The area of asset tokenization and real-world assets (RWA) has attracted the attention of individual and institutional investors in 2023 due to its successful combination of professionally managed financial products and mechanisms using digital assets. Having advised over 40 clients on their tokenization strategies and issuance of tokenized products, we have seen the following themes emerging in the tokenization market in Q3 2023:

Efficiency and profit improvement with blockchain

For investors entering this space, the biggest efficiencies come from end-to-end digital systems, or on-chain lifecycles. That means costs and manual time can be saved compared to traditional processes. Let’s look at some examples below.

- Goldman Sachs Digital Asset Platform (GS DAP) achieves cost reduction of 15 basis points on digital bond issuance of 100 million euros (approximately 16.3 billion yen, equivalent to 163 yen per euro) As a result, an additional return of €150,000 was passed on to the sole buyer, Union Investment.

- JP Morgan’s Onyx Digital Assets (ODA) is expected to have a tokenized repo volume of $1 trillion (approximately 150 trillion yen, exchanged at 150 yen to the dollar) by the end of 2023, It is expected to reduce costs by $1 million.

- Broadridge’s Distributed Ledger Repo (DLR) delivers cost savings of $1 million per 100,000 repo transactions for sell-side clients like Societe Generale. ing.

- Equilend has launched 1Source, a distributed ledger-based securities lending solution. The total cost savings for the securities lending industry is estimated at $100 million.

- Intain, a structured finance services platform, uses Hyperledger and Avalanche blockchain solutions to reduce loan lifecycle fees for small businesses from 150 basis points to 50 basis points. , achieving a fee reduction of 100 basis points.

- Vanguard, through Grow Inc., leverages R3’s Corda to enable straight-through processing, saving 100 hours per week.

- Liquid Mortgage reduced mortgage-backed securities (MBS) reporting from 55 days to 30 minutes using Stellar blockchain.

From money market and government bonds

Asset managers and issuers are becoming familiar with tokenization workflows by experimenting with money market and government bond products. These tokenized assets are fully on-chain and generate yield that can be passed on to customers.

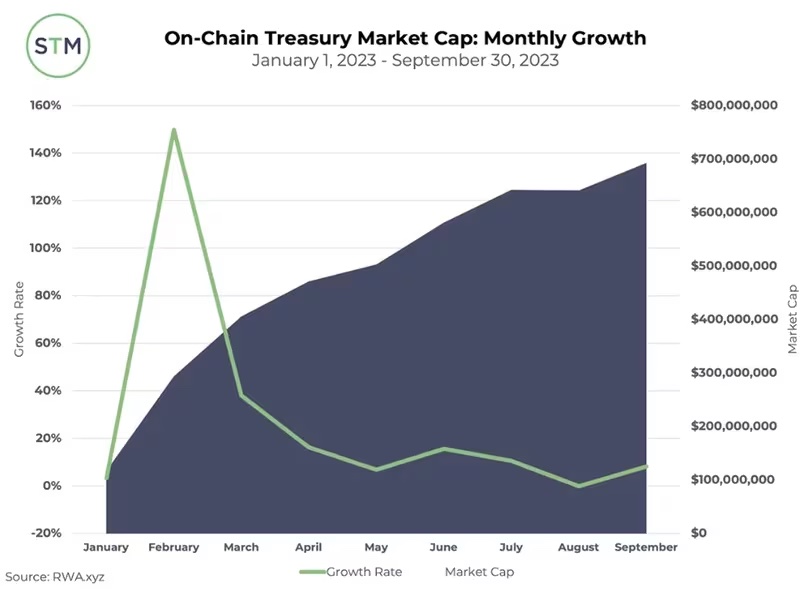

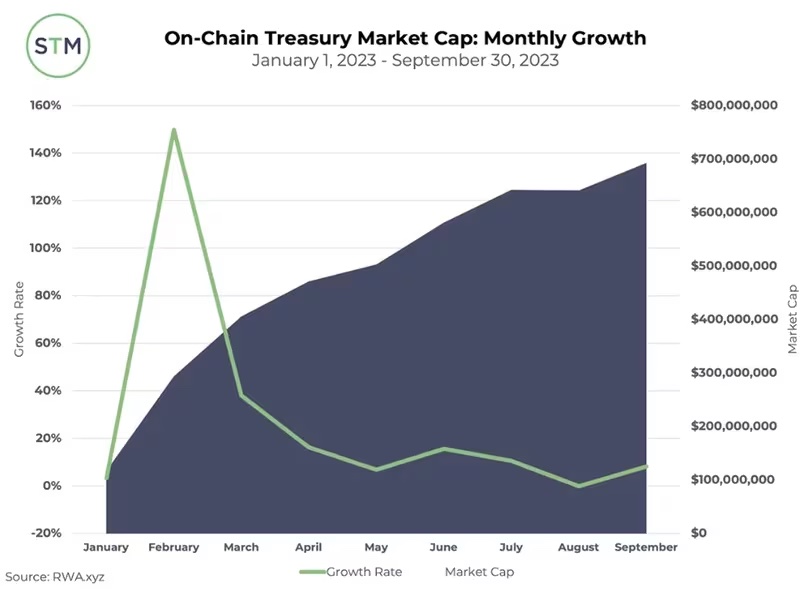

While efforts toward alternative products continue to advance, money markets offer returns of up to 5% per year with low risk. The asset class accumulated approximately $700 million of on-chain capital by the end of Q3 2023, an increase of approximately 520% year-to-date.

Market capitalization and monthly growth rate of on-chain government bonds (green)

Market capitalization and monthly growth rate of on-chain government bonds (green)(RWA xyz)

Distribution of tokenized products through institutional investors

One of the weaknesses of the traditional tokenization industry is the actual distribution of goods and capital syndication. Financial institutions are not only tokenizing assets for operational and efficiency purposes, but are also beginning to offer tokenized products to their own customers as buyers.

Citi offers digital corporate bonds to private banking and wealth management clients in Southeast Asia through BondbloX in Singapore. UBS previously launched an Ethereum-based money market fund, also in Singapore, following the issuance of more than $400 million in digital corporate bonds for high-net-worth clients.

As financial giants like JPMorgan and Goldman Sachs continue to develop a range of digital financial products, the private banking, wealth and asset management, and alternatives firm is offering retail broker-dealer access. It is expected to act as a sales channel to unlock a significant amount of struggling capital.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original text: Tokenization and Real-World Assets Take Center Stage

The post Tokenization and real-world assets (RWA) take center stage | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

72

1 year ago

72

English (US) ·

English (US) ·