1/31 (Tue) morning market trends (compared to the previous day)

- NY Dow: $33,717 -0.7%

- Nasdaq: $11,393 -1.9%

- Nikkei Stock Average: ¥27,433 +0.19%

- USD/JPY: 130.4 +0.6%

- USD Index: 102.2 +0.3%

- 10-year US Treasury yield: 3.54 +0.8%

- Gold futures: $1,921 -0.4%

- Bitcoin: $22,724 -4.2%

- Ethereum: $1,558 -5%

traditional finance

crypto assets

Today’s New York Dow dropped for the first time in seven days, temporarily falling $280. The Nasdaq and gold futures also fell across the board. Following last week’s financial results of IT stocks such as Microsoft, concerns over Apple (February 2nd) and Alphabet C (same day), etc., which are about to settle their financial results, have led to sales from the IT and high-tech sectors.

In addition to the financial results of major IT companies, important economic indicators such as the US FOMC interest rate announcement, the manufacturing index, and the US unemployment rate will be announced this week.

As for the rate hike, it is almost expected to be eased to 0.25% from the previous 0.5% point. Also, depending on the situation, there seems to be a view that the interest rate may be cut by a total of 1% by the end of the year. While there is growing optimism about the easing of the pace of interest rate hikes, some point out that Chairman Powell will maintain the tightening stance so far at the FOMC on the premise that he will push the inflation rate down to the authorities’ target of 2%.

- February 1 (Wednesday 24:00): US January ISM manufacturing business index forecast 48.0 last time 48.4

- February 2 (Thursday 4:00): FOMC policy interest rate last time 0.5% point

- February 3 (Thursday 22:30-24:00): US unemployment rate, non-farm payroll forecast 3.6%, previous 3.5%

- Coinbase Global | $56.1 (-8.4%/-8.5%)

- Marathon | $7.1 (-10.6%/-11%)

- MicroStrategy | $245.6 (-4.9%/-4.9%)

Relation: Strong U.S. GDP is only a sign of economic slowdown

US stocks

Compared to the previous day for individual stocks, Big Bear ai (AI related) +64.5%, Lucid (EV) -8.3%, GM -3.8%, Toyota +0.08%, Tesla -5.5%, Microsoft -2%, Alphabet C- 2.4%, Amazon-1.4%, Apple-1.7%, Meta-2.6%, Coinbase-8.5%, Marathon Digital-10.6%.

Toyota announced yesterday that it sold over 10 million vehicles worldwide last year. It was the world’s top for three consecutive years. Due to the spread of the new coronavirus last year and the shortage of semiconductors, production was forced to decrease, mainly in Japan. Germany’s Volkswagen ranked second with 8.26 million units sold worldwide.

Relation: Financing from DeFi protocol “Teller”, Toyota Motor VC division, etc.

Relation: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

Relation: What is “leveraged trading” practiced by virtual currency investors | Explanation for beginners

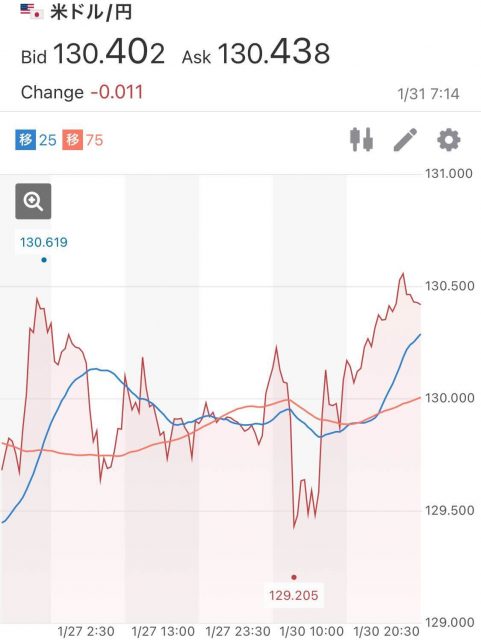

USD/JPY

The dollar-yen exchange rate is 130.43 yen per dollar, up 0.62% from the previous day. The buyback of the dollar (low stock prices) has become dominant before important announcements such as the FOMC policy interest rate and US employment statistics.

Source: Yahoo! Finance

Relation: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

Virtual currency-related stocks are getting cheaper due to the decline of the NY Dow and virtual currencies.

Relation: Stock investment recommended for virtual currency investors, representative virtual currency stocks of Japan and the United States “10 selections”

GM Radio “zkSync”

Here’s the first GM radio archive of the year that aired last week.

Don’t forget, #GMRadio with @zkSync‘s Head of Engineering, @anthonykrose is on in approx. 24 hours!

We’ll be talking about Ethereum scaling, pros/cons of ZK rollups, decentralization with/without a token, Anthony’s background at SpaceX, and much more!https://t.co/7B9Zj6UW4F

— CoinPost Global (@CoinPost_Global) January 25, 2023

Last time, our special guest was Anthony Rose, Head of Engineering at Matter Labs. The company is developing Ethereum (ETH) L2 solution “zkSync”. Matter Labs is developing a technology to improve the scalability of Ethereum by utilizing cryptographic technology called zero-knowledge proofs. On the radio, he talked about the strengths and challenges of ZK Rollup and the future prospects of zkSync.

Relation: This year’s first GM Radio will be held, guests will be Ethereum L2 “zkSync” development company executives

Click here to watch the archives of the two previous episodes, including Animoka Brands Chairman Yat Siu.

Reminder: Our 2nd #GMRadio starts in 30 min (24:00 UTC / 19:00 EST / 9:00 JST)

Reminder: Our 2nd #GMRadio starts in 30 min (24:00 UTC / 19:00 EST / 9:00 JST)

Tune in to hear about “Leading The Open Metaverse With Innovative Blockchain Games” with @ysiuExecutive Chairman of @animocabrands and @Ben_CharbitCEO of @Darewise!https://t.co/nr8dNhMpBM

Tune in to hear about “Leading The Open Metaverse With Innovative Blockchain Games” with @ysiuExecutive Chairman of @animocabrands and @Ben_CharbitCEO of @Darewise!https://t.co/nr8dNhMpBM

— CoinPost Global (@CoinPost_Global) December 22, 2022

The post U.S. Stock Market and Virtual Currency Overall Down | 31st Financial Tankan appeared first on Our Bitcoin News.

2 years ago

163

2 years ago

163

English (US) ·

English (US) ·