Deflationary pressure on ETH

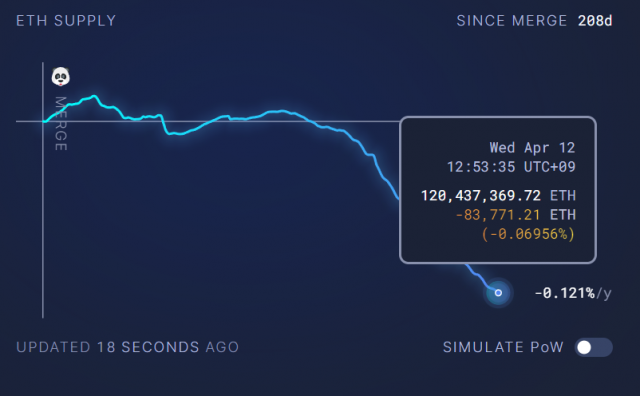

It was revealed that the supply of crypto assets (virtual currency) Ethereum (ETH) decreased by 82,924 ETH (equivalent to about 21 billion yen) in 208 days after the upgrade of The Merge.

The number of ETH burns (burning) according to the amount of network usage is increasing, and it is in a situation where the amount of new issuance due to staking rewards is exceeded.

Source: Ultrasound money

According to the data site ultrasound.money, the estimated annual change in ETH supply is -0.121%. 0.121% of the current ETH supply of 120,457,776 ETH is 145,753 ETH, equivalent to approximately 37 billion yen at the prevailing price.

With The Merge, Ethereum’s consensus algorithm moved from traditional Proof of Work (PoW) to Proof of Stake (PoS). Due to this change, the mining reward (13,000 ETH/day) became 0 (zero), and the amount of new ETH issued per day was only the staking reward (1,600 ETH* at that time).

What is Burn

The act of reducing the number of issued virtual currencies. The virtual currency burn is a mechanism that reduces the supply of stocks, which is similar to “share buybacks”. A company that buys back stock buys back the shares it has issued with its own money. Repurchases reduce the number of shares circulating in the market, increasing the value per share, which has a positive impact on shareholders. By burning, the value of each coin in circulation increases.

Cryptocurrency Glossary

Cryptocurrency Glossary

EIP-1559, introduced in the August 2021 “London” upgrade, also reduced the pace of ETH supply growth by about 90% by burning base fees.

Many investors have noted that the steadily declining supply of Ethereum will lead to increased deflationary pressures.

If the annual inflation rate of PoW remained at 4.13% (4.93 million ETH), the supply of ETH would have increased by 2.33 million ETH (580 billion yen) in the past 208 days.

connection:What is the ETH “Shanghai” upgrade?Summary of each company’s view on staking cancellation and ETH selling pressure

shanghai upgrade

The “Shanghai” (Shapella) upgrade, which will allow Ethereum validators to withdraw locked-up assets, is less than 18 hours away. According to blocknative, it is expected to be deployed to the mainnet around 7:30 (22:27 UTC) Japan time tomorrow.

18.14 million ETH (equivalent to approximately 4.2 trillion yen) locked up in the Ethereum staking contract and staking rewards (from 1 million ETH) can be withdrawn for the first time.

Many expect the implementation of the withdrawal feature to trigger a massive sell-off of investors in the short term. However, in Ethereum, there is a withdrawal limit in order to prevent a large number of validators from leaving at once and becoming unstable, and the maximum daily sales volume is 118,000 ETH.

Major U.S. cryptocurrency exchange Coinbase has the second largest ETH staking share (11.4%). The company plans to start accepting unstakes 24 hours after the upgrade is complete. Due to the expected high volume of withdrawal requests, Coinbase said it could take weeks or months to fully process.

Liquid staking giant Lido, which holds the top ETH staking share (31.2%), plans to start accepting stETH withdrawals around mid-May.

The unrealized P&L of staked ETH is worth -$4.7 billion, according to on-chain analytics firm Glassnode. As a result, only 9% have unstakes after the Chapela upgrade, and 68% are considering starting new staking and compounding operations.

connection:Ethereum’s important upgrade “Shanghai” approaching, BTC remains at the $ 30,000 level

The staking share of Ethereum (ETH) supply is also the lowest among other Layer 1 blockchains at 14%. Since the average value is 65% and BNB is 90%, there are expectations that investors who have refrained from ETH staking until now will be able to participate with peace of mind by implementing a withdrawal function.

The post Total Ethereum Supply Declining, What Is the Impact of the Shapella Upgrade on the Market? appeared first on Our Bitcoin News.

2 years ago

77

2 years ago

77

English (US) ·

English (US) ·