The post TRX Price Eyes $1 as On-Chain Momentum & Bullish Charts Align appeared first on Coinpedia Fintech News

The TRX price has been gaining attention over the last 5 years, with fantastic bullish price action, even in the tough times, until 2025, which came with strong bearish moves.

However, the Q2 and Q3 picked up again thanks to Justin Sun’s amazing announcements and strategies. Now, Q3 last month in September 2025, people are seeing renewed hype back again, with many bullish chart projections hinting at a potential rally toward the $1 mark.

While ambitious, this target doesn’t appear far-fetched given TRON’s history of explosive growth and the strong on-chain activity now fueling renewed optimism for TRX crypto.

TRX Price Today Shows Resilient Structure

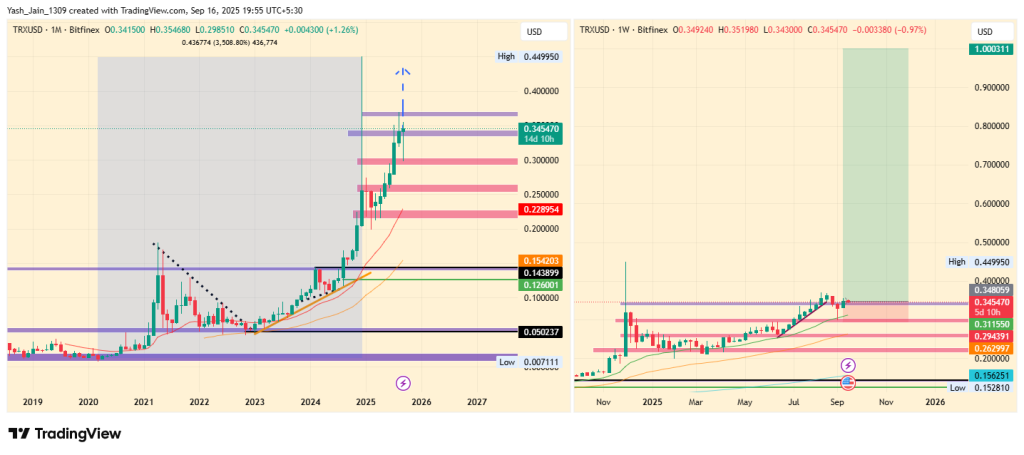

The TRX price today trades at $0.3467, showing signs of strength despite the broader market’s mixed sentiment. On the TRX price chart, the bird’s-eye view reveals a massive rally of over 3000% from 2020 to late 2024, peaking near $0.4502.

Against this backdrop, a fresh projection shared on September 12th by a renowned trader suggested that the TRX is heading toward $1, representing nearly 190% upside from current levels.

When viewed from a long-term perspective, this forecast appears far less ambitious than it initially seems on a magnified 2025 chart.

Diverging Chart Targets Fuel Debate

Another crypto trader offered an even bolder outlook. He highlighted that the TRX price action has been following an ascending channel pattern and is currently near its lower boundary, leaving plenty of room to climb. This outlook sets potential targets around $4.5 and beyond, far higher than the $1 level.

While this TRX price prediction from both traders appears aggressive, but both viewpoints are based on its strong underlying structure on the TRX price USD chart, which has been building for years.

TRON Network Activity Supports Bullish Outlook

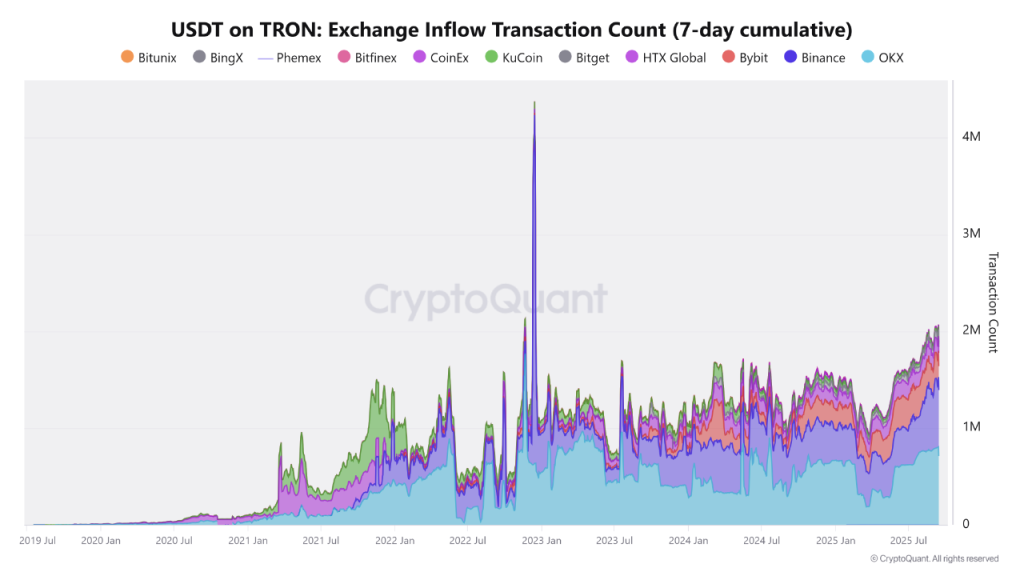

Beyond the price action, its on-chain data from CryptoQuant adds further weight to the bullish narrative on TRX price. Since Tether and Tron partnered, the token has exploded.

Now coming to the latest month of September, it served as a primary liquidity bridge for both spot and derivatives trading, and its amazing surge in USDT deposit activity on exchanges is proof of this. This clearly explains its rising utility and adoption.

Weekly transactions have climbed to 2.07 million, placing September among TRON’s busiest months in recent times. This is showing sustained user confidence in using TRON for deposits and settlements.

The data also shows that concentration across major exchanges is around 86.8% of all TRON-based deposits, which highlights the core operational liquidity pools where most funding and settlement activity occurs.

source: cryptoquant

source: cryptoquantIf this trend of growing transactions continues, it would signal rising demand for TRX crypto liquidity, which often precedes or coincides with higher trading activity on spot and derivative markets.

Another notable factor is the stabilization of liquidity behavior on TRON. This suggests a more mature and stable operational layer for USDT settlements.

As TRON deepens its market footprint, the TRX price forecast narrative is shifting for upside, calling for a possible rally extension, especially if broader crypto sentiment improves in tandem.

2 weeks ago

29

2 weeks ago

29

English (US) ·

English (US) ·