- CME futures indicate that money is starting to flow into Ethereum at a faster pace than Bitcoin.

- Options listed on Deribit suggest an increasing bias in Ethereum call options.

Key derivatives market indicators show that sophisticated traders are turning from Bitcoin (BTC) to Ethereum (ETH), suggesting ETH could outperform in the coming weeks. ing.

Bitcoin is up more than 60% this quarter, while Ethereum, considered a deflationary asset with bond-like appeal and an ESG-compliant label, has lagged far behind, up 35%, according to data from CoinDesk. On longer time frames, the difference in performance is even wider, with Bitcoin up 163% versus 89% for Ether.

However, this gap may narrow as Ethereum futures are seeing more inflows than Bitcoin. Notional open interest (the dollar amount locked in physically settled Ethereum futures contracts on the Chicago Mercantile Exchange, CME) rose 30% to $711 million over the past five days, according to Velo Data. (approximately 104 billion yen, equivalent to 1 dollar = 146 yen), which exceeded Bitcoin’s 19% increase of 4.9 billion dollars (approximately 720 billion yen). CME’s ETH standard futures size is 50 ETH and Bitcoin is 5 BTC.

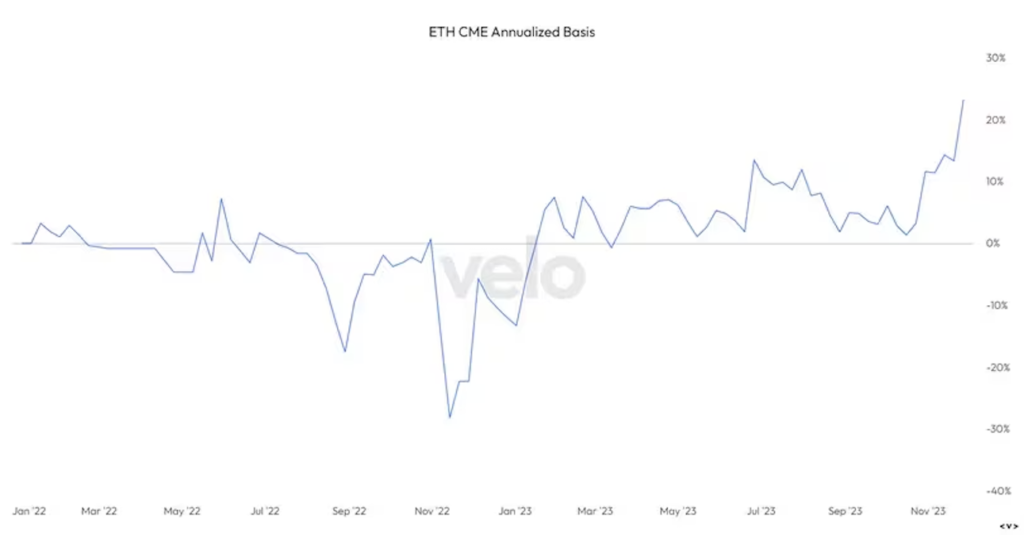

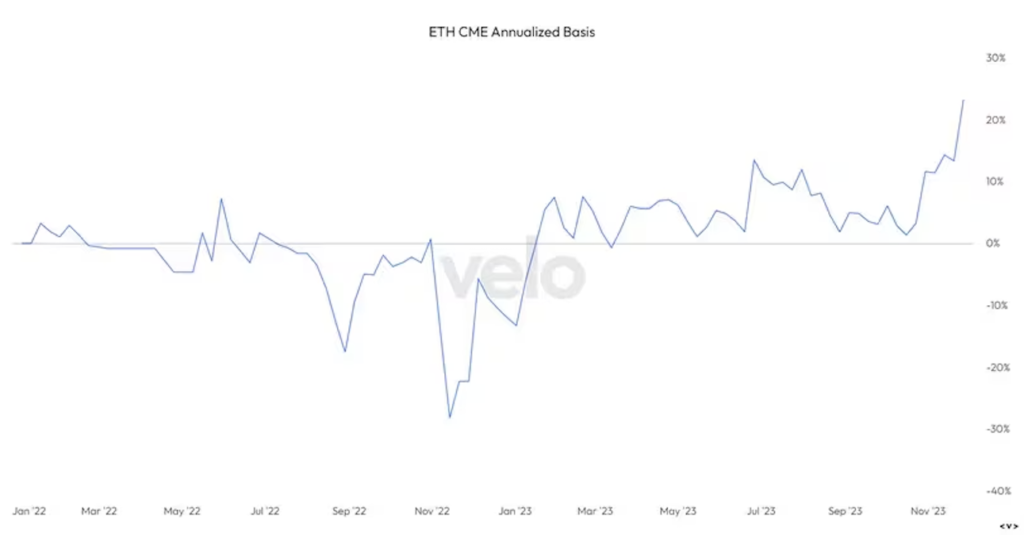

The emergence of positive spreads in the pricing of Ethereum and Bitcoin CME futures also suggests the same. According to Reflexivity Research, the premium on Ethereum futures to spot index prices was 5% higher than Bitcoin earlier this week.

“Ethereum’s futures basis (difference between spot price and futures price) on CME is currently trading at a 5% premium to Bitcoin, and is currently over 20%. Additionally, ETH’s open interest on CME is , we see it now starting to rise after lagging behind Bitcoin’s rise,” Reflexivity Research said in a market update on December 5th.

“While it may be too early to tell, ‘tradfi’ (traditional markets) may be turning to ETH exchange-traded funds (ETFs) trading in the next two months,” Reflexivity Research said. “We need to continue to monitor early signs that the market is starting to invest in ETH ETFs up front.”

Basis is the spread between the futures price and the spot price. (Velo Data)

Basis is the spread between the futures price and the spot price. (Velo Data)Meanwhile, in the options market listed on Deribit, traders are starting to lean towards Ethereum calls and Bitcoin puts. A call option provides the right, but not the obligation, to buy the underlying asset at a predetermined price at a later date. Buyers of calls are implicitly bullish on the market, and buyers of puts are bearish.

According to Amberdata, Ethereum’s one-month call-put skew, which measures the implied volatility premium (or spread between demand) for call and put options expiring in four weeks, has increased this month. This has doubled to over 4%, indicating that the call bias is increasing. Meanwhile, BTC’s one-month skew has fallen from 5% to 2%, indicating that traders are starting to lean more towards puts than calls.

Perhaps Bitcoin will take a breather and Ethereum will be able to catch up with Bitcoin in the coming weeks.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Velo Data

|Original text: Two Key Metrics Show Crypto Traders Turning to Ether From Bitcoin

The post Two major indicators show traders switching from Bitcoin to Ethereum | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

77

1 year ago

77

English (US) ·

English (US) ·