The post Toncoin Price Set for 20% Rally, On-Chain Metrics Signal Buy Opportunity appeared first on Coinpedia Fintech News

Amid the ongoing market reversal, Telegram-linked Toncoin (TON) has experienced a breakout from a long consolidation zone, with on-chain metrics now flashing a buy signal. Prior to this rally, TON had been consolidating between $5.38 and $5.80, near the $5.75 resistance level for the past two weeks.

TON Price Momentum

However, today’s impressive rally broke out of that zone and shifted the overall market sentiment. At press time, TON is trading near the $5.90 level and has experienced a price surge of over 4.5% in the past 24 hours. During the same period, its trading volume increased by 6.5% and has been steadily rising, indicating renewed interest from traders and investors.

The potential reason behind the price rally is the bullish market sentiment and the upcoming airdrop in October 2024.

Toncoin Technical Analysis and Upcoming Levels

According to expert technical analysis, TON appears bullish and is now trading above the 200 Exponential Moving Average (EMA) on a daily time frame, indicating an uptrend. The 200 EMA is a technical indicator that Traders and investors use to determine whether an asset is in an uptrend or downtrend.

Source: Trading View

Source: Trading ViewBased on the historical price momentum, following the breakout, there is a strong possibility that TON could soar by 20% to the $7 level in the coming days. However, this bullish thesis will only hold if TON closes its daily candle above the $5.90 level, otherwise, it may fail.

Bullish On-Chain Metrics

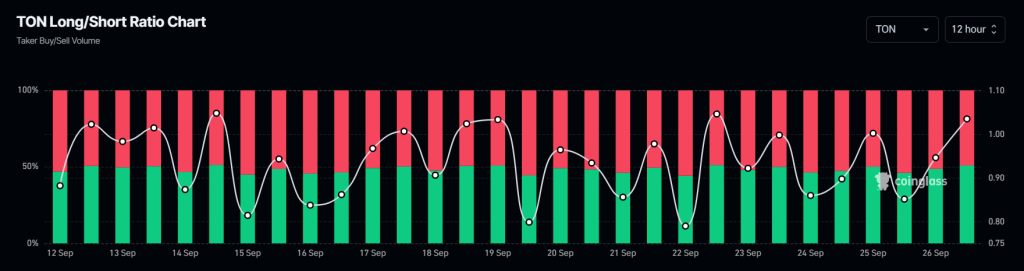

As of now, TON’s bullish outlooks it further supported by on-chain metrics. Coinglass’s TON Long/Short ratio currently stands at 1.035, indicating strong bullish market sentiment among traders.

Source: Coinglass

Source: CoinglassAdditionally, its future open interest has increased by 5.7% in the last 24 hours, signaling that traders are potentially building more long positions compared to short ones.

11 months ago

56

11 months ago

56

English (US) ·

English (US) ·