March 24 (Friday) morning market trends (compared to the previous day)

- Bitcoin: $28,259 +2.6%

- Ethereum: $1,818 +4.1%

- Arbitrum: $1.42 -71%

- NY Dow: $32,105 +0.2%

- NASDAQ: $11,787 +1%

- Nikkei Stock Average: ¥27,419 -0.1%

- USD/JPY: 130.8 -0.4%

- USD Index: 102.5 +0.2%

- 10-year US Treasuries: 3.4 -2.4% annual yield

- Gold Futures: $1,996 +2.3%

crypto assets

traditional finance

Today’s NY Dow rebounded slightly and closed at +75 dollars. The Nasdaq closed at +$117.

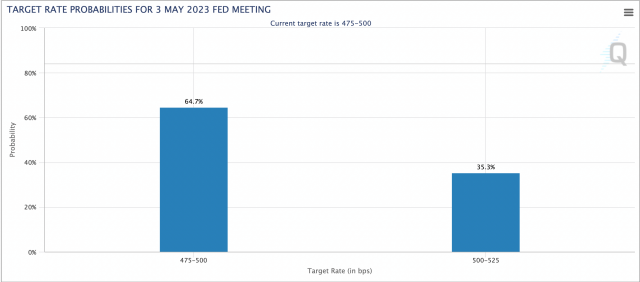

Yesterday, Chairman Powell stressed at the FOMC that “if necessary, we will raise interest rates more than expected” to curb inflation, but the interest rate futures market will stop raising interest rates at the next FOMC on May 3. Observations are increasing, exceeding 60%.

Source: CME

In the background, the wording of yesterday’s FOMC statement on the outlook was tweaked. The phrase “continued raising of the target range is expected to be appropriate in order to achieve the inflation target” has been deleted, and the phrase “some additional tightening may be appropriate” has been removed. Adopted.

The chairman also ruled out a rate cut this year, and although optimism is waning, some parts of the market are still in a position where financial turmoil and recession will eventually force a rate cut. They seem to expect that they won’t get any more. It is suggested that the effective Federal Funds (FF) interest rate in December will fall from the current 4.58% to around 4.18%.

connection: Bitcoin decline, optimistic view retreats with FOMC Powell remarks and Yellen congressional testimony

Economic indicators from this week onwards (Japan time)

- March 30, 21:30 (Thursday): U.S. October-December Quarterly Real Gross Domestic Product (GDP, Final Value) (Quarterly Change Annual Rate)

- March 31, 21:30 (Friday): U.S. February Personal Consumption Expenditure (PCE Core Deflator) (MoM/YoY)

connection: What is the US monetary policy meeting “FOMC” that attracts the attention of global investors | Easy-to-understand explanation

US stocks

US bank stocks continued to lose pressure after some buybacks followed US Treasury Secretary Janet Yellen’s congressional testimony today. The Treasury Secretary said at a public hearing yesterday that he was not considering offering “total” deposit insurance, but today, with the banking system in turmoil, he said he was “ready to take additional measures if justified.” There is,” he changed his tone. JPMorgan Chase -0.2%, Citigroup -0.5%, First Republic -6%, Bank of America -2.4%, Wells Fargo -1.5% (YoY).

On the other hand, IT/tech stocks rallied due to the drop in US bond yields. Compared to the previous day for individual stocks, NVIDIA +2.7%, c3.ai +9.4%, Big Bear.ai +4.8%, Tesla +0.5%, Microsoft +1.9%, Alphabet +2.1%, Amazon +0.01%, Apple -0.7% , Meta +2.2%.

connection: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase | $66.3 (-14%/-12%)

- Block | $61.8 (-14.8%/-16%)

- MicroStrategy | $263 (+6.6%/-1.6%)

SEC investigation into coinbase

Coinbase stock continues to fall. The selling point came yesterday after the company announced it had received a “Wells Notice” from the Securities and Exchange Commission (SEC).

connection: U.S. SEC investigates Coinbase on suspicion of violating securities laws Sends Wells notice

The payment service block (former Square) fell sharply by -14.8% from the previous day. Short-selling hedge fund Hindenburg Research was disgusted after it said it had taken a short position in the company.

In a report, Hindenburg Research argued that Block’s popular payment app, CashApp, has likely facilitated the government’s fraudulent cash handouts during the coronavirus crisis, arguing that it has spent two years researching the block. ing. Brock said it was considering legal action after Hindenburg’s short sale statement.

GM radio of the week

GM Radio this Thursday. We invited Christian Casazza, who belongs to the ecosystem development department of Ocean Protocol’s core team, and Nicholas Scavuzzo, who belongs to the DeFi (decentralized finance) department, to talk about the future of the data market.

https://t.co/MORb3f36Vs

— CoinPost Global (We’re hiring!) (@CoinPost_Global) March 22, 2023

connection: “GM Radio” Joins “Ocean Protocol” aiming to capitalize data

Click here for last week’s radio archive.

https://t.co/FLUMQlajlf

— CoinPost Global (We’re hiring!) (@CoinPost_Global) March 17, 2023

The post U.S. IT stocks and Nasdaq rebound Overnight after additional FOMC interest rate hike | 24th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

165

2 years ago

165

English (US) ·

English (US) ·