“Tokenization,” especially “tokenization of real-world assets (RWA),” has recently been attracting attention as the next big thing in the crypto asset (virtual currency) industry.

Most people don’t realize that this trend is just another form of security token. Security tokens may not have been heard of since 2018, and there’s a reason for that.

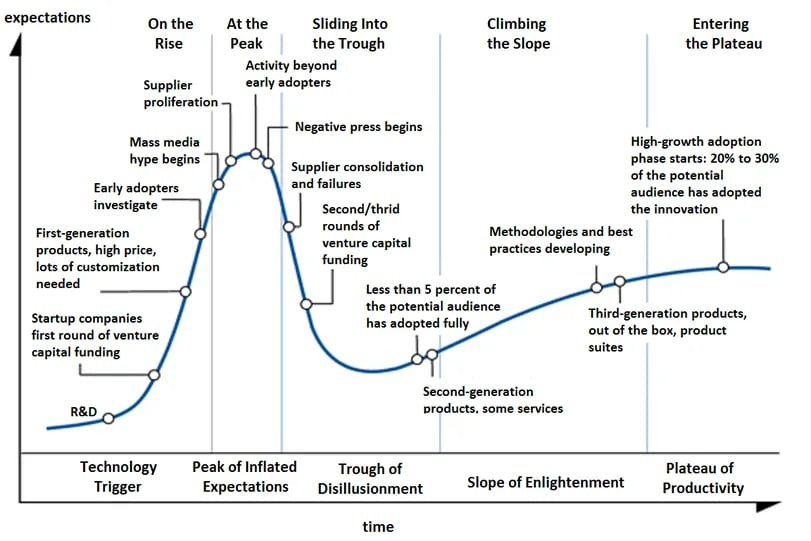

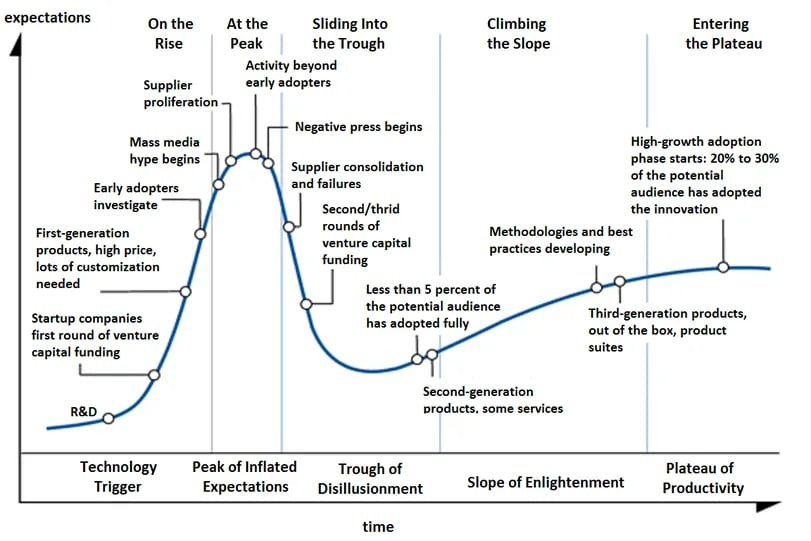

Those who tout tokenization are largely wrong. But they don’t mean any harm. It’s no one’s fault that something becomes popular, but “security tokens,” “tokenization,” and RWA are all part of the same technology continuum, and if Gartner’s “hype cycle” is correct; It will soon go bankrupt again.

“Refugees from DeFi”

Many of the current tokenization advocates are refugees from decentralized finance (DeFi), the former champion of the hype cycle.

While some influential traditional finance (TradFi) influencers and CEOs believe that tokenization is a natural evolution of finance (for example, BlackRock CEO Larry Fink said the recent launch of a Bitcoin ETF , which states that it is the “first step” to having everything on-chain), “tokenization of all financial assets” is more complex and widely misunderstood by both proponents and opponents.

RWA tokenization began in late 2017 and is about to enter its 8th year. My company Vertalo launched its first fully Reg D/S stock tokenization in March 2018.

The challenges we encountered are too numerous to mention here, from our initial role as issuers of tokenized stocks to our mission to “connect and enable the digital asset ecosystem.” This led to the company’s focus on becoming a “pick-and-shovel” enterprise software company.

We have since seen the expansion of NFTs and DeFi, followed by a significant contraction. NFTs and DeFi were easier and more end-user friendly applications of tokenization technology.

Precedents for NFT and DeFi

In the case of NFTs, easily accessible marketplaces like OpenSea allowed people to buy computer-generated art represented by tradeable tokens.

If we apply the progress of NFTs to Gartner’s Hype Cycle, we can say that we have passed the peak and are rapidly falling through the “trough of disillusionment”. For example, Coatue, an investor in OpenSea, scaled back its $120 million (approximately 17.8 billion yen, equivalent to 148 yen to the dollar) investment to $13 million in light of OpenSea’s slump.

Similarly, the once-hot DeFi market has cooled, with many projects rebranding and focusing on RWA. This includes DeFi giants MakerDAO and Aave.

The team promoting RWA’s credit now lists large traditional financial institutions as customers and partners. This makes sense since many DeFi entrepreneurs studied at Stanford University or Wharton Business School before working at Wall Street banks.

Tired of quantitative jobs supporting bond salesmen and stock traders and fascinated by the volatility and work-life balance offered by decentralization, the DeFi movement is well-versed in the world of global finance (and money) but I’m not really interested in rules, regulations, or strictness.

Sensing an ominous omen, smart DeFi entrepreneurs who are keen observers of trends and their army of engineers and mathematicians will exit the governance token airdrop game in 2022 and move on to something “new”: tokens. The company began to rebuild its marketing and strategy to begin evolving.

As a result, the RWA moniker was adopted en masse, and people quickly ran away from what appeared to be boilerplate rug pulls, which was a signature move and risk in the DeFi world from 2020-22.

“Diffusion of suppliers”

The fact that most of the assets and collateral commonly managed in most RWA projects are stablecoins rather than actual hard assets does not seem to be a problem.

Tokenization is not a quiet movement. If we apply the current RWA market to the hype cycle, it probably corresponds to the peak of “supplier proliferation.” Everyone wants to get into the RWA business now, and as soon as possible.

Tokenizing RWA is actually a great idea. Today, ownership of most private assets, the asset class covered by RWA, is tracked on spreadsheets or centralized databases.

If there are constraints on selling an asset (such as public stocks, bearer bonds, or crypto assets), there is little reason to invest in technology that facilitates the sale. The outdated data management infrastructure found in private markets is a result of inertia.

And tokenization, RWA proponents say, solves this.

Is tokenization actually the solution?

While there is some truth to this innocent lie, the absolute truth is that tokenization itself does not solve liquidity and legality issues regarding private assets, and may even introduce new challenges. Thing.

Proponents of RWA tokenization conveniently avoid this issue. It is easy to do so because most of the so-called real assets that are tokenized are simple debt or collateral instruments that are not subject to the same compliance and reporting standards as regulated securities.

In reality, most RWA projects involve an old process called “recollateralization,” where the collateral is itself a regulated crypto asset and the product is a form of loan. That’s why almost all RWA projects tout money market-like yields. However, I am not concerned about the quality of the collateral.

Lending is big business, and we have no intention of discounting the future or long-term success of tokenization. However, bringing real assets on-chain is not accurate. Tokenization simply refers to the collateralization of crypto assets in the form of tokens. Tokenization is just one important piece of the puzzle.

When Larry Fink and JPMorgan CEO Jamie Dimon talk about “the tokenization of all financial assets,” they are not talking about crypto-backed RWA, they are actually talking about real estate. We’re talking about private equity tokenization, and eventually public equity tokenization. This is not just something that can be achieved with smart contracts.

From actual experience

Having spent over seven years developing a digital transfer agent and tokenization platform, and having tokenized approximately 4 billion shares representing the stocks of nearly 100 companies, I can tell you that a large amount of “tokenization of financial assets” has occurred. The reality is much more complex.

First of all, tokenization is a relatively simple and minor business. Tokenization is a commodity business, and hundreds of companies can tokenize their assets.

Tokenization itself is not a very profitable business, and as a business model, tokenization is a low-cost competition when it comes to fees. With so many businesses offering the same thing, tokenization will quickly become a commodity.

Second, but far more important, there is a fiduciary responsibility regarding the tokenization and transfer of RWA. This is the difficult part, and the ledger, or blockchain, plays an important role.

Blockchain offers real benefits for tokenizing financial assets by providing immutability, auditability, and reliability. A foundation of provable ownership is created, allowing for instant, error-free recording of all transactions. Without this, the financial revolution using tokens cannot occur.

Blockchain will allow financial professionals and their clients to back up the words of Larry Fink and Jamie Dimon, and instead of using the cumbersome and technical world of DeFi and cryptocurrencies, RWA tokens will make it more popular.

So before you start riding the hype cycle, look at what happened in the past and what should happen next. Don’t end up on the wrong part of the cycle. Otherwise, it will become a second story to NFT.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original text: Real World Asset Tokenization Is Fake News

The post Tokenization of real assets (RWA) is fake news | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

86

1 year ago

86

English (US) ·

English (US) ·