US presidential election and virtual currency

According to the survey “2024 Election: The Role of Crypto” released by US crypto asset management company Grayscale, crypto asset (virtual currency) policy will play an important role in elections. It has been shown that it has the potential to be successful. This trend is especially noticeable among young people.

Approximately one-fifth of respondents already own crypto assets. In particular, 40% of millennials (currently ages 26 to 42) are willing to include crypto assets in their future portfolios, and some younger voters tend to hold more crypto assets than stocks. Additionally, 46% of voters are waiting for additional regulatory policies to be developed before considering investing in crypto assets, and many are considering candidates’ positions on crypto assets before the election.

The survey was conducted between November 27 and 29, 2022 among 1,759 adults planning to vote in the 2024 presidential election.

At an event held in December, three presidential candidates advocated for a reboot of the cryptocurrency ecosystem. The event was hosted by the Stand with Crypto Alliance, backed by Coinbase. Entrepreneur Vivek Ramaswamy, former Arkansas Governor Asa Hutchinson, and Democratic Congressman Dean Phillips all shared the same philosophy about creating a clear and consistent regulatory framework for digital assets.

In September, Coinbase launched a campaign claiming that more than 50 million Americans own crypto assets. The company emphasizes that this constitutes a large constituency and that policymakers should respond to this fact. The company also calls on the 15% of the population that owns crypto assets to stand up against tyrannical laws and policies that crack down on crypto assets.

connection:Coinbase launches voter registration tool for midterm elections

BTC as an inflation hedge

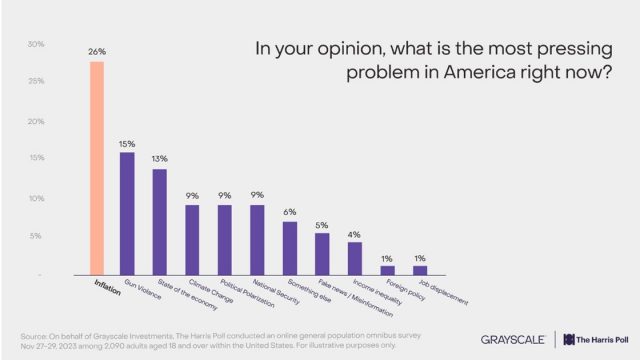

Source: Grayscale

Grayscale’s survey results found that 26% of respondents are most concerned about inflation. The researchers found that respondents who were more familiar with crypto assets were more likely to be interested in Bitcoin due to inflation and other macroeconomic events. However, Grayscale also points out that “further education is needed” to improve understanding of Bitcoin.

Jefferies, one of the world’s leading investment firms, ranks Bitcoin on a par with gold as an “important hedge” against currency depreciation and a return to inflation. An Oct. 4 memo to investors recommended that long-term USD-based global investors, including pension funds, allocate 10% to Bitcoin.

connection:Argentina’s new government allows use of Bitcoin in contracts

Expectations for blockchain

A Grayscale survey found that 46% of voters are waiting for more crypto policies and want regulatory clarity. Gen Z and Millennials own more crypto assets than stocks, and a majority of voters in each generation believe crypto and blockchain technology is the future of finance.

A majority of voters aged 18-34 say clear policies and/or regulations would make them “a lot” or “somewhat” more likely to invest in crypto assets.

Grayscale believes Bitcoin faces tailwinds due to Bitcoin halving in 2024, possible approval of Bitcoin spot ETF listing in the US, and possible interest rate cuts by the US Federal Reserve He concluded that there is a high possibility that it will.

connection:“Bitcoin will exceed $50,000 by the end of January 2024” Matrixport predicts, based on the year-end sales season and the excitement of virtual currency-related stocks

connection:

Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

The post U.S. presidential election, virtual currency, and growing interest in Bitcoin policy among voters = Grayscale survey appeared first on Our Bitcoin News.

1 year ago

85

1 year ago

85

English (US) ·

English (US) ·