Digital securities (security tokens: ST) that use blockchain technology and STOs (security token offerings) that raise funds through them are attracting a lot of attention both in Japan and overseas. Various advantages such as ease of trading, cost reduction, high security, and small-lot transactions have been pointed out, and it is likely that individual investors will continue to permeate the market in the future.

An event “Digital Securities Forum” was held in Tokyo on December 21, 2022, where key domestic players discussed the current status and prospects of ST. Mr. Tatsuya Saito of Mitsubishi UFJ Trust and Banking gave a lecture titled “The structure and impact of the digital securities market, looking back at actual data.” In addition, key persons from Mizuho Trust & Banking, Sumitomo Mitsui Trust Bank, Nomura Holdings, Tokai Tokyo Securities, and Mitsui & Co. DAM took the stage for a panel discussion, looking back on past achievements and talking about future projections.

Sponsored by Nihon Keizai Shimbun. Co-sponsored by N.Avenue, which operates coindesk JAPAN. The event will be held for the second time following last year.

The event started with a speech by Mr. Mamoru Yanase, Counselor of the Financial Services Agency’s Policy Bureau. Counselor Yanase pointed out, “The financial industry has been one of the first to utilize information and communication technology among various industries.” Regarding tokens, he said, “I think there is a high potential” in terms of creating new services, facilitating asset value exchange, and building new relationships with investors.

Mamoru Yanase Counselor, Policy Bureau, Financial Services Agency

Mamoru Yanase Counselor, Policy Bureau, Financial Services AgencyIn addition, after introducing the efforts of the Financial Services Agency, such as the revision of the Financial Instruments and Exchange Act (enforced on May 1, 2020), which organizes the legal position of security tokens (ST), we will further develop digital securities. In order to achieve this, I would like industry players to demonstrate their originality and ingenuity and expand use cases based on the various possibilities that this will bring.” ” he emailed.

What are the benefits of security tokens?

Next, Mr. Saito, who gave a lecture, was involved in the launch of the digital asset platform “Progmat” as a product manager of the Digital Asset Business Office of the Digital Planning Department of UFJ Trust Bank. In the future, in order for Progmat to be widely used as an infrastructure for the industry, it is planned to become a joint-stock company by receiving investment from various domestic key players, and Mr. Saito will be appointed as the representative.

UFJ Trust Bank Digital Planning Department Digital Asset Business Office Mr. Saito

UFJ Trust Bank Digital Planning Department Digital Asset Business Office Mr. SaitoMr. Saito explained that in the past, commercialization of assets required “listing costs”, and it was difficult to commercialize unless the assets were large-scale. However, he points out that if blockchain technology is used well, it will be possible to develop products for a wide range of individuals without listing. He continued, “It’s easy to make small lots and improve liquidity regardless of the scale,” and “P2P transactions are possible because they can be exchanged simultaneously on the blockchain.”

Many cases of ST utilization in Japan are currently tied to real estate, and projects will appear one after another from August 2021. As of December 2022, the management balance of the real estate ST fund exceeds 43 billion yen. Regarding the reason why real estate ST is doing well, he explained, “It is highly evaluated for its hybrid product characteristics that combine the good aspects of J-REIT and crowdfunding.” The potential size of the real estate ST market is expected to reach 2.6 trillion yen in 10 years.

In the future, ST will be increasingly used for real assets other than real estate.

In the future, Mr. Saito predicts that the “real asset tokenization” market centered on ST will merge with the global and public Web3 ecosystem. For that reason, he wants to realize a permissionless stablecoin in Japan as well. I want to push the flow,” he said enthusiastically.

What kind of “trust” is necessary even in a trustless world?

From left: CoinDesk Japan Kamimoto, UFJ Trust and Banking Mr. Saito, Mizuho Trust & Banking Mr. Ogata, Trust Base Mr. Tanaka

From left: CoinDesk Japan Kamimoto, UFJ Trust and Banking Mr. Saito, Mizuho Trust & Banking Mr. Ogata, Trust Base Mr. TanakaFollowing the lecture, Mr. Saito, Mr. Chie Ogata, Researcher of Mizuho Trust & Banking Trust Frontier Development Department, and Sumitomo Mitsui Trust Co., Ltd. Mr. Satoshi Tanaka, chief investigator of the bank’s digital planning department and CEO of Trust Base, a DX strategy subsidiary of the group, took the stage.

All three companies have announced their investment and participation in the digital securities platform “Progmat”. Regarding the aim, Mr. Ogata said, “I find it attractive that it is a unified standard. We should compete where we should compete, but where we do not, we need to reduce costs as much as possible in the future. I agree with that idea. ‘ said.

Mr. Saito said that the convenience of users would be impaired if similar platforms were to emerge, saying, “If a segmented market is created, matching opportunities will also be impaired. It is,” he pointed out. He also said that he would like to create a global and permissionless stablecoin instead of Galapagos, saying, “I want to acquire the power to be used globally as a new company.”

Mr. Tanaka said that it is a high hurdle for general users to handle permissionless and global products, and said, “If we tell people to use Metamask for wallets, it will not be a product that people can use with peace of mind.” said. In order for ST to expand the scale of the market in the future, the market will not develop easily unless people with trust create a world where trustlessness can be realized. The trust bank industry can take on this responsibility,” he emphasized.

What kind of assets will be tokenized in the future?

The topic then shifted to what assets will be tokenized in the future.

Mr. Saito predicts, “In addition to real estate, movable properties such as aircraft and ships will be tokenized steadily in the future.” After that, he said, “Personally, what I find interesting is small-scale assets.” , said that it could be digitized and traded.

For whiskey, for example, there is already a mechanism for raising funds by tokenizing the “future drinking rights” while the brewery is maturing the whiskey.

In response to this, Mr. Ogata said, “It is also possible to entrust the business and tokenize the beneficiary rights. Combined with solar facilities, there are products that can return value and tokens that support local areas. I might be able to make it,” he said of the possibility.

Mr. Tanaka says that while a 20-plus-year-old train strap has little value on the balance sheet, he feels that there is potential for “things that actually have value for maniacs.” “Financing methods will become more diverse, investors will have more options, and they will be able to enjoy asset management.

“Security Tokens (STs) are gaining recognition.”

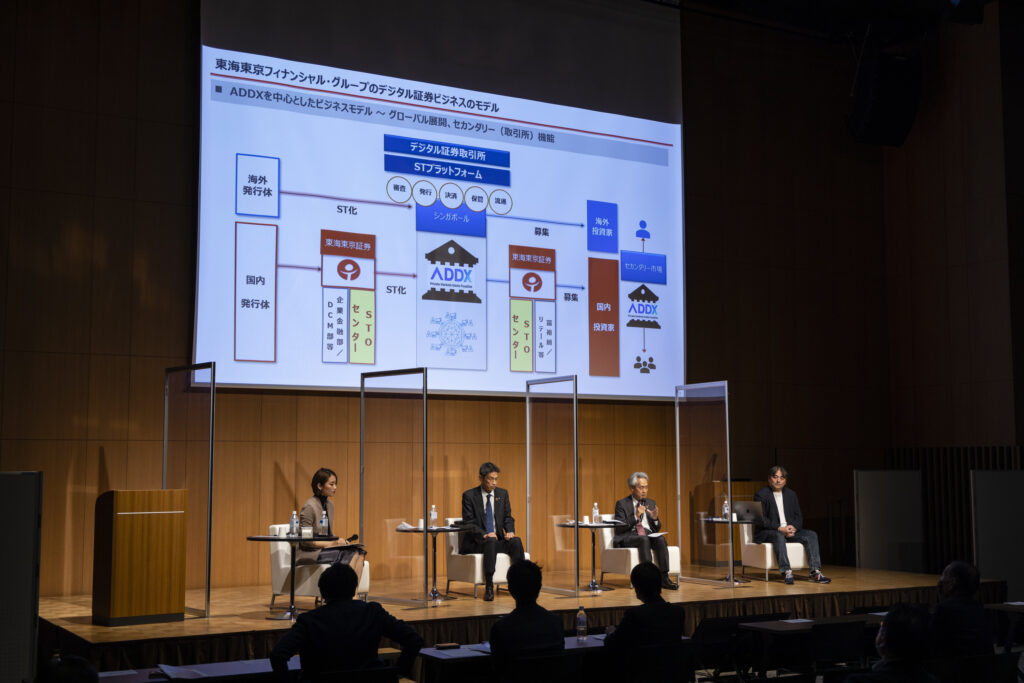

From the left, Mr. Numata of CoinDesk Japan/Nomura Holdings, Mr. Takei of Tokai Tokyo Bank, and Mr. Ueno of Mitsui Bussan Digital Asset Management

From the left, Mr. Numata of CoinDesk Japan/Nomura Holdings, Mr. Takei of Tokai Tokyo Bank, and Mr. Ueno of Mitsui Bussan Digital Asset ManagementIn the second part of the panel discussion, “Considering the current situation and outlook of digital securities from case studies,” Mr. Kaoru Numata, executive officer of Nomura Holdings, Mr. Takao Takei, executive officer of Tokai Tokyo Bank, and Mitsui Bussan Digital Asset Management Ueno Mr. Takashi took the stage and talked about the actual situation and future prospects of sending out various STs to the world.

Nomura Group is actively working on ST, such as advocating a consortium-type blockchain platform “ibet for Fin” that specializes in the issuance and distribution of securities tokens by its subsidiary BOOSTRY. According to Mr. Numata, in 2022, it will handle a total of 7 cases, including 3 real estate STOs and 4 bond STOs, making it the top securities company in Japan. As a result of the continuous introduction of products, “ST is still niche, but its recognition has increased,” says Mr. Numata. There are also voices from companies that want to issue it, and there are cases where customers understand that it is an STO.

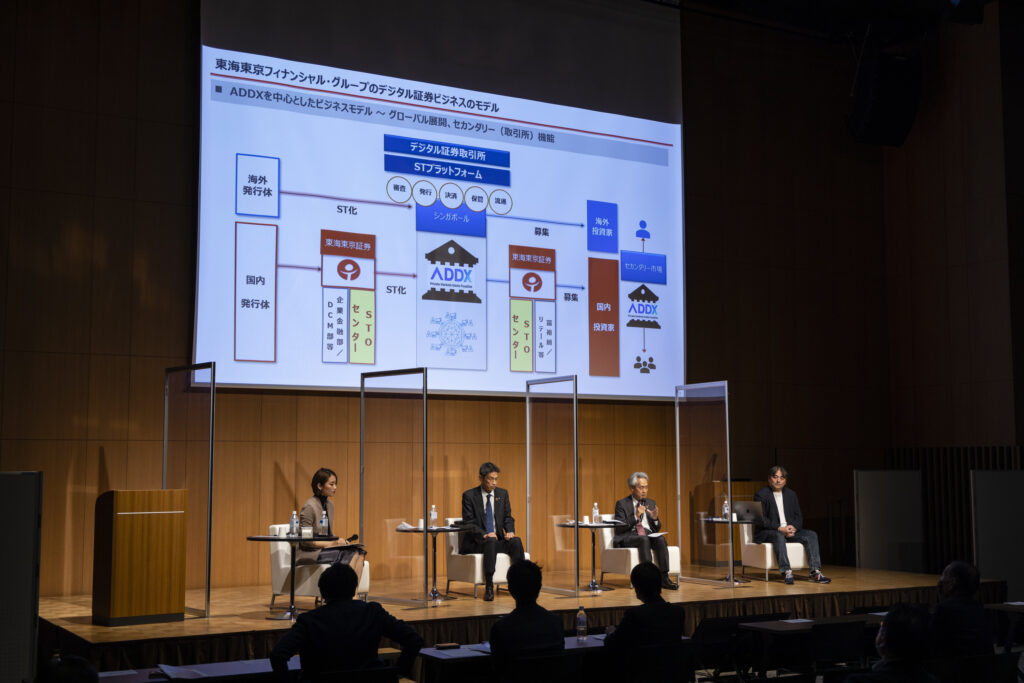

Mr. Takei of the Tokai Tokyo Bank Group, which has continued to work on ST-related initiatives since investing in Singapore’s stock exchange ADDX in 2019, plans to complete the first project (Tosei & Co., Ltd.) in November 2021 in two years. He said that he will release a property fund), launch the “STO Center” from January 2022, and launch private placement ST projects and real estate STs from December 2022 to March 2023.

Since the fall of 2021, the Mitsui & Co. Group has sold four digital securities linked to various real estate properties. Mr. Ueno is currently working on the launch of a new asset management service “ALTERNA” that utilizes digital securities. This is a service that allows individual investors to use their smartphones to invest for the purpose of yield, starting at around 100,000 yen, and is currently awaiting approval from the relevant authorities. Mr. Ueno said, “Ever since the Lehman Brothers collapse, there has been a desire to make financing easier for individual investors. Now that we are finally here, legal reforms and technological backup have brought this to fruition. It’s in its current form,” he said.

What is the real appearance of “real estate STO”?

In addition, Mr. Nomura and Numata explained two publicly offered real estate STO projects backed by condominiums in Tokyo, which were issued in August 2022. The total appraisal value of the properties in Ginza and Daikanyama is around 4 billion yen, and the ST issuance amount is 1.833 billion yen. The offer conditions were “one unit of 1 million yen, two or more units, and a yield of 2.9%.” Mitsui & Co. DAM is the asset manager, Sumitomo Mitsui Trust Bank is the trustee, Nomura Securities handles it, and it is operated on the blockchain platform “ibet for Fin”.

“The property itself is very good, and listening to customers from all over the country, many of them purchased it because of its location,” he said. Unlike REITs with large-scale portfolios, the tactile feel of a single, easy-to-understand building was well-received. It is said that it was

According to Mr. Ueno, among the real estate STs issued in the past, the yield is on the low side, but he said, “Nevertheless, being able to confirm solid investor demand was a big step forward.”

Mr. Takei of Tokai Tokyo Securities explained about projects for housing, offices, commercial facilities and complex facilities in Yokohama City. The investment company was Tosei Asset Advisors, and the total amount solicited was 870 million yen (10 million yen per unit).

Regarding the sales system, the sales staff commented, “It was difficult to sell a product that I had no experience with, including obtaining a sales qualification (ST sales representative).” It is said that there were voices such as “There was an unusual office work.” On the other hand, investors said that “the concept of ST is difficult to understand” and “there are expectations for assets other than real estate.”

Hot spring inn STO in Kusatsu, Gunma is also popular

Nomura also introduced a case study of a hot spring inn. This product is backed by two inns in Kusatsu, Gunma Prefecture, “Yuyado Tokino Niwa” and “Oyado Konoha.” The appraisal value of the property is approximately 4.4 billion yen. In March 2022, when one unit was 500,000 yen and more than 10 units were solicited, about 2.1 billion yen was applied, and it was a great success.

The asset manager is Mitsui & Co. DAM. Mr. Ueno said, “It’s a special type of real estate, so we were really excited to see if there would be demand for it.” When the lid was opened, there were more than 4,000 reactions, and he looked back, saying, “The keyword is diversity. It was a project that felt great potential in the market for individual investors, which ST is aiming for.”

In addition, Mr. Numata explained the “Green Digital Track Bond” issued by the Japan Exchange Group in June 2022 and Marui Group’s self-offered digital bonds (issued in June and October 2022). There was also

All three of the speakers talked about the importance of investor protection and the future potential of ST.

Mr. Ueno said, “Considering the expansion of investment targets and the fact that Japan’s personal financial assets have exceeded 2,000 trillion yen, I think there are still unlimited business opportunities. It is also in line with our policy.We are not in a phase of competing (for a limited pie).We also want to increase the scope for collaboration while having various functions.We definitely want to work together to open up new markets. I hope we can liven things up,” he called out to other players who are thinking of entering the ST industry.

|Text and editing: coindesk JAPAN

|Image: Nihon Keizai Shimbun N Brand Studio

The post Token use, increasing awareness and expanding expectations What was said at “Digital Securities Forum 2022″[Event Report]| coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

130

2 years ago

130

English (US) ·

English (US) ·