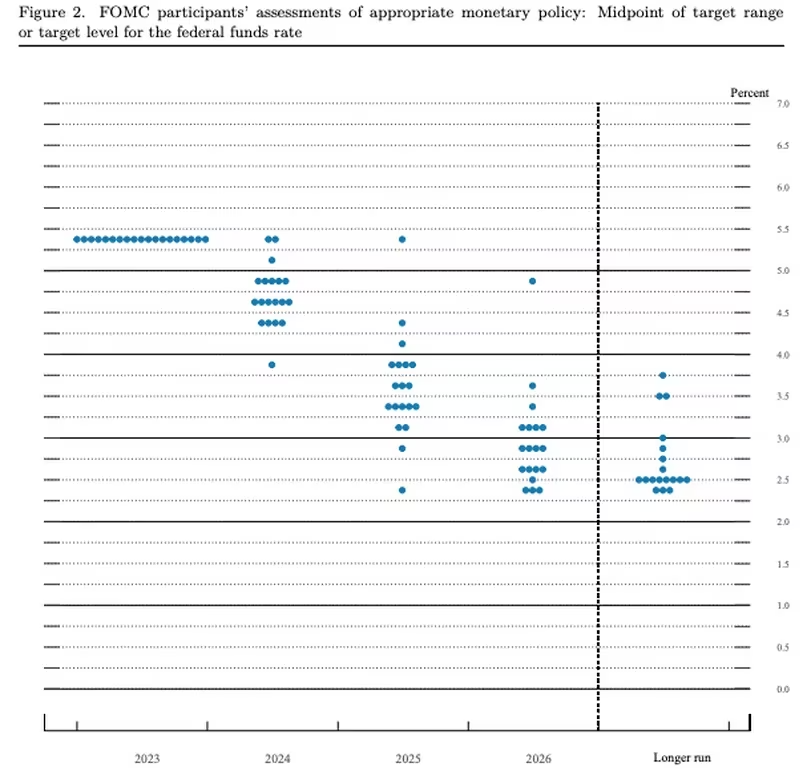

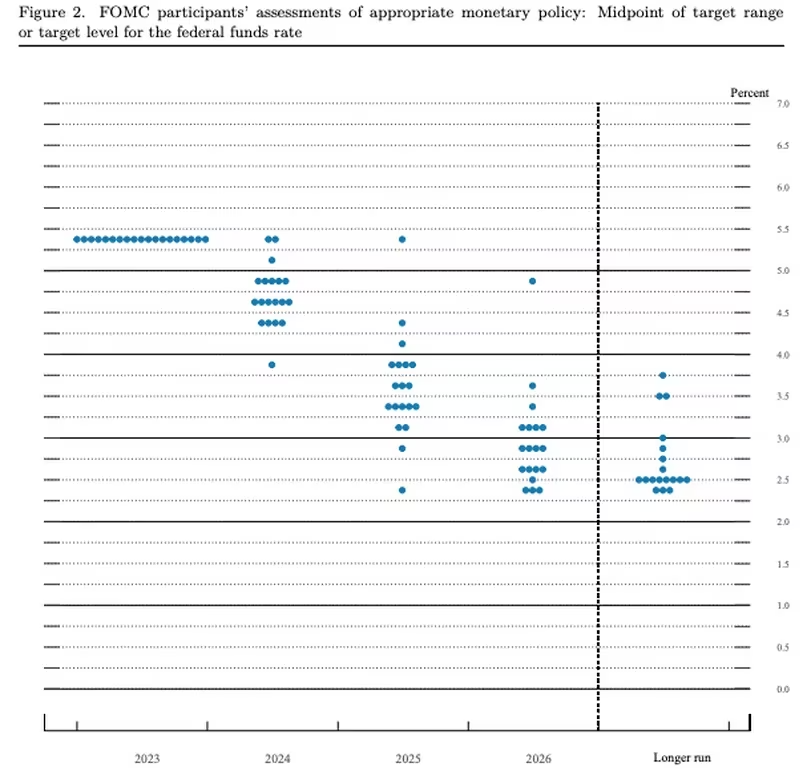

A dot chart released on the 13th as part of the Federal Reserve’s policy decisions showed that Fed officials expect to cut interest rates by 75 basis points in 2024. This is a sharp increase from the 25 basis point rate policymakers expected to cut three months ago.

Stock and bond markets soar

Traditional markets had already been on a sharp upward trend since October due to expectations for monetary easing, but they soared even further on this news. All three major U.S. stock indexes rose more than 1%, and the Dow Jones Industrial Average exceeded $37,000 (approximately 5.18 million yen, equivalent to 140 yen to the dollar) for the first time in history. Stock prices rose again on the 14th, but the increase was smaller than the day before.

The rally in bond markets was even bigger, with the yield on the two-year U.S. Treasury note falling about 40 basis points since the news to 4.32%, its lowest level since May. With the current federal funds rate at 5.25% to 5.5%, a two-year rate of 4.32% indicates a strong belief that a significant rate cut is coming soon.

In fact, the Chicago Mercantile Exchange (CME) FedWatch tool currently shows a 21% chance that the Fed will cut interest rates by 25 basis points in January, and an 84% chance that there will be at least one rate cut by March. ing.

Looking at other interest rate-sensitive markets, the dollar index is down about 2% since the Fed news on the 13th, while gold is up 2.5%. These two are further evidence that traditional finance (TradFi) is fully buying into the rate cut story for now.

The Fed’s dovish signals also boosted Bitcoin (BTC) prices, which are recovering from Sunday night’s “flash crash” which saw them drop more than 5% in a matter of minutes this week. At the time of writing, it is trading at $43,200, which is about 1% back from its pre-crash price.

Are market participants getting ahead of the curve?

The Fed’s median rate cut in 2024 is expected to be 75 basis points, but the market is pricing in a rate cut of nearly 150 basis points. Of course, even the Fed’s more conservative forecasts would require a significant slowdown in the economy and inflation.

Despite many claims this year that a recession is imminent, the data continues to show otherwise. Gross domestic product (GDP) growth in the third quarter was a staggering 5.2% annualized, the highest since the fourth quarter of 2021, when the government’s significant coronavirus-related stimulus was still permeating the economy. It reached a high standard. Further news on the 14th showed that the number of new weekly jobless claims fell sharply to a two-month low, and that retail sales rose unexpectedly in November, further indicating that the economy is doing well. It’s just.

As for inflation, the most recent consumer price index (CPI)-based inflation rate was 3.1%, well below the near-double-digit levels in 2022, but still well above the Fed’s 2% target. There is. Core inflation, which is usually the focus of Fed policymakers, is harder to come down and is still at 4% in recent figures.

|Translation and editing: Rinan Hayashi

|Image: Shutterstock

|Original text: TradFi Goes All-In on Fed Rate Cuts. What It Means for Bitcoin

The post TradFi rises significantly due to Fed interest rate cut — what about Bitcoin? | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

60

1 year ago

60

English (US) ·

English (US) ·