Tokenomics of cryptocurrencies

TokenUnlocks, which provides crypto asset (virtual currency) besting information, released an analysis report on token unlocking of major projects on the 18th.

Token unlock is an event in which tokens allocated to initial investors and major development contributors are released after being locked up for a certain period of time. Contractual terms that vest after a certain period of time, called vesting, are designed to avoid large asset sales during periods of low liquidity.

There are “cliff type” that releases a certain amount every few months such as quarters, and “liner type” that distributes small amounts more frequently. Investors are wary of adding downward pressure on token prices.

Relation:Apecoin (APE) to Release Lockup Tokens Worth 16 Billion Yen

price impact

TokenUnlocks has analyzed tokenomics (token economy) for 143 protocols since its establishment on July 4, 2022. The analysis target was 143 major projects belonging to 7 categories such as DeFi (decentralized finance), DAO (decentralized autonomous organization), and NFT (non-fungible token). The total market capitalization of issued tokens is about 3 trillion yen, covering 2.6% of the virtual currency market size (112 trillion yen) (as of early 2011).

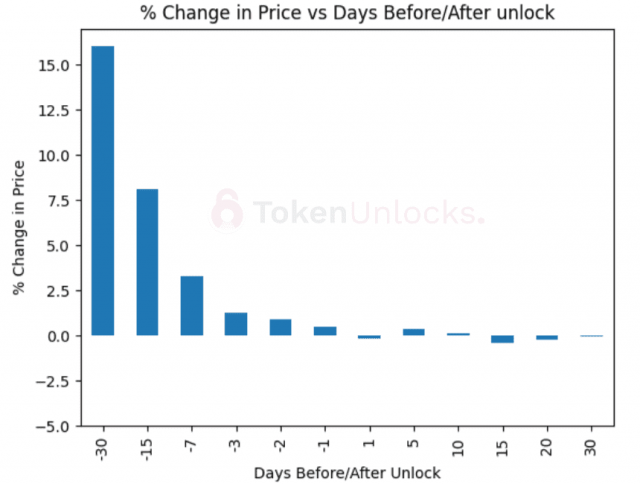

Below is a graph of the volatility of token prices related to unlocking events that occurred during 2022, among others. This volatility is calculated relative to the Bitcoin price to fairly reflect changes within the market.

Source: TokenUnlocks (same below)

TokenUnlocks noted that “token prices tend to drop by up to 15%” before unlock events, and that “they tend to remain flat overall” after unlocks. If you shorted 30 days ago, 15 days ago, and 7 days ago, there is a 27% chance of a 5% loss, a 20% chance of a 10% loss, and a 6% chance of a 7% loss. ” concludes.

Main unlocking cases

TokenUnlocks also introduces token unlocks for 4 projects with confirmed price fluctuations.

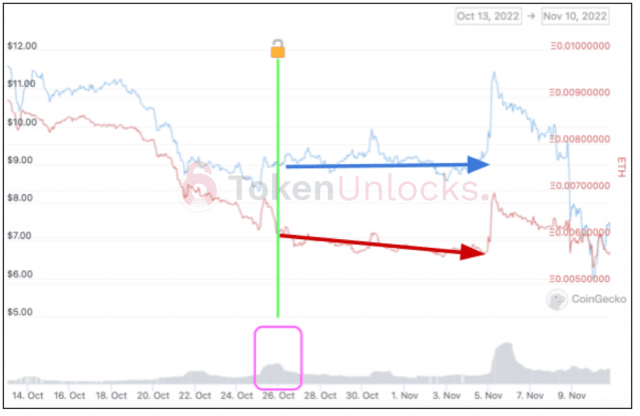

For example, the NFT game “Axie Infinity (AXS)” unlocked tokens four times in 2022. In particular, on October 26, 21 million AXS, which is equivalent to 8% of the issued amount, was released, and the AXS circulation volume in the market increased by about 15% in one day.

The price of AXS denominated in Ethereum fell about 30% from 0.0086 ETH in early October to 0.006 ETH on October 26th. The sharp rise on November 5th is attributed to orders placed at small exchanges.

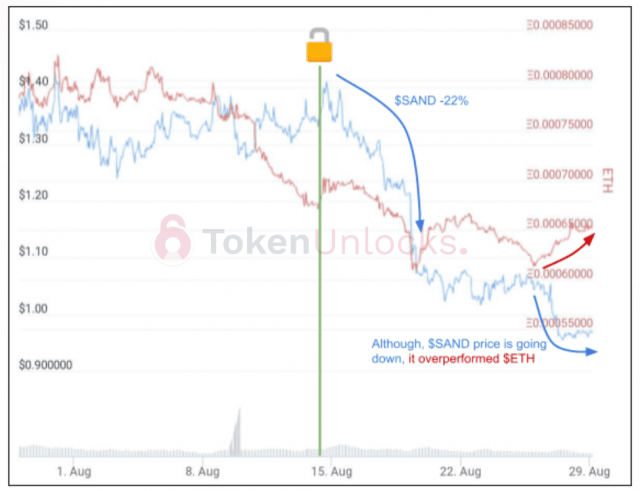

Next, in the case of the Metaverse decentralized blockchain game “The Sandbox (SAND)”, about 40% of the issued amount is allocated to initial investors, advisors, and teams, and tokens will be issued every six months until 2024. Released.

Before and after token unlocks in February and August 2022, both SAND tended to underperform Ethereum (ETH) by nearly 10%. In addition, on-chain data confirms that “tokens acquired by advisors and teams tend to be immediately sent to exchanges”. Once all unlocked tokens are sold, there are signs that the SAND price will recover in ETH terms.

In the case of Ethereum (ETH) Layer 2 scaling solution “Immutable X (IMX)”, tokens allocated for project development and private sale (39% of the issued amount) will be distributed from November 2022 to October 2025. Released monthly.

About 12% of the total issued volume was unlocked on November 5, 2010, which was the first time, and the IMX circulation volume increased by nearly 50%. Partly due to the bankruptcy of the virtual currency exchange FTX, the price of IMX has fallen by up to 50% against the US dollar and 20% against the ETH in the two weeks since the token was released. Immutable co-founder Robbie Ferguson promised on Twitter that more than half of the tokens unlocked will be relocked for at least a year.

1/ Four major announcements for $IMX.

First: for the upcoming unlock, the majority of the unlocking supply (>50%) is from @immutable‘s Project Development allocation.

We will be relocking *all* of these for at least 1 year. (PS we also don’t give *any* directly as comp)

— Robbie Ferguson 🅧 – Hiring! (@0xferg) September 29, 2022

Relation:Axie (AXS) Completes Token Distribution for Early Investors Concerns About Selling Pressure

token allocation

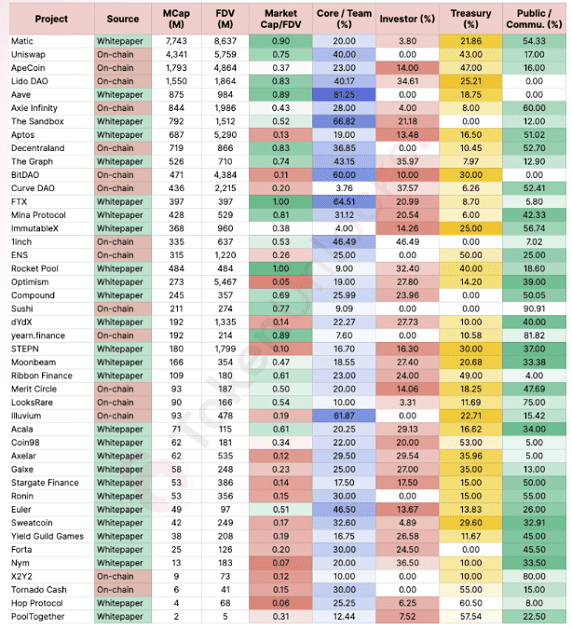

In addition, TokenUnlocks selected 44 major tokens such as layer 1, layer 2, DEX (distributed exchange), and games, and analyzed token allocation. The following data is arranged in descending order of market capitalization, and the darker the color, the higher the allocation ratio.

From this table, it can be seen that the higher the token allocation to the core team and investors, the higher the market capitalization. By allocating more tokens to investor groups, the project will gain credibility and more capital will be invested, TokenUnlocks said.

A weighted average value that takes into account the market capitalization is calculated for the average value of the above token allocation. The breakdown is core development/team (31.0%), treasury (24.8%), early investors (10.7%), and community (33.5%).

Relation:GameStop sells $4.8 billion IMX token

Upcoming unlocks for top 300 tokens by market cap

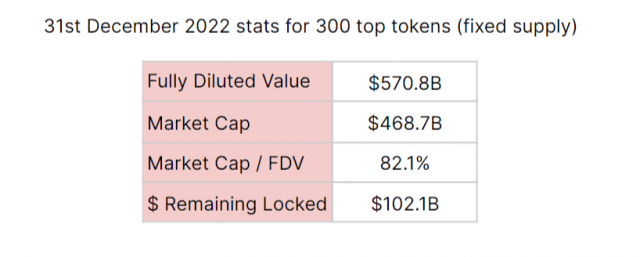

Finally, Token Unlock states that 17.9% of the total issued volume of the top 300 tokens by market capitalization on the market site CoinGecko has been locked up, and tokens worth 13.16 trillion yen ($10.21 billion) will be unlocked in the future. When it becomes, I showed an approximate calculation.

Based on data as of December 1, 2022, the total market capitalization of circulated tokens is 60.42 trillion yen, and the fully diluted value (FDV) including tokens that have not yet been circulated is 73.58 trillion yen. there is *The statistical data excludes tokens with no issuance limit, such as Ethereum (ETH) and Cosmos (ATOM).

As for the outlook for 2023, TokenUnlocks points out that “many projects funded in 2021 will try to survive by cashing out vested tokens.”

As reference data, we have presented the top 15 projects with the highest estimated lockup token value as follows: Not only in 2023, but it is believed that they will be released to the market in accordance with their respective token emission plans in the future.

TokenUnlocks said, “When determining the optimal token allocation method, we also consider other factors such as project category, industry outlook, product feasibility, and future growth potential of tokens. is necessary,” he notes.

Relation:Lido (LDO) Token Sale Proposal, Criticism Continues Without Lockup Period

The post Token unlocking and impact on cryptocurrency prices? TokenUnlocks Report appeared first on Our Bitcoin News.

2 years ago

158

2 years ago

158

English (US) ·

English (US) ·