FTX and bank failures are a tailwind for DeFi

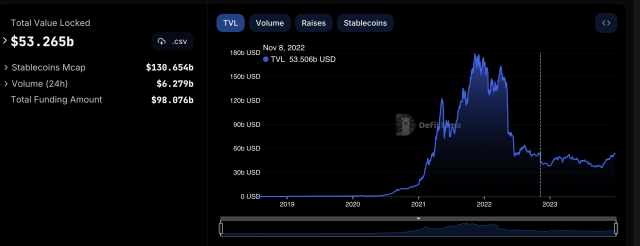

Total assets locked in decentralized finance (DeFi) protocols across all blockchains hit $53.2 billion, the highest this year since before FTX’s collapse in early November 2022. It reached the level of This was revealed by data from Devillama, The Block, etc.

Source: Defillama

In May and June last year, the centralized organizations of Terra (Luna), Three Arrows Capital, and Celsius collapsed, which dealt a big blow to DeFi users, but things started to recover in the first half of this year. TVL once reached a high price in April, but then fell back and rose again from October, returning to the level before the FTX bankruptcy. The cause appears to have been that the market environment has deteriorated again since April, including the SEC’s lawsuit against Coinbase and Binance (June) and the Federal Reserve’s continued interest rate hikes.

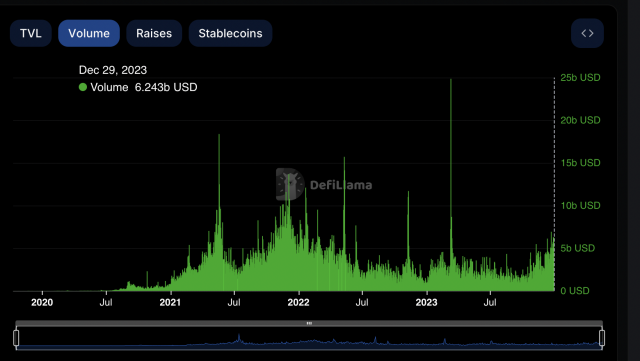

On the other hand, the collapse of FTX and BlockFi led to a loss of trust in centralized organizations, and the Arbitrum (March) token airdrop became a turning point for more virtual currency users to use decentralized exchanges and DeFi lending and borrowing services. Along with this, trading volume appears to be recovering.

Source: Defillama

After the Arbitrum airdrop, expectations for airdrops on protocols such as zkSync, Starknet, and LayerZero have increased, supporting an increase in trading volume. Additionally, the revival of the Solana ecosystem since October has increased interest in non-EVM and EVM+ parallel processing blockchains, leading to an influx of funds into TVL of these non-EVM chains.

connection:Solana Blockchain’s record-setting index seen through data Background of SOL’s new year-to-date high price

There have been major upgrades in Ethereum this year, and TVL in the liquid staking space has also seen a significant increase in funding. In mid-April, Ethereum implemented a withdrawal function for staked ETH with the major upgrade “Shapella”.

connection: Ethereum “Shapella” mainnet implementation completed

Furthermore, the RWA field has become more prominent in this year’s DeFi scene, with MakerDAO’s use of $2.5 billion in real assets as collateral becoming a hot topic.

connection: Promote RWA tokenization Start of collateral settlement of BlackRock MMF

Improvements in DeFi’s UX and UI, as well as lower fees and further improvements in processing speed due to the expected next year’s Ethereum “Dencun” upgrade and the implementation of Solana’s “Fire Dancer” client, are expected to further expand the DeFi user base in the future. .

connection: Why is Solana’s “Fire Dancer” expected to be a game changer?

CoinPost Special feature for virtual currency beginners

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

The post Total DeFi deposited assets of approximately 7.5 trillion yen, returning to the level before the collapse of virtual currency exchange FTX appeared first on Our Bitcoin News.

1 year ago

121

1 year ago

121

English (US) ·

English (US) ·