6/3 (Sat) morning market trends (compared to the previous day)

- NY Dow: $33,762 +2.1%

- NASDAQ: $13,240 +1%

- Nikkei Average: ¥31,524 +1.2%

- USD/JPY: 139.9 +0.8%

- US dollar index: 104 +0.4%

- 10-year US Treasury yield: 3.69 +0.1%

- Gold Futures: $1,964 -1.5%

- Bitcoin: $27,299 +1.6%

- Ethereum: $1,908 +2.2%

traditional finance

crypto assets

NY Dow Nasdaq today

Today’s NY Dow continues to rise sharply to +701 dollars. The Nasdaq also closed higher at +139.7. It seems that the bill passed by the Senate on the US debt ceiling issue and the strong employment statistics were favorably received.

Progress on the U.S. Debt Problem

At the plenary session on the morning of the 2nd of Japan time, the US Senate passed the “Fiscal Responsibility Bill” by a majority of 63 in favor and 36 against, based on the agreement between the Biden administration and the Republican Party of the House of Representatives to suspend the federal government debt ceiling. The bill is expected to be sent to the president for enactment as it has already been approved by the House of Representatives on the 1st.

The default was avoided as the bill was voted in parliament just before “X-Day” (June 5).

According to Bloomberg and other sources, President Biden said after the Senate passed, “Our work is not done yet, but this agreement is an important step forward. I look forward to signing the bill into law as soon as possible. I am,” he commented.

connection: “X Day” approaching US debt ceiling problem, possible scenarios and their impact

US employment data for May

The US May employment statistics released last night increased by 339,000 from the previous month. This greatly exceeded the expected increase of 195,000. Meanwhile, the unemployment rate rose by 3.7%, above expectations of 3.5% and last month’s 3.4%.

The rate of increase in the unemployment rate is the highest since April 2020 (corona shock). Average hourly wages increased by 0.3% month-on-month, in line with expectations, slightly below the previous month’s 0.4% increase.

While the data are mixed and may justify holding rate hikes suggested by Fed Chair Powell and FOMC members, they “did not provide clear signs of a labor market slowdown.” It is also pointed out that On the other hand, there are some views that support the scenario of resuming additional interest rate hikes in July.

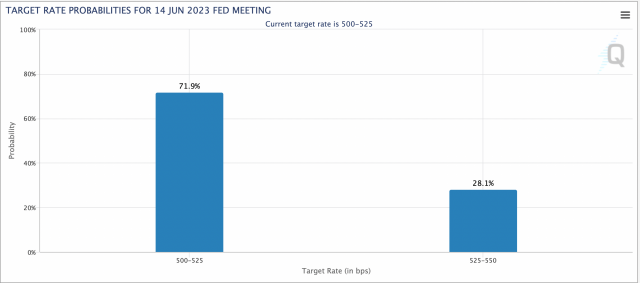

The CME short-term money market is currently hovering around 70% on expectations of a pause in interest rate hikes in June.

Source: CME

dollar yenbacklash

The dollar yen rose in response to strong employment statistics, etc., and was temporarily attached to 1 dollar = 140.07 sen.

Source: Yahoo! Finance

economic indicators

- June 13, 21:30 (Tue): May Consumer Price Index (CPI)

- Wednesday, June 14, 21:30: May Wholesale Price Index (PPI)

- June 15, 3:00 (Thursday): US Federal Open Market Committee (FOMC) policy interest rate announcement

US stocks

Today’s S&P 500 stock price index is up about 20% from its low in October last year, ending with a new high since last August.

Not only tech stocks such as Tesla but also cyclical stocks such as industrials, banks and energy were bought, but Nvidia fell back and c3.ai continued to fall sharply due to the previous day’s results. Individual stocks compared to the previous day: Nvidia -1.1%, c3.ai -7%, AMD -1.3%, Tesla +3.1%, Microsoft +0.8%, Alphabet +0.7%, Amazon +1.2%, Apple +0.4%, Meta + 0%.

connection: Default concerns recede, US stocks rebound, c3.ai drops sharply following financial results | 2nd Financial Tankan

Source: Tradingview

Apple plans to hold its annual developer conference “WWDC23” from the early morning of June 6, Japan time. It is highly likely that the highly anticipated VR/MR headset will be announced at this event.

A new era begins. Join us for #WWDC23 on June 5 at 10 am PT.

Tap the  and we’ll send you a reminder on event day. pic.twitter.com/T1pDvEzvys

and we’ll send you a reminder on event day. pic.twitter.com/T1pDvEzvys

—Apple (@Apple) May 31, 2023

connection: Top 3 rankings of ETFs (listed investment trusts) in Japan and overseas that can be purchased with NISA

Virtual currency related stocks

- Coinbase|$64.5 (+1.5%/+13%)

- MicroStrategy | $302 (+0.7%/+5.9%)

- Marathon Digital | $10 (+0.4%/+12%)

connection: Good news for the cryptocurrency industry with the US debt ceiling agreement The mining tax increase proposal is postponed

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

The post U.S. Debt Ceiling Suspension Bill to be signed by President US stocks continue to rise | appeared first on Our Bitcoin News.

2 years ago

128

2 years ago

128

English (US) ·

English (US) ·