You’ve managed to acquire a million users. Amazing.

But if 999,999 of them don’t make it through the funnel, or churn, now that’s not so amazing.

That’s an extreme example, but it shows why optimizing your growth funnel is crucial in the early days of your company.

What does a growth funnel look like? Although each startup’s will funnel will look different, at the core, it consists of three major pillars: acquisition, activation, and retention. I won’t go over these pillars in depth, but let’s talk about some key optimization concepts.

Acquiring the right users

As your startup matures and robust user-level data starts flowing in, you should prioritize understanding which acquisition sources stand to attract the most users. As a bonus, try to measure which sources add the most users incrementally as well.

Cross-functional teams (i.e., product, growth and data) should continuously question the best sources of traffic at a defined cadence, too.

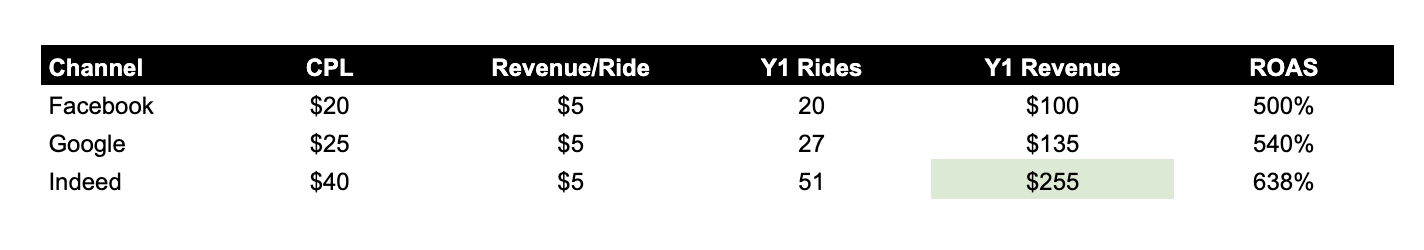

While leading fleet growth at Postmates, I quickly learned to become numb to remarkable upper-funnel metrics. Here’s an example of how we prioritized budget allocation with down-funnel metrics:

Indeed seems to be the worst acquisition channel (CPL) but ends up being the best over time (ROAS). (These are not actual results and are purely for demonstration purposes.) Image Credits: Jonathan Martinez

Even though Indeed has the worst CPL of the channel grouping, it nets the highest revenue-producing fleet drivers, who are the most active in Y1.

English (US) ·

English (US) ·