5/23 (Tue) morning market trends (compared to the previous day)

- NY Dow: $33,286 -0.4%

- NASDAQ: $12,720 +0.5%

- Nikkei Stock Average: ¥31,086 +0.9%

- USD/JPY: 138.5 +0.4%

- USD Index: 103.2 +0.04%

- 10-year US Treasury yield: 3.7 +0.7% annual yield

- Gold Futures: $1,973 +0.0%

- Bitcoin: $26,916 +0.5%

- Ethereum: $1,821 +1.%

traditional finance

crypto assets

NY Dow today

Today’s NY Dow continues to drop to -140 dollars. The Nasdaq closed at +62.8. US President Biden and House Speaker McCarthy are scheduled to meet on the US debt ceiling this evening. The US stock market has continued to rise, mainly in IT and high-tech stocks, due to expectations that it will be possible to avoid default.

8:00 a.m. Update: House Speaker McCarthy said after meeting with US President Biden that there was “no deal yet” and said “no” to a question about whether the public should prepare for a default.

*MCCARTHY, ON WHETHER AMERICANS SHOULD PREPARE FOR DEFAULT: NO

— *Walter Bloomberg (@DeItaone) May 22, 2023

connection: Top 3 rankings of ETFs (listed investment trusts) in Japan and overseas that can be purchased with NISA

Progress on the U.S. Debt Problem

House Speaker McCarthy met with Democratic negotiators yesterday ahead of his meeting with President Biden, amid fears that the U.S. could default as early as June 1. Speaking to reporters, McCarthy said the talks had been “productive” but “no deal has been reached”.

He also said a deal this week is needed to avoid a default before June 1, the so-called “Day X,” adding: “A deal could be done tonight or tomorrow. While showing an optimistic view, he emphasized that the two parties have not yet agreed on anything.

Treasury Secretary Janet Yellen again warned on a US TV show on the 21st that it was “extremely unlikely” that the US government would be able to meet all its payment obligations until mid-June, urging a deal to raise the debt ceiling. . (Bloomberg report)

connection: What is a real estate investment trust “REIT?” Explaining the main advantages and disadvantages

US Fed President Statement

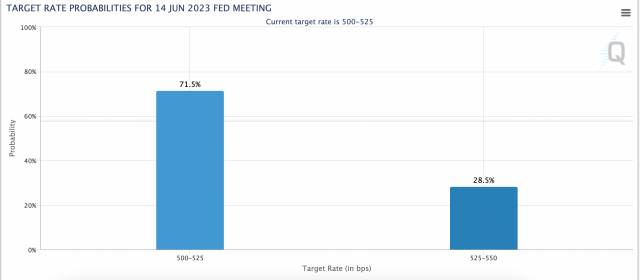

Hawkish St. Louis Fed President James Bullard said on Wednesday that the FOMC will have to raise interest rates two more times this year to keep inflation under control.

Pointing out that inflationary pressures are still high, he argued that the current environment, with the unemployment rate at its lowest level since the 1960s, is the perfect opportunity to continue raising interest rates.

On the 19th of last week, FRB Chairman Powell again hinted at the possibility of suspending interest rate hikes at the FOMC meeting in June, but since many Fed presidents have made hawkish remarks so far, interest rate futures markets have suspended rate hikes. Observations on the

Source: CME

The dollar/yen exchange rate rose to 138.69 yen against the dollar in response to remarks by the president of the Federal Reserve Bank and expectations for default avoidance. The dollar index also rose to high levels.

Source: Yahoo! Finance

connection: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

AI Generated Pentagon Explosion Hoax Spreads

On the 22nd, false information that “an explosion occurred near the Pentagon (the US Department of Defense)” spread on the Internet through Twitter and other means. In response to this, the US financial market and the virtual currency market temporarily panicked. The fire department in Virginia, where the Pentagon is located, denied that an explosion occurred.

This morning blue check accounts accounts claimed large explosions at the Pentagon.

… then the White House.

Russian state media amplified the faked Pentagon image from their gold check account.

The images look AI generated, as folks identified. pic.twitter.com/Bd9uu3jwPZ

—John Scott-Railton (@jsrailton) May 22, 2023

It is pointed out that the image of the explosion was generated by AI, and it is believed that it was circulated by the Twitter account of the Russian government-affiliated media.

economic indicators

- May 23, 22:45 (Tuesday): US May Manufacturing Purchasing Managers Index (PMI, preliminary figures)

- May 25, 3:00 (Thursday): Federal Open Market Committee (FOMC) Minutes

- May 25, 21:30 (Thursday): U.S. January-March Quarterly GDP Personal Consumption (revised value)

US stocks overall high

IT/tech stocks remained strong. Individual stocks YoY: NVIDIA -0.2%, c3.ai +10.2%, Tesla +4.8%, Microsoft +0.8%, Alphabet +1.8%, Amazon -1%, Apple -0.5%, Meta -1%.

Virtual currency-related stocks also rose sharply

- Coinbase|$61 (+7.5%/+7.5%)

- MicroStrategy | $294.1 (+2%/+2%)

- Marathon Digital | $9.6 (+5.4%/+5.4%)

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

The post U.S. IT and cryptocurrency-related stocks continue to rise Expectations rise due to talks on debt ceiling issue | 23rd Financial Tankan appeared first on Our Bitcoin News.

2 years ago

178

2 years ago

178

English (US) ·

English (US) ·