While cryptocurrency bears tightening their grip amidst the United States Presidential elections, Tron (TRX) holders enjoy profits.

IntoTheBlock data shows that 97% of investors are making money at current prices, with 2% at break even and only 1% experiencing losses.

Source: IntoTheBlock

Source: IntoTheBlockSuch significant profitability levels reflect Tron’s resilience and unwavering confidence in the altcoin’s future.

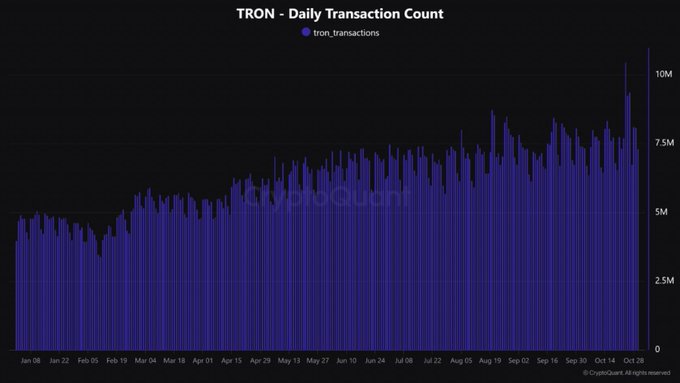

Tron has displayed remarkable performance in the past few sessions, hitting new milestones in daily transactions in October.

Tron transactions peak in October

Tronscan data shows the TRX blockchain expanded over the past month, attaining over 10.4 million transactions on 24 October – a 1-year high.

TRX transactions have increased gradually throughout 2024, hitting $8.4 billion in 24-hour transfer volume.

The network boasts over 296 million accounts and more than 2.1 million transacting daily.

Further stats show TRON dominated around 43% of the altcoin traffic, outshining other top alt chains.

While this metric changes daily, TRX has confirmed stable activities as other platforms stagnate.

Tron’s October success showcased the blockchain’s resilience amidst slowed meme coin activity.

The blockchain’s themed tokens Launchpad display faded interest, with nearly zero asset launches since September.

Nevertheless, the magnified traffic saw TRON fees soaring to $207.26 million in October.

The project saw the second-highest revenue in its history, only eclipsed by August’s earnings of above $221 million.

Stablecoins boost Tron activity

Tether (USDT) turnover, which hit the highest mark since 2023, has been vital in driving Tron’s recent activity.

Moreover, Tron-based USDT users have seen their profiles shifting, with notable growth in transactions of $1K to $10K and $10K to $100K.

Furthermore, the year-long USDT supply increase on Tron contributed to the growth.

The figure was at 45 billion coins early in the year and gradually surged to over 62 billion.

TRX price outlook – indicators suggest rallies

TRX changes hands at $0.1623 after a 1.65% 24-hour dip.

The altcoin mirrors the broad crypto market performance, which has seen bear dominance amid the US elections.

Source: Coinmarketcap

Source: CoinmarketcapMeanwhile, TRX maintained its price action beyond the 200 Simple Moving Average since early August on the daily timeframe.

That signals a long-term upward trend for TRX.

Also, the alligator indicators green, blue, and red lines appear to converge, suggesting a consolidation period.

That could show that the altcoin has been amassing strength before the next uptrend.

The prevailing moderate volumes indicate a stable and low-volatility atmosphere, which could precede remarkable jumps.

Furthermore, TRX’s token burns boost the altcoin’s trajectory.

The project incinerated over 149 million tokens, worth about $25 million, in October 2024.

The notable burn is part of the project’s dedication to reducing asset supply for enhanced scarcity – a recipe for long-term price stability.

The post Tron displays resilience amid market uncertainty; only 1% of TRX holders are at loss appeared first on Invezz

English (US) ·

English (US) ·