Following a shakeup in the U.S. banking system over the past week, crypto exchanges and wallets gained momentum as some look for bankless alternatives.

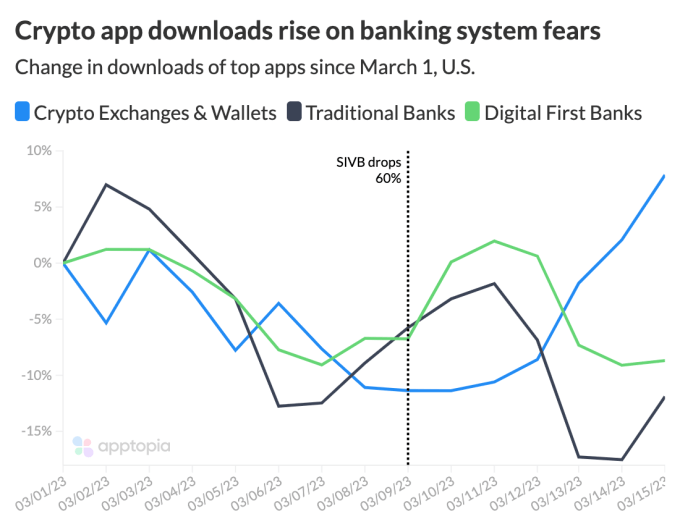

The top 10 crypto applications for exchanges and wallets have risen about 15% since Silicon Valley Bank’s stock fell 60% last week, according to a chart from real-time app data provider Apptopia. The top 10 crypto apps were defined as Coinbase, Crypto.com, Trust, Binance, Bitcoin and Crypto DeFi Wallet, Blockchain.com, KuKoin, Kraken, eToro and BitPay.

Meanwhile, the top 10 traditional banks and top 10 “digital first” bank app downloads have fallen during the same time frame about 5% and 3%, respectively. The top 10 banking apps include Capital One, Chase, Bank of America, Wells Fargo, Discover, Citi and U.S. Bank, among others. The top 10 digital first apps were Chime, Dave, Albert, Empower, Varo, MoneyLion, Current, Aspiration, Sable and Oxygen.

Image Credits: Apptopia (opens in a new window)

The divergence in downloads points to general concern across the U.S. from customers amid the recent banking crisis.

Last week, Silvergate Capital, Silicon Valley Bank and Signature Bank all shut down or were closed, which resulted in crypto companies and investors and traditional users alike scrambling to move their assets.

The shuttering of these banks brought on bigger questions around where people and companies should park assets and which banks they can (or can’t) trust.

Other midsize and regional banks, including First Republic, have been under pressure following SVB’s collapse. First Republic had the third-highest rate of uninsured U.S. deposits behind SVB and Signature with about $119.5 billion in uninsured deposits, according to Reuters.

The crypto market is showing a “positive contagion” after the SVB collapse, similar to what transpired in 2020 when investors fled traditional markets during the COVID-19 pandemic in favor of alternative assets, Stefan Rust, CEO of inflation data aggregator Truflation and former CEO of Bitcoin.com, previously said to TechCrunch+.

In the wake of all this chaos, bitcoin and ether, the biggest cryptocurrencies by market cap, had a seven-day increase of about 15% and 9%, respectively, at the time of publication, according to CoinMarketCap data. The global market cap for all cryptocurrencies also increased 8.3% during the same time period to about $1.1 trillion, slightly down from a weekly high of $1.14 trillion on Tuesday, the data showed.

The market madness has seemingly created a bullish sentiment in the crypto economy; as traders responded positively to the news, the overall market cap rose on the week and crypto app downloads increased.

Top crypto app downloads rise over 15% following SVB collapse by Jacquelyn Melinek originally published on TechCrunch

English (US) ·

English (US) ·