The main reason why the tokenization market has not really taken off is due to technical bottlenecks, current infrastructure and interoperability limitations. But in the last year, amazing progress has been made in overcoming these problems. It’s easy to point out projects that didn’t work out, but the real story of tokenization in 2023 will be driven by the power of large financial institutions entering the market, enabling the next wave of tangible results to materialize. This is because we have laid the groundwork for this to happen — carefully select what you want to read over the weekend from this week’s columns, analytical articles, interviews, and more.

Tokenization will really (finally) begin in 2024

Everyone from TradFi (traditional finance) leaders to crypto experts predict that tokenization opportunities will reach into the tens of trillions. While we are already witnessing some compelling use cases, it is still just a drop in the ocean compared to the large amount of digitized assets that are likely to be on-chain in the coming years.

When will the current tokenization trend turn into a torrent? And what is stopping it? …read more

Following the Argentine presidential election: What Bitcoiners are getting wrong

If you follow crypto assets (virtual currency) related media or Twitter, you may have seen news or posts proudly announcing that Javier Milei won the Argentina presidential election run-off on November 19th. You must have seen it.

This is disturbing to me because it highlights how blind crypto enthusiasts can be to the larger issue, and it’s important to note that “Be careful what you wish for.” It reminds me of the old adage, “Please add a .” …read more

Bitcoin ETF, impact on price volatility

The U.S. Securities and Exchange Commission (SEC) is widely expected to approve exchange-traded funds (ETFs) that invest directly in Bitcoin, rather than Bitcoin (BTC) futures.

Analysts agree that the approval will have a bullish impact on prices. But analysts are divided on whether the approval will reduce Bitcoin’s notorious price volatility, which has made it less attractive as a safe-haven asset. …read more

Why did Cerezo Osaka, celebrating its 30th anniversary since its establishment, choose generative NFTs with fan motifs?

J League “Cerezo Osaka” is conducting INO of club NFT “CEREZO OSAKA SUPPORTERS NFT (abbreviation: Ceresapo NFT)” on Coincheck INO. The number of applications for the Arrow List (so-called pre-sale), which was held until November 28th, was 1,177 out of 100 units sold, a multiplier of 11.7 times, and when sales started on a first-come, first-served basis on the 30th, it took just under 7 minutes. Sold out.

When you think of sports-related NFTs, some people may think of Dapper Labs’ NFT game NBA Top Shot. At its peak, NFT cards containing video game highlights were selling for hundreds of thousands of dollars. …read more

Polygon’s secret deal: Millions of dollars given to major companies that became validators

In March 2022, Polygon Labs announced “important adoption milestones” for its technology platform. DraftKings has begun implementing one of its network validators, announcing that it will be “the first example of a major publicly traded company taking an active role in blockchain governance.”

Something Polygon didn’t reveal at the time. That means DraftKings will be taking on this mission on very lucrative and favorable terms. Over the next 20 months, Polygon ended up losing millions of dollars in subsidies to useless validators. …read more

“Politicians masquerading as regulators”: 3 points to learn from Fortune magazine’s special feature on SEC Chairman Gensler

When Gary Gensler took over as chairman of the Securities and Exchange Commission (SEC) in 2021, it’s strange to look back on how the crypto-assets (virtual currency) industry perceived him. is. At the time, Mr. Gensler was seen as a breath of fresh air for an industry that was in dire need of change. …read more

We would like to continue to maintain the network and advance discussions in the future — Minutes of the 4th “DAO Rulemaking Hackathon” of the Liberal Democratic Party web3PT

The “DAO Rulemaking Hackathon”, which has been held every Wednesday since November 15th to discuss the state of laws regarding DAOs (Decentralized Autonomous Organizations), was held for the fourth time on December 6th. . As it was the final meeting, more people gathered in conference room 101 on the first floor of the Liberal Democratic Party headquarters than in the past three meetings.

This time, presentations were made by SOKO Lifetech, Makigumi, Tales & Tokens, Sparkle Michinoku DAO, DeNA, and Neo Yamakoshi Village Caretaker DAO Ushi no Kakuzutsu fan club. …read more

How to invest in Web3 through the stock market[US version]

![How to invest in Web3 through the stock market[US version]](https://www.coindeskjapan.com/wp-content/uploads/2023/12/shutterstock_2321011373-710x458.jpg)

For those new to new technology, innovation can sometimes seem like an overnight success story. However, in reality, in many cases it takes decades to create.

Currently, we are using four innovative technologies created over several decades: blockchain, AI (artificial intelligence), IoT (Internet of Things), and XR (collective term for VR, AR, MR, etc.). We are now at a precious moment in time when the momentum is rapidly increasing. …read more

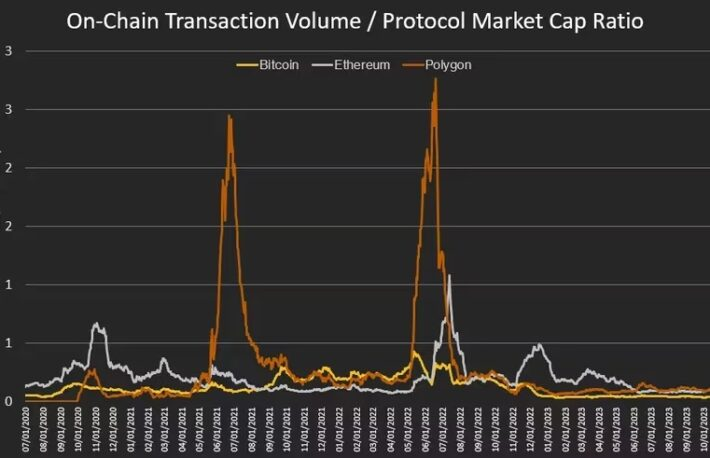

On-chain transaction volume: why is it an important metric for blockchain?

On-chain transaction volume is the pulse of the blockchain network. For digital asset investors, keeping a close eye on these flows within the network and comparing them across protocols can help confirm a protocol’s prevalence and usefulness, and determine whether a project will develop further or is an outdated relic. This is a way to judge. …read more

British asset management companies and exchanges focusing on MMF tokenization—TradFi tokenization race progresses

Imagine a token that represents ownership in a money market fund (MMF), functions like a stablecoin that generates yield, and can also serve as collateral for transactions.

British investment firm Aberdeen (abrdn) and exchange Archax are joining the race to tokenize traditional assets.

Archax, one of the first crypto companies to be regulated by the UK Financial Conduct Authority (FCA), and Aberdeen, which has $626 billion in assets under management (approximately 94 trillion yen, exchanged at 150 yen to the dollar), announced in October , has started operating institutional grade MMF tokens. The companies are currently leveraging this token to attract customers looking for new and flexible ways to allocate capital. …read more

[ST Frontline]Untapped real estate market of 100 trillion yen, sleeping cash of 1,000 trillion yen. Daiwa Securities is opening up a market with huge potential with security tokens!

![[ST Frontline]Untapped real estate market of 100 trillion yen, sleeping cash of 1,000 trillion yen. Daiwa Securities is opening up a market with huge potential with security tokens!](https://www.coindeskjapan.com/wp-content/uploads/2023/12/2023STSpecial_%E5%A4%A7%E5%92%8C%E8%A8%BC%E5%88%B8_thumbnail-710x458.png)

Osaka Digital Exchange’s (ODX) private trading system “START” will launch on December 25th as Japan’s first secondary market for security tokens, and the purchase and sale of security tokens will begin. Daiwa Securities Group Headquarters is a shareholder of ODX, and Daiwa Securities is the underwriter for one of the two deals announced on November 20th as the first deals in Japan.

Daiwa Securities Group Headquarters Managing Executive Officer discusses how the long-awaited secondary market will affect the security token market, the significance of Daiwa Securities’ efforts in security tokens, and the potential of the real estate market, which still has a lot of room for development. We asked Atsushi Itaya, who serves as a board member. …read more

The post Tokenization has really (finally) begun/What Bitcoiners misunderstand about Argentina’s presidential election[10 carefully selected books to read on the weekend] appeared first on Our Bitcoin News.

1 year ago

111

1 year ago

111

English (US) ·

English (US) ·