3/4 (Sat) morning market trends (compared to the previous day)

- NY Dow: $33,390 +1.1%

- Nasdaq: $11,689 +1.9%

- Nikkei Stock Average: ¥27,927 +1.5%

- USD/JPY: 135.8 -0.6%

- USD Index: 104.5 -0.4%

- 10 year US Treasury yield: 3.9 -2.7% annual yield

- Gold futures: $1,861 +1.1%

- Bitcoin: $22,311 -4.8%

- Ethereum: $1,561 -5.1%

traditional finance

crypto assets

Today, the New York Dow continued to rise and closed higher at $380. The Nasdaq and S&P 500 also continued to rise from yesterday.

The ISM non-manufacturing business index for February, released on the night of the 3rd, was 55.1, down slightly from 55.2 in January, but surpassing the forecast of 54.5. The content justified the Fed’s hawkish stance, and although the stock market and other markets showed a negative reaction, selling was limited.

The purchase price index fell to 65.6 from 67.8 in January, while the employment index rose to 54 from 50.0 in January, reaching its highest level since December 2009. Employment conditions are improving as the service sector struggled to find workers during the coronavirus pandemic.

In addition, the October-December quarter US non-farm labor productivity revision announced on the evening of the 2nd increased by 1.7% year-on-year, which was a preliminary estimate of +3.0%, lower than the forecast of +2.5%. On the other hand, the revised unit labor cost for the same period increased by 3.2% year-on-year, which is higher than the forecast (+1.6%) from the preliminary forecast of +1.1%. Also, the number of new applications for unemployment insurance in the US last week (Feb. 25) decreased by 2,000 to 190,000, which was a decrease from the previous forecast of 192,000 (195,000). In addition, the number of continuous recipients of unemployment insurance (Feb. 18) was 1.655 million, a decrease from the previous 1.66 million, contrary to expectations (1.669 million). Concern about wage inflation increased due to the continued tightness of the labor market, and US long-term interest rates soared to the 4% level at one point, returning to the highest level since November last year. U.S. Treasuries continued to fall.

Fed official remarks

Atlanta Federal Reserve Bank President Raphael Bostic told reporters on Wednesday that a 0.25-point rate hike (0.25%) would be appropriate at the FOMC meeting scheduled for March 21-22. “My position depends on the data, and if the economy continues to suggest stronger than expected conditions, I will adjust the policy trajectory,” he said. As for when the Fed will stop raising rates, he said, “It could happen by mid-summer or late summer, but it will depend on the situation.”

Bostic will not have a vote at this year’s FOMC.

The FOMC is expected to raise rates by 0.25 percentage points at this month’s and May’s meetings, with several officials suggesting a 0.5 percentage point hike is possible. In addition, some market participants see the possibility of continued interest rate hikes beyond May.

connection: Expectations of US Fed interest rate hikes after May

March Economic Indicators (3/8-3/15)

- March 8, 22:15 (Wednesday): U.S. February ADP employment statistics (month-on-month change)

- March 10, 22:30 (Friday): U.S. February average hourly wage (vs. previous month), change in February non-agricultural sector employment (vs. previous month)

- March 14, 21:30 (Tuesday): US February Consumer Price Index Core Index (CPI)

- Wednesday, March 15, 21:30: U.S. February Retail Sales

- Wednesday, March 15, 21:30: U.S. February Wholesale Price Index (PPI)

connection: Bitcoin plummeted due to large-scale loss cut, stock price crash of Silvergate Bank holding company, which handles virtual currency business

connection: What is the CPI (Consumer Price Index) that attracts attention in the virtual currency market?

US stocks

Compared to the previous day for individual stocks, NVIDIA +2.4%, c3.ai +33.6%, Big Bear.ai +11.9%, Tesla +3.6%, Microsoft +1.6%, Alphabet +1.8%, Amazon +3%, Apple +3.5% , Meta +6.1%, Coinbase +1.3%, Silvergate Capital +0.8%.

Artificial intelligence (AI) related stocks are all high in trading on the 3rd. Enterprise artificial intelligence (AI) software company c3.ai sees share price surge after financial results. Quarterly results exceeded market expectations, and sales and profit forecasts for fiscal 2023 were revised upward.

connection: Microsoft, interactive artificial intelligence installed in search engine “Bing”

connection: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase|$64.5 (+1.2%/+10.4%)

- Riot Platforms | $6.3 (+2.6%/+8%)

- Silvergate Capital | $1.85 (+0.8%/-60%)

Coinbase announced today that it has acquired asset management firm One River Digital Asset Management. One River Digital Asset Management is the digital asset management division of financial giant One River Asset Management. Coinbase plans to launch Coinbase Asset Management for institutional investors based on One River Digital Asset Management.

Coinbase has made a strategic acquisition of One River Digital Asset Management.

This acquisition marks the formation of Coinbase Asset Management and will enable additional institutional access to the cryptoeconomy.

Read more  https://t.co/veNd0Rd4mN pic.twitter.com/MtGUeJfvsU

https://t.co/veNd0Rd4mN pic.twitter.com/MtGUeJfvsU

— Coinbase (@coinbase) March 3, 2023

Silvergate Capital Bank plunged -60% this week. Coinbase, Paxos and other cryptocurrency-related companies have terminated their business ties with the company in response to concerns over Silvergate’s financial health.

connection: U.S. Silvergate stock price plunge Following suspension of trading with U.S. coinbase and others

In addition, the cryptocurrency mining company Riot Blockchain announced its financial results for the full year 2022 (January to December) on the 2nd. Posted a net loss of approximately ¥70 billion ($509.6 million) in 2022. It closed at the end of December with no long-term debt, $321.8 million in working capital, including $230.3 million in cash on hand, and 6,974 BTC (15.8 billion yen at the end of the year). In addition, the 10-K filing (submission of annual report) to the SEC (U.S. Securities and Exchange Commission) will be postponed on the 2nd because the current calculation method for BTC impairment charges does not meet the requirements of accounting rules. Announced.

connection: U.S.-listed mining company Riot announces full-year financial results that maintains a strong financial base

connection: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

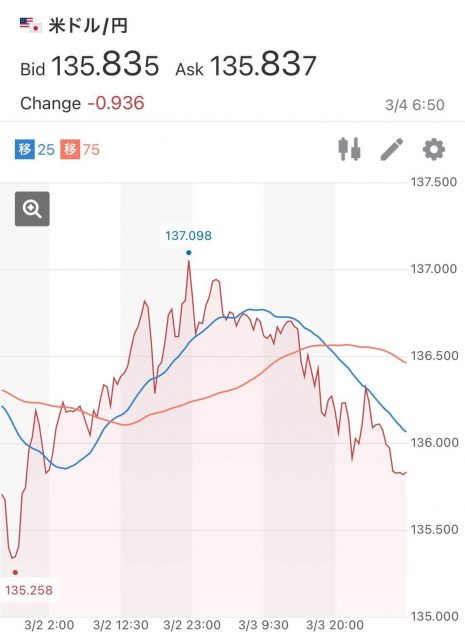

dollar yen 135.8 yen

US dollar = 135.8 yen, down 0.6% from the previous day. The dollar/yen fell below 136 yen after the US 10-year bond yield fell to the 3.98% level. Although the dollar rose to the 137 yen level on the 2nd, the rise in US Treasury yields took a break, which pushed the dollar down.

connection: Professional commentary on the options market and advanced trading strategies that are attracting attention due to the soaring price of Bitcoin

Some have pointed out that next week’s U.S. employment data may lead to an increase in U.S. Treasury yields and the dollar, but some are cautious that the results will be lower than expected and that the previous data will be revised downward. ing. The previous report (announced in February for January) resulted in a significant increase of 517,000 in the number of non-agricultural sector employees, resulting in a sharp rise in the dollar/yen, but for February, the increase is currently expected to remain at 200,000. Some analysts seem to believe that the FRB’s terminal rate hike has already been factored in by the market due to the strong economic indicators since January.

Source: Yahoo! Finance

connection: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

GM radio on Thursdays

This Thursday we held our 10th Annual GM Radio. Stephen Richardson, who is the head of APAC (Asia Pacific) division and executive of the financial markets division at Fireblocks, participated as a guest and discussed the problems and future prospects of cryptocurrency asset management.

https://t.co/p0vjT2xo4I

— CoinPost Global (We’re hiring!) (@CoinPost_Global) March 2, 2023

connection: Fireblocks, a unicorn company in the virtual currency industry, will participate in “GM Radio” next time

GM radio on Mondays

Coinpost Global held the 9th GM Radio on the afternoon of the 27th. This time, we talked with Mike Jarmuz, managing partner of Lightning Ventures, on the theme of “Building on Bitcoin”.

Massive thanks to @MikeJarmuz of @ltngventures for a fascinating conversation on VC investing, token funding concerns, Bitcoin/Lightning Network startups, and more!

The first Space cut out midway so here are both Space recordings

Thanks to everyone who stuck with us!

— CoinPost Global (We’re hiring!) (@CoinPost_Global) February 27, 2023

connection: “GM Radio” Bitcoin-specialized VC “Lightning Ventures” participates

The post U.S. AI (artificial intelligence)-related stocks rise across the board, dollar-yen decline | 4th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

173

2 years ago

173

English (US) ·

English (US) ·