After developing a free earned-wage advance offering for frontline workers two years ago, fintech company Clair is back with a new tool to help workers get paid after completing a shift and receiving $175 million in new equity and debt funding.

Nico Simko, co-founder and CEO of Clair, told TechCrunch that the new investment includes $25 million in equity. It was led by Thrive Capital and includes Upfront Ventures and Kairos. Clair’s total venture-backed funds now rise to $45 million. As part of the investment, Michael Presser, investing partner at Kairos, was appointed as a board observer.

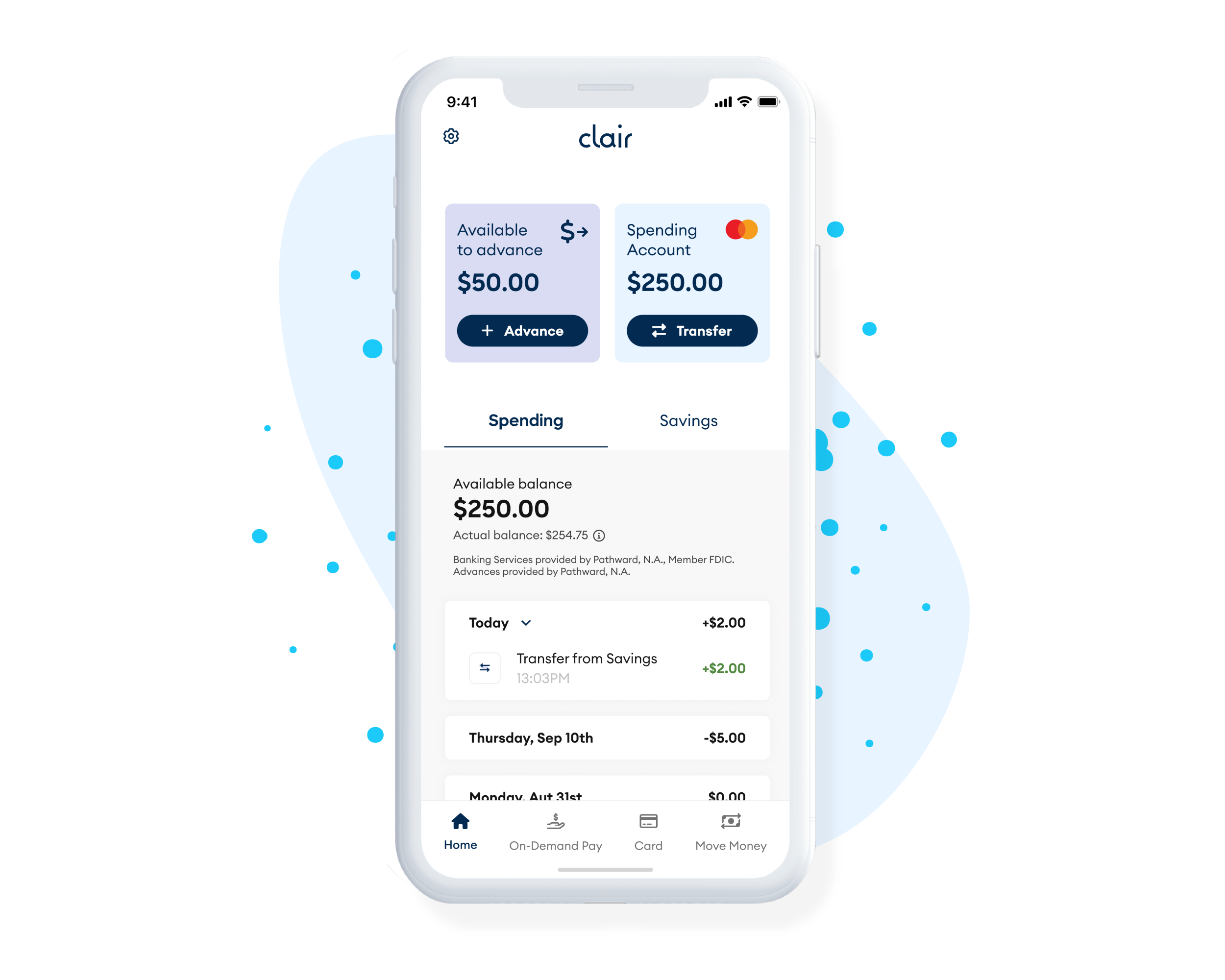

Clair frontline worker pay app. Image Credits: Clair

The other $150 million is part of a new consumer lending program from partner bank Pathward, which holds the FDIC-insured accounts for Clair and provides the wage advances to frontline workers.

Clair currently works with over 10,000 employers, workforce management systems and payroll and over 50,000 workers. Employees will see Clair through those existing employer systems that allow you to select your schedule separate from your payroll system. Employers can onboard employees and see payroll data. Employees can download the Clair app and conduct financial activities, including savings, check printing and the ability to withdraw funds for free through ATMs.

Simko touts the company’s new offering as “the first free on-demand pay solution” where users can withdraw funds immediately for the money they’ve earned but not yet received, instantly into their account.

“We’re the first provider that went to a bank and convinced the bank to do those advances, basically as micro loans, $50 loans,” Simko said. “Most early-stage, on-demand pay companies are the ones advancing the funds. By convincing a bank to do this, it gives regulatory certainty to our partners and consumers because there is a national bank backing it.”

He explained that having a bank make the advances “fueled our growth, which included 10x revenue growth over the past year,” and provided security measures for employers still thinking about the demise of Silicon Valley Bank and First Republic Bank.

Simko intends to deploy the new capital into meeting demand for Clair’s backlog of customers. And while it is focused on workforce management and payroll companies, the company has received some inbound requests from larger businesses that Simko aims to address.

Clair is also launching a lending program for employers called Clair for Employers, which is a way for them to offer free, holistic financial wellness benefits to their employees. The offering integrates with a companies’ payroll providers, and employees of companies using it can also access additional features in their Clair accounts, including 3% cash back on gas and groceries purchased on their Clair Debit Mastercard.

In addition, the company is looking at other offerings, including a dynamic 401(k) and health savings account.

“With financial services tied to payroll and workforce management, the sky’s the limit,” Simko said. “Most of these need to be tied to a bank and payroll system, and since we have these deep kinds of HR integrations, the vision of Clair is to build the best bang for America’s workforce.”

Thrive Capital doubles down on Clair, a fintech helping frontline workers get paid instantly by Christine Hall originally published on TechCrunch

English (US) ·

English (US) ·