Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry continues to grow, with a record number of downloads and consumer spending across both the iOS and Google Play stores combined in 2021, according to the latest year-end reports. App Annie says global spending across iOS, Google Play and third-party Android app stores in China grew 19% in 2021 to reach $170 billion. Downloads of apps also grew by 5%, reaching 230 billion in 2021, and mobile ad spend grew 23% year-over-year to reach $295 billion.

In addition, consumers are spending more time in apps than ever before — even topping the time they spend watching TV, in some cases. The average American watches 3.1 hours of TV per day, for example, but in 2021, they spent 4.1 hours on their mobile device. And they’re not even the world’s heaviest mobile users. In markets like Brazil, Indonesia and South Korea, users surpassed five hours per day in mobile apps in 2021.

Apps aren’t just a way to pass idle hours, either. They can grow to become huge businesses. In 2021, 233 apps and games generated over $100 million in consumer spend, and 13 topped $1 billion in revenue, App Annie noted. This was up 20% from 2020, when 193 apps and games topped $100 million in annual consumer spend, and just eight apps topped $1 billion.

This Week in Apps offers a way to keep up with this fast-moving industry in one place with the latest from the world of apps, including news, updates, startup fundings, mergers and acquisitions, and suggestions about new apps and games to try, too.

Do you want This Week in Apps in your inbox every Saturday? Sign up here: techcrunch.com/newsletters

Top Stories

Epic Games kicks off its appeal

Both Epic Games and Apple appealed the original ruling of the lawsuit where Epic had sought to prove Apple was behaving in an anti-competitive manner by not allowing alternative payments or other means of distributing apps outside the App Store. Although Apple largely won that case, as the judge ruled it was not a monopolist, it was instructed to stop preventing app developers from adding links to third-party purchasing mechanisms — a decision it didn’t agree with, prompting its appeal. Apple was also given permission to hold off on the App Store changes until the appeal’s ruling, in another blow to Epic. Meanwhile, Epic appealed the case since it wanted another shot at making its arguments before the court.

This week, Epic Games filed its opening brief appealing the District Court’s decision in the Epic v. Apple case. In it, the company attempts to lay out why it thinks the District Court erred in its original decision, noting again how Apple reduces innovation, prevents alternative app stores from competing with its own, extracts “supracompetitive” commissions while making minimal investments in the App Store, and more. It also wants the appeals court to reconsider the market definitions for deciding the case. The lower court determined the case was about the “digital mobile game transactions” market, but Epic’s brief points out that Apple’s restrictions apply to both game and non-game developers alike. And it argues the court based its market definition on a misreading of Amex, by treating two separate transactions — consumers’ app downloads on the App Store and the in-app purchase itself — as a single transaction.

Epic’s Opening Brief by TechCrunch on Scribd

OK, we’ll just call it a “platform fee” then

When the Netherlands’ regulator ordered Apple to allow dating apps on the App Store to be able to process third-party payments, it looked like it might be a small win for a more open ecosystem that would allow alternatives to Apple’s own payment systems and its commissions. But anyone celebrating this did so too soon. Apple has now clarified that while it will adhere to the letter of the law, by offering entitlements to the dating apps looking to process payments on their own, it won’t adhere to the spirit. Not only will the developers have to publish a separate binary for their app they want it distributed to the Netherlands App Store, they’ll still have to pay Apple a commission on those third-party payments. And yet developers won’t be able to take advantage of any platform advantages, like getting Apple to assist with refunds, payment history, subscription management or other issues related to the purchases — as those will now take place outside its App Store. So what’s the platform fee for? I guess access to users?

Wrote Apple on its developer documentation page: “Consistent with the ACM’s order, dating apps that are granted an entitlement to link out or use a third-party in-app payment provider will pay Apple a commission on transactions.” But Apple didn’t say how much that commission will be. Likely, Apple will take the course that Google did in South Korea, where it dropped the commission rate for external payments by a mere 4%.

Twitter gets into NFTs

Image Credits: Twitter

It’s official, Twitter has embraced NFTs. Users on Twitter’s iOS app who also subscribe to Twitter Blue will be the first to take advantage of a new feature that lets them authenticate with their crypto wallet to use an NFT as their profile pic on the service. The new NFT hexagon-shaped pics will help to differentiate the crypto-enthusiasts from the rest of Twitter.

To use the feature as a Twitter Blue subscriber, you’ll go to your profile to change your profile photo as you would normally. Here, you’ll be presented with the new option to choose an NFT instead. You then connect with your crypto wallet.

At launch, Coinbase Wallet, Rainbow, MetaMask, Ledger Live, Argent and Trust Wallet are supported. After authenticating, you’ll select the NFT you want to showcase. Twitter says that, currently, JPEG and PNG NFTs minted on the Ethereum (ERC-721 or ERC-1155 tokens) can be used as NFT Profile Pictures. In a later update, Twitter said it was looking into adding support for SVGs, but can’t render them right now.

It’s worth noting the Twitter Blue subscription service is not yet globally available, which will limit the adoption of NFT Profile Pictures to the early markets where the offering is now live — the U.S., Canada, Australia and New Zealand.

Not everyone is happy with the update, which is receiving mixed reactions. Some people are trolling the hexa-profiles, others are blocking people and some artists claim the feature has encouraged more people to steal their art and mint it as an NFT (which to be fair, could have happened before).

Weekly News

Platforms: Apple

- Apple developers can now create custom codes for subscriptions in App Store Connect, each with a unique name you choose (like SPRINGPROMO, for example). The codes can be redeemed through a direct URL or with the app.

- Apple released iOS 15.3 RC to developers and beta testers on Thursday, which includes a fix for a Safari bug that could have led to the leaking of users’ browsing history and Google ID. It has also now stopped signing iOS 15.2, preventing further downgrades. And it’s begun pushing iOS 14 users to upgrade to iOS 15.

- Apple announced it’s expanding its App Store Foundation program to 29 countries in Europe. Already available in select European markets including Germany, France, Italy, Spain and Sweden, the program offers developers support on app development, marketing and monetization with help from Apple employees.

- Apple says it’s updating the App Store submission experience starting January 25, 2022. The new App Store Connect experience will allow developers to submit multiple items, submit without needing a new app version, view past submissions and more.

Platforms: Google

Image Credits: Google

- Google Play Games for PC enters beta testing. The downloadable app, which brings Android games to Windows PC users, is launching to beta testers in Hong Kong, South Korea and Taiwan. Among the more than 25 titles available at launch are “Mobile Legends: Bang Bang,” “Summoners War,” “State of Survival: The Joker Collaboration” and “Three Kingdoms Tactic.”

E-commerce/Food delivery

- TikTok kids are boosting toy retailer Learning Express’ sales. The company’s online sales increased 25% in 2021, compared with massive 233% growth in 2020, amid the pandemic. Interestingly, the retailer hasn’t spent money on TikTok marketing and advertising, noting that kids are starting to find them on their own. Over the past years, the TikTok toy trends have turned toys into viral hits like Pop Its, Squishmallow, fidget spinners and more, thanks to kids sharing videos on the social app. The retailer, where individual stores are franchises, is also benefitting from some of its owners’ own TikTok presence — like the Birmingham location, which has 2.3 million followers and its most popular video received 62 million views.

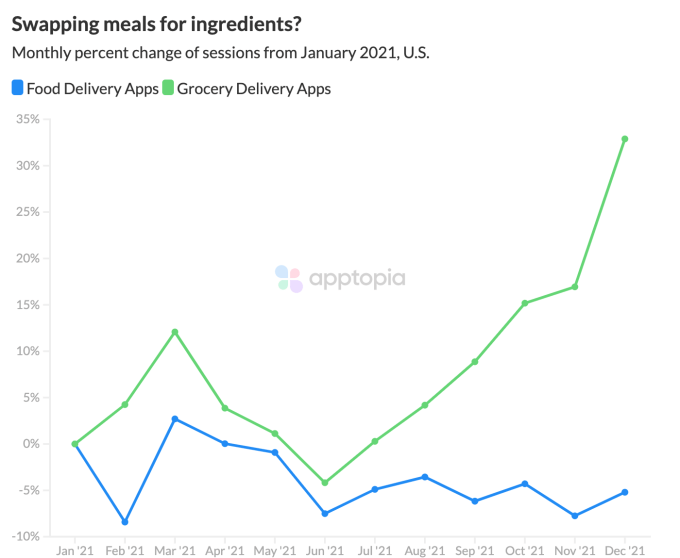

- Consumers may be swapping food delivery apps for grocery delivery, Apptopia research shows. Food delivery apps in Q2 2021 saw total sessions fall 10% from March, and the rest of the year showed no real gains. Meanwhile, in December, grocery delivery apps posted a 20% increase in downloads from the month prior. And DoorDash and Uber Eats adapted, the former by adding grocery and convenience stores to its app, and the latter by removing the word “restaurant” from its app’s title.

Image Credits: Apptopia

Fintech

- British digital banking app Revolut expanded into U.S. stock trading. The company already let British users buy and sell shares, but is now licensed as a U.S. broker-dealer. Users will be able to trade 1,100 securities, including shares on the New York Stock Exchange and Nasdaq, as well as gain access to 200 ETFs.

- Investing app Acorns scrapped its $2.2 billion merger agreement with SPAC Pioneer Merger Corp. The deal, announced last May, would have allowed Acorns to list on the Nasdaq, and the merger was valued at $1.5 billion pre-money. Acorns will pay $17.5 million in termination fees through December 15. The company said that “given market conditions,” it was pivoting to a private capital raise at a higher pre-money valuation instead.

Social

- TikTok fired its marketing chief, Nick Tran, a former Hulu exec, after kicking off a series of marketing stunts without approval. These included the TikTok Kitchen service, which would use ghost kitchens to promote popular TikTok creators’ recipes in partnership with Virtual Dining Concepts; as well as new business lines involving NFTs and TikTok Resumes.

- Instagram and TikTok have begun testing support for paid creator subscriptions. Instagram officially announced its alpha test of subscriptions, offering creators eight price points between 99 cents and $99.99 which they can charge users. Subscribers gain access to exclusive live videos and stories, and receive a special badge elevating them in the comments section and the DM inbox. Meanwhile, TikTok also confirmed it has begun testing subscriptions, but wouldn’t share details.

Image Credits: Instagram

- Instagram also launched an expanded version of “remix,” which now allows anyone to remix any public video on the platform going forward, unless the creators opt out.

- Snapchat is trying to make it harder for kids to buy drugs on the app after an NBC News investigation found the app was linked to the sale of fentanyl-laced pills that led to the deaths of teenagers and young adults in over a dozen states. The app now prevents 13 to 17-year-old users from showing up in Quick Add search results, unless they have friends in common with the person searching — a feature aimed at preventing users from adding people they don’t know to deter drug transactions.

- Facebook and Instagram are working on NFT features that will allow users to display their NFTs on their social profiles. Instagram head Adam Mosseri had previously said the company was looking into NFT support. This week, a report from The FT added Meta is considering its own NFT marketplace, but noted the efforts were in early stages. This is not entirely new information, as Mosseri had said the company was considering a marketplace. It has also invited NFT artists to offer feedback through panel discussions, which was discussed in the press last year when some artists were upset about being asked to advise the social giant on the matter without compensation. But the report indicates the investment may extend to Facebook as well.

Messaging

- WhatsApp is rolling out in-app chat support as an alternative to email. The feature had previously been available in beta testing, but has begun showing up for non-beta users.

- Meta’s Workplace service for businesses will integrate with WhatsApp later this year. The service, which now has more than 7 million users, will integrate with the messaging app so Workplace customers can share announcements with front-line employees, including deskless workers.

- Messenger Kids introduced new “internet safety” activities to teach young children how to use Messenger and be safe online. In each episode of “Pledge Planets,” kids learn to make healthy decisions, stay safe online, learn to use blocking and reporting tools, and build resilience.

Image Credits: Meta

Streaming & Entertainment

- Spotify is still the top streaming music service but its market share has slipped a bit, according to new research from MIDiA, as the streaming market has grown. In Q2 2021, 523.9 million people subscribed to a music streaming service globally, up 26.4% from the same time last year. Spotify’s market share, meanwhile, dropped from 34% in 2019 to 31% today, followed by Apple, then Amazon Music. YouTube Music grew by more than 50% year-over-year, making it the only Western streamer to have increased market share.

- YouTube’s app is testing “smart downloads,” a feature that automatically downloads videos when an Android device is connected to Wi-Fi, in order to be ready when there’s either weak coverage or no signal at a later point. The feature is already supported in YouTube Music.

Gaming

Image Credits: Netflix

- Netflix expanded its growing gaming lineup this week with the launch of two more games: Arcanium: Rise of Akhan, an open-world single-player card strategy game developed by Rogue Games; and puzzle game Krispee Street developed by Frosty Pop. The additions bring Netflix’s gaming catalog to 12 titles, including Bowling Ballers, Shooting Hoops, Teeter Up, Asphalt Xtreme, Stranger Things 1984, Stranger Things 3, Card Blast, Dominos Cafe, Wonderputt Forever and Knittens.

- During its less-than-stellar earnings, Netflix’s COO Greg Peters also said the company is open to licensing “large game IP” that people would recognize as it expands its gaming business. “I think you will [see] some of that happen over the year to come,” Peters noted.

- In addition to the major news of Microsoft’s Activision Blizzard deal, the company also announced this week that its Xbox Game Pass service has grown to 25 million subscribers, up from 18 million in January 2021.

- Wordle!, an iOS game that existed before the rise of the popular web-based game by the same name, has benefitted from the latter’s popularity leading to a surge in downloads. The developer, Steven Cravotta, hadn’t been updating the game, which first launched in 2017 but never really took off, until it jumped to 200,000 downloads per week from those likely looking for the other Wordle game. So Cravotta reached out to Wordle’s developer (Josh Wardle) to note he was donating the proceeds to charity, which has totaled $2,000+ so far.

- U.S. consumer spending in mobile action games jumped up 68.9% in 2021, driven by almost entirely Genshin Impact, reported Sensor Tower. Spending for the year reached $966.8 million, making Action the fastest-rising gaming genre and Open World Adventure the largest Action subgenre. MiHoYo’s Genshin Impact earned $406.3 million in the U.S. in 2021, followed by Marvel Contest of Champions by Kabam and Dragon Ball Legends from Bandai Namco.

- Mobile gamers who use TikTok play for longer, play more genres and spend more money, according to a new report from NewZoo. TikTok gamers are 66% more likely to pay for games, and are 40% more likely to pay for add-ons. They’re also more likely to watch gaming content, often on TikTok. The group also tends to use social platforms to find new games (45% versus 32% for those who don’t use TikTok). They play on average 7.1 genres versus 4.2 genres for non-TikTok users, and are more likely to notice ad types.

Productivity/Utilities

- Read-it-later app Instapaper on iOS introduced new features, including public folders, which allow users to share their saved reading lists with others via web or mobile. The app also added custom app icons in a variety of neutral tones for its premium users, and a “read now” feature for web users that lets you click the Instapaper logo immediately after saving an article to read it immediately. The company said it can’t offer the feature on iOS due to technical limitations.

Health & Fitness

- MY2022, an app mandated for use by all attendees of the 2022 Olympic Games in Beijing, was found to have technical flaws allowing encryption to be sidestepped, according to The Citizen Lab’s research. The flaw means users’ voice audio and file transfers could be accessed and health forms containing passport details, demographic info, and medical and travel history, are also vulnerable.

Government & Policy

- Another bill in the works, this time in Illinois, wants to force Apple and Google to allow alternative payments in apps distributed in their app stores. Senators in the state have filed the “Freedom to Subscribe Directly Act” which is being supported by Illinois-based Apple critic Basecamp, which faced a number of issues getting its subscription email app HEY into the App Store. The Senators support the bill because they see it as a way for the state to tap into lost tax revenues that are redirected to California today.

Funding and M&A

Indonesia-based startup BukuKas, which has now rebranded as Lummo, raised $80 million in Series C funding led by Tiger Global and Sequoia Capital India. The company offers two apps, an e-commerce enabler solutions LummoShop (previously Tokko) and bookkeeping app BukuKas. The company has 300 employees and focuses on the SMB market.

Indonesia-based startup BukuKas, which has now rebranded as Lummo, raised $80 million in Series C funding led by Tiger Global and Sequoia Capital India. The company offers two apps, an e-commerce enabler solutions LummoShop (previously Tokko) and bookkeeping app BukuKas. The company has 300 employees and focuses on the SMB market.

African mobile games publisher Carry1st raised $20 million in Series A funding led by Andreessen Horowitz (a16z). The round marks a16z’s first investment in an African-headquartered company. The three-year-old startup has signed publishing deals for seven games from six studios, including Tilting Point, publisher of Nickelodeon’s SpongeBob: Krusty Cook-Off, which Carry1st launched in Africa. Other partners include CrazyLabs and Sweden’s Raketspel.

African mobile games publisher Carry1st raised $20 million in Series A funding led by Andreessen Horowitz (a16z). The round marks a16z’s first investment in an African-headquartered company. The three-year-old startup has signed publishing deals for seven games from six studios, including Tilting Point, publisher of Nickelodeon’s SpongeBob: Krusty Cook-Off, which Carry1st launched in Africa. Other partners include CrazyLabs and Sweden’s Raketspel.

Indian startup INDmoney raised $75 million in Series D funding for its super finance app that aims to be a one-stop shop for investments and expenses. Tiger Global, Steadview Capital and Dragoneer co-led the round, valuing the startup at $600 million.

Indian startup INDmoney raised $75 million in Series D funding for its super finance app that aims to be a one-stop shop for investments and expenses. Tiger Global, Steadview Capital and Dragoneer co-led the round, valuing the startup at $600 million.

InFlow, a science-backed app to address ADHD symptoms using Cognitive Behavioral Therapy (CBT) raised $2.3 million in seed funding led by Hoxton Ventures. The app offers users short exercises and challenges aimed at helping them create healthy habits, and is being downloaded 15,000 times per month, the company said.

InFlow, a science-backed app to address ADHD symptoms using Cognitive Behavioral Therapy (CBT) raised $2.3 million in seed funding led by Hoxton Ventures. The app offers users short exercises and challenges aimed at helping them create healthy habits, and is being downloaded 15,000 times per month, the company said.

Istanbul-based Spyke Games, a mobile games startup, raised $55 million in a seed round from Griffin Gaming Partners, a VC focused on gaming startups. Spyke aims to combine casual gaming with multiplayer functionality and other social elements. Its first title, Royal Riches, is launching globally this month after a more limited release.

Istanbul-based Spyke Games, a mobile games startup, raised $55 million in a seed round from Griffin Gaming Partners, a VC focused on gaming startups. Spyke aims to combine casual gaming with multiplayer functionality and other social elements. Its first title, Royal Riches, is launching globally this month after a more limited release.

Istanbul-based Dream Games, the casual gaming developer behind top-grossing game Royal Match, raised $255 million in Series C funding led by Index Ventures. The round values the startup at $2.75 billion, up from $1 billion six months ago.

Istanbul-based Dream Games, the casual gaming developer behind top-grossing game Royal Match, raised $255 million in Series C funding led by Index Ventures. The round values the startup at $2.75 billion, up from $1 billion six months ago.

Appcues, a startup developing technology for better user onboarding across platforms, including mobile, raised $32.1 million in Series B funding. The company offers analytics and no-code tools to fix onboarding issues.

Appcues, a startup developing technology for better user onboarding across platforms, including mobile, raised $32.1 million in Series B funding. The company offers analytics and no-code tools to fix onboarding issues.

Public.com acquired HyperCharts, a data visualization platform that shows financial and biz metrics for publicly traded companies. Deal terms were not disclosed.

Public.com acquired HyperCharts, a data visualization platform that shows financial and biz metrics for publicly traded companies. Deal terms were not disclosed.

Big Health, the maker of cognitive-behavioral therapy apps Sleepio and Daylight, raised $75 million in Series C funding led by SoftBank Vision Fund 2 to launch six new digital mental health therapeutics by 2024. To date, the company has more than 10 million users and has raised just under $130 million from investors.

Big Health, the maker of cognitive-behavioral therapy apps Sleepio and Daylight, raised $75 million in Series C funding led by SoftBank Vision Fund 2 to launch six new digital mental health therapeutics by 2024. To date, the company has more than 10 million users and has raised just under $130 million from investors.

Global spam call blocking platform Truecaller acquired Israeli company CallHero, which had developed a digital assistant, SmartAgent, which helps its users verify and identify calls. Following the close of the $4.5 million deal (cash + stock), Truecaller will integrate CallHero’s technology into its own platform.

Global spam call blocking platform Truecaller acquired Israeli company CallHero, which had developed a digital assistant, SmartAgent, which helps its users verify and identify calls. Following the close of the $4.5 million deal (cash + stock), Truecaller will integrate CallHero’s technology into its own platform.

Western & Southern Financial Group acquired Fabric Technologies Inc. and its subsidiary, Fabric Insurance Agency LLC, a digital life insurance platform and mobile app that has over 60,000 families as customers, and has placed billions in life insurance coverage.

Western & Southern Financial Group acquired Fabric Technologies Inc. and its subsidiary, Fabric Insurance Agency LLC, a digital life insurance platform and mobile app that has over 60,000 families as customers, and has placed billions in life insurance coverage.

English (US) ·

English (US) ·