For consumers, the holiday season means indulging in gifts, family traditions and festive celebrations. But for retail businesses, it’s the most critical time of the year.

We’re seeing a gathering storm of economic conditions — inflation, inventory and supply chain issues, and an elongated holiday season — that has companies scrambling to determine the right e-commerce strategy for the holiday season. Retail e-commerce channels such as Amazon, Walmart and Instacart, where a majority of all e-commerce happens, will be the real holiday battlefront. The key to succeed this year will be flexibility, responsiveness and endurance: Companies will have to be ready to respond to the market and the consumer throughout the season.

Following two years when e-commerce enjoyed pandemic tailwinds, consumers are now living with inflation and an unofficial recession, and we can expect more selective and price-conscious shopping behavior. While prices across major retail e-commerce marketplaces like Amazon, Walmart and Target have mostly kept pace with inflation, consumers are feeling the squeeze on their everyday essential purchases.

According to CommerceIQ data based on thousands of products across 450+ online retailers, grocery and home and kitchen prices have risen about 20% on average over last year, far outpacing inflation. The average shopper has to focus more of their budget on essentials, leaving them less to spend on gifts and other discretionary purchases.

However, unemployment has remained low so far, and consumer spending has been resilient, which we can see in the continued strength of online shopping. For instance, in Q2 2022, e-commerce growth has already rebounded to 9% at Target, 12% at Walmart and 10% at Amazon in North America.

On top of this shift in value, the holiday shopping season is kicking off earlier this year, spurred by the second Amazon Prime Day in October. Other retailers will follow suit in an attempt to capture the spending of price-conscious consumers as they plan ahead for the holidays.

What does this mean for brands? The focus must be on endurance and companies will need to be ready to shift their strategy for discounting, inventory planning and ad and marketing spend as the environment changes, all while fending off potential consumer fatigue.

Increase discounts while balancing profitability

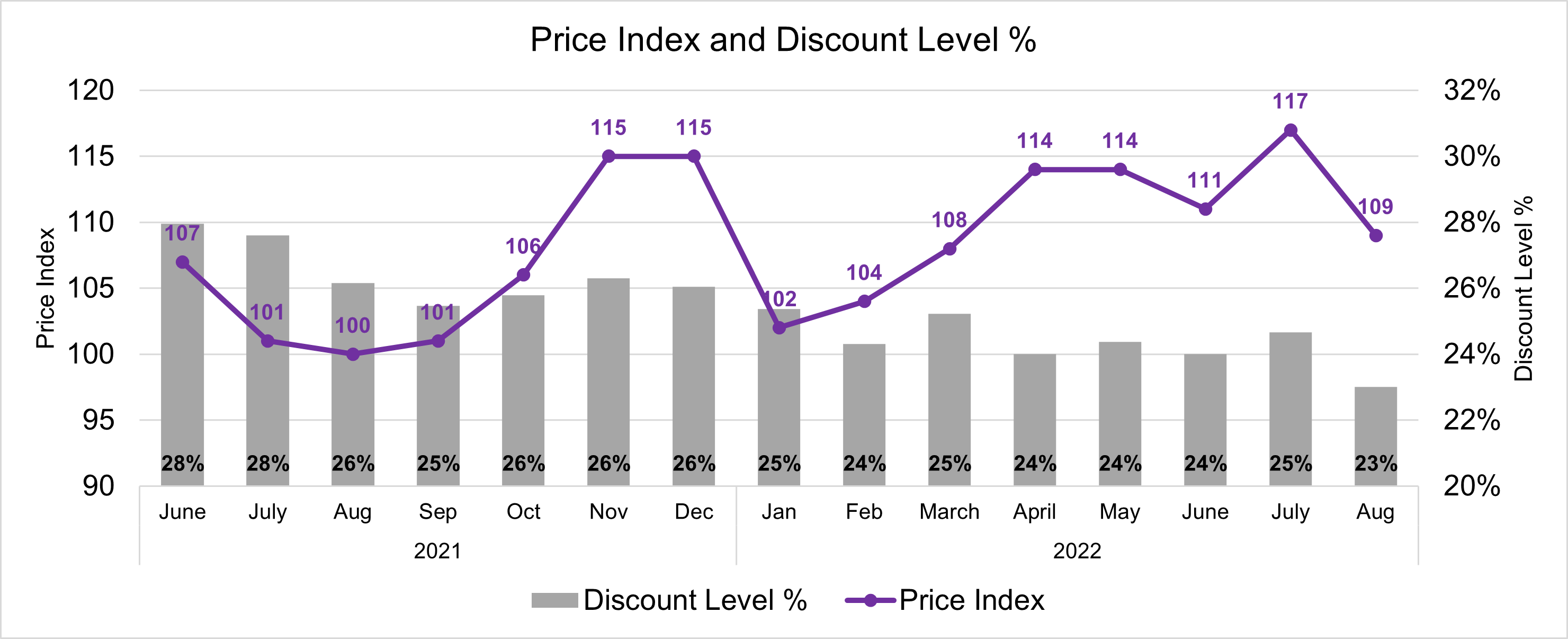

Discounting has taken a back seat over the past couple of years, largely thanks to consumers’ lockdown savings and stimulus checks, but that is set to change this year. Promotions and discounts have been on the rise throughout 2022, and Amazon Prime Day was a great indicator of what could come in the holiday season. According to CommerceIQ data, during Prime Day 2022, discount levels for items on sale rose 10% to 12% compared to Prime Day 2021. The trend will likely continue at other major retailers as we head into the holidays.

While companies and retailers will look to increase promotions and discounts throughout the season, the majority of promotions will still occur during specific sales like Black Friday and Cyber Monday rather than broadly across the season as consumers hold out for the best deals.

There is an opportunity to further eventize promotional events like Cyber Week to capture greater volume, but getting discount levels wrong could lead to big hits to profitability. Companies that go into the season with excess inventory could face a perfect storm that eats into the bottom line.

Prices continue to rise leading into 2022 holidays, but discounts have yet to pick up. Image Credits: CommerceIQ

Here are some principles companies should keep in mind when planning e-commerce promotional strategies for the holiday season:

Tips for e-commerce startups that want to win market share this holiday season by Ram Iyer originally published on TechCrunch

English (US) ·

English (US) ·