2/4 (Sat) morning market trends (compared to the previous day)

- NY Dow: $33,926 -0.38%

- Nasdaq: $12,006 -1.6%

- Nikkei Stock Average: ¥27,509 +0.4%

- USD/JPY: 131.1 +2%

- USD Index: 102.9 +1.2%

- 10-year US Treasury yield: 3.5 +3.7% annual yield

- Gold Futures: $1,878.6 -2.7%

- Bitcoin: $23,378 -1.7%

- Ethereum: $1,658 -0.6%

traditional finance

crypto assets

The New York Dow and Nasdaq dropped today. After the FOMC interest rate announcement on the 2nd, the market continued to rise yesterday, led by IT stocks. It seems that the concern has increased.

In the United States, the number of employees increased by 517,000 in January this year, far exceeding the expected increase of 188,000. The unemployment rate fell to its lowest level in 53 years. Could labor market conditions diverge from expectations of a recession, confirming the Fed’s hawkish stance? It has been pointed out that “it reminds us of what Fed Chairman Powell is trying to say to the market.”

Relation: FOMC interest rate hike narrowed

However, Fed Chairman Jerome Powell said at the FOMC press conference on the 2nd that he was pleased to see the labor market continue to have strong data despite the early stages of disinflation. Since most of the increase in January was due to seasonal factors and the employment index has a strong lag, the FOMC will not place too much weight on this data in its policy decisions.”

- U.S. unemployment rate: 3.4% this time, 3.6% forecast, 3.5% last time

- Average hourly wage: +0.3% month-on-month +4.4% year-on-year

- January non-manufacturing headline index (consumer demand picks up again): Jan 55.2 forecast 50.5 last month 49.2

The ISM index suggests that the labor market, slowing inflation and easing wage increases continue to support consumption.

connection: What is the US monetary policy meeting “FOMC” that attracts the attention of global investors | Easy-to-understand explanation

US stocks

U.S. IT and high-tech stocks rose almost across the board after the FOMC, but continued to pull back two days after the close, after Amazon, Apple and Alphabet (Google) announced disappointing quarterly earnings results. On the other hand, the buying of AI stocks continues as Google and Microsoft are beginning to get serious about artificial intelligence.

alphabet

Alphabet’s financial results for the 4Q (October to December) of 2022, announced on the 2nd, fell short of market expectations for sales and earnings per share. Google’s advertising, which includes search and YouTube, has seen weak demand as a slowing economy weighs on corporate spending. On the other hand, in the AI field, where competition is currently intensifying, CEO Sundar Pichai indicated a policy to focus on artificial intelligence software at a press conference, and offered “LaMDA” to compete with Microsoft-funded “ChatGPT”. He said it will begin in the next few weeks.

connection: U.S. OpenAI announces subscription plan for conversational AI language model “ChatGPT”

apple

Apple also announced its financial results on the same day. Sales and earnings per share fell short of market expectations in the October-December period. Sales decreased in all regions of the world. It was the first time since 2015 that sales fell short of analyst forecasts during the same period, including the holiday season at the end of last year. At that time, production disruptions due to city blockades due to China’s zero coronavirus policy led to sluggish sales of its main product, the iPhone. It should be noted that the company announced new models of the Mac and smart speakers in the past few weeks, missing the end of the October-December period. On the other hand, CEO Tim Cook said at a press conference that since China has withdrawn its zero-corona policy and resumed economic activity, future performance improvement can be expected.

Amazon

Amazon also posted weak results. Sales for the quarter beat market expectations, but earnings per share fell short. Under high inflation, sales for the same period, including holiday sales, exceeded market expectations, but online store sales decreased year-on-year, marking the fourth negative quarter in the past five quarters. Despite aggressive cost reductions, including 18,000 personnel in the HR department in January, there is a possibility that operating income will decrease to zero in the first quarter (January to March) of this term. Market concerns over a slowdown in core e-commerce and slowing growth in AWS revenue grew. “Although we face near-term economic uncertainty, we remain optimistic about long-term opportunities,” CEO Andy Jassy said in a statement.

In terms of individual stocks, c3.ai +18%, Big Bear.ai +45, Tesla +0.9%, Microsoft -2.3%, Alphabet -2.75%, Amazon -8.4%, Apple +2.4%, Meta -1.2%, Coinbase-8.4%, Microstrategy-2.5%.

Relation: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

USD/JPY returns to 130 level

US dollar = 131.1 yen, +2%% from the previous day. Strong U.S. employment data sent the U.S. Treasury bond market down sharply and yields on 2- and 10-year Treasuries soared.

Source: Yahoo! Finance

Relation: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

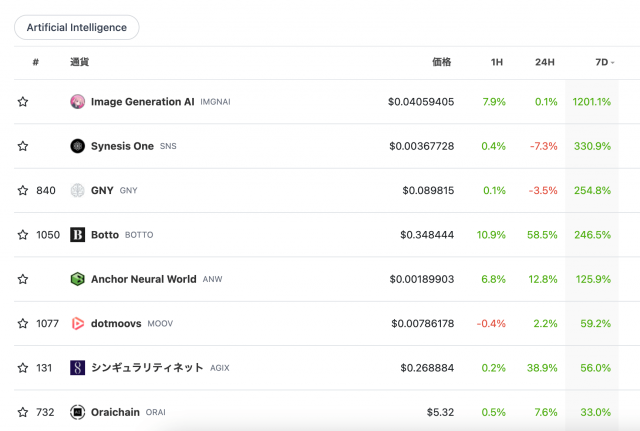

AI token surge

Bitcoin and Ethereum have fallen due to the decline of the NY Dow, but AI-related tokens have soared due to the above-mentioned rise in AI-related stocks.

connection: Bitcoin rubbing against the resistance line, approaching the golden cross of the moving average line

- AGIX (AI electronics market) +39%

- FET (AI smart computer) +18%

- ORAI (AI Oracle) +8.0%

AI related token

Source: CoinGecko

In addition, NYSE-listed US investment firm WisdomTree revealed in its quarterly results that the value of cryptocurrencies in its funds fell sharply from $357 million in the same period of 2021 to $136 million. Net inflows to equity and commodity fans were $5.3 billion in Q4, while net inflows into cryptocurrencies were just $4 million. In addition to traditional financial products, WisdomTree manages assets worth $82 billion in Bitcoin funds and cryptocurrency ETPs (listed-traded financial products).

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase|$74.6 (-8.3%/+21%)

- MicroStrategy | $284.7 (-2.5%/+10%)

- Silvergate Capital | $18.8 (-10.2%/+38%)

- Marathon Digital | $7 (-11%/-12%)

silver gate

Shares of Silvergate Capital soared 38% yesterday after major trust bank State Street held a 9.3% stake in the company as of December 2017, after filings revealed that the company’s shares had fallen sharply after the close. The stock fell sharply following reports that the Justice Department was investigating the company’s ties to FTX. Silvergate has seen a significant drop in customer deposits of digital assets due to the bankruptcy of FTX, but the Department of Justice is investigating whether there was any illegal conduct in the handling of bank accounts related to FTX and former CEO Sam. In the past, FTX deposited customer funds into Alameda-named Silvergate accounts.

marathon

Bitcoin mining firm Marathon Digital said in a statement released yesterday that it sold a total of 1,500 BTC of Bitcoin in January. The proceeds from the sale will be used for operations, and the company holds 11,418 BTC (8,090 BTC uncollateralized) as of January 31.

$MARA‘s January Production Update is here:

Prod. a Record 687 BTC in Jan

Prod. a Record 687 BTC in Jan

45% Increase From Prior Month

45% Increase From Prior Month

Unrestricted Cash to $133.8M

Unrestricted Cash to $133.8M

Unrestricted BTC to 8,090 BTC

Unrestricted BTC to 8,090 BTC

Read the full report here: https://t.co/QFool6SNWe

— Marathon Digital Holdings (NASDAQ: MARA) (@MarathonDH) February 2, 2023

micro strategy

In addition, MicroStrategy announced in its earnings report that it had recorded an impairment loss of approximately 25.4 billion yen ($197.6 million) on Bitcoin held as financial assets. In 4Q, we sold about 704 BTC as a tax measure, but had newly purchased about 2,395 BTC in the previous two months. Shares of MicroStrategy are up +101% year-to-date.

connection: US Micro Strategy, 25 billion yen impairment loss for bitcoin holdings

Source: Tradingview

connection: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

GM radio yesterday

The 4th GM Radio was held yesterday. Four guests, including the co-founder of LayerZero Labs, who participated for the second time, and the founder of DeFi Kingdoms, talked about “Possibilities of cross-chain games” and “Challenges of blockchain games”.

connection: 4th “GM Radio” held, guests are DeFi Kingdoms executives

Click here to watch the archive of the previous “zkSync” episode.

Don’t forget, #GMRadio with @zkSync‘s Head of Engineering, @anthonykrose is on in approx. 24 hours!

We’ll be talking about Ethereum scaling, pros/cons of ZK rollups, decentralization with/without a token, Anthony’s background at SpaceX, and much more!https://t.co/7B9Zj6UW4F

— CoinPost Global (@CoinPost_Global) January 25, 2023

The post U.S. Nasdaq, Bitcoin, etc. fall sharply, US dollar rises, fears of continued Fed interest rate hike | 4th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

173

2 years ago

173

English (US) ·

English (US) ·