 32.5% of the market capitalization of Bitcoin is held as unrealized profits for holders.

Source: Glassnode

The plotted data is visualized with “color” so that it can be judged intuitively.

- Red: yield/accumulation period

- Orange: Hope/Fear

- Yellow: optimism/anxiety

- Green: belief/denial

- Blue: Euphoria/Overheating

classified into

According to Glassnode, the drop in total profitability within the Bitcoin network is typical of the early to mid bear market (orange).

The depth of red indicates the bottom signal of the market, and above the NUPL 0.75-0.8 level indicates the top signal of the bubble market.

Click here for a list of market reports published in the past

The post There is also a change in the signal in the unrealized profit and loss (NUPL), which is struggling in the high price range of Bitcoin appeared first on Our Bitcoin News.

2 years ago

120

2 years ago

120

English (US) ·

English (US) ·