5/19 (Friday) morning market trends (compared to the previous day)

- NY Dow: $33,535 +0.3%

- NASDAQ: $12,688 +1.5%

- Nikkei Stock Average: ¥30,573 +1.5%

- USD/JPY: 138.6 -0.05%

- USD Index: 103.5 +0.6%

- 10-year US Treasury yield: 3.6 +2% per annum

- Gold Futures: $1,960 +0.01%

- Bitcoin: $26,950 -1.5%

- Ethereum: $1,814 -0.5%

traditional finance

crypto assets

NY Dow today

Today’s NY Dow continues to rise to +115 dollars. The Nasdaq closed at +$188. At the beginning of the market, the hawkish remarks of the US Federal Reserve Bank President Dallas put pressure on the market, but expectations that the US debt ceiling problem could be resolved before “X-Day” supported the market.

connection: NY Dow, virtual currency-related stocks sharply rebounded US default concerns receded?

connection: Top 3 rankings of ETFs (listed investment trusts) in Japan and overseas that can be purchased with NISA

Progress on the U.S. Debt Problem

Regarding the US debt ceiling issue, no specific progress has been made yet, but after President Biden returned from the G7 Hiroshima Summit, the two parties will hold talks again to avoid default, and will hold a press conference scheduled for the 21st. It seems that it is expected to be able to communicate decisions on negotiations through

House Speaker McCarthy and Democratic Senate Majority Leader Chuck Schumer also said that if a bipartisan deal is reached on the 18th, a vote will be held next week. Treasury Secretary Yellen warned again on Wednesday that the U.S. could default as early as June 1 if the debt ceiling is not raised.

Expectations for default avoidance pushed the dollar further up, widening its gains against major currencies. The dollar/yen exchange rate rose to 138.75 yen at one point, reaching a new high for the year.

Source: Yahoo! Finance

Dallas Fed President Speech

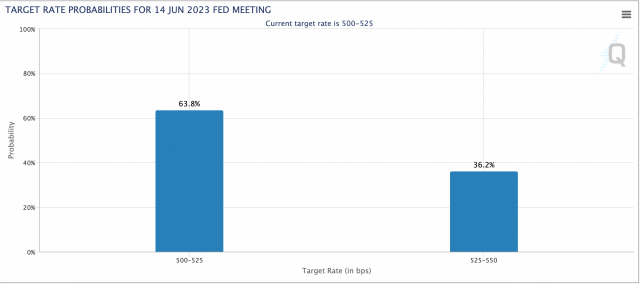

While most market participants expect the FOMC to announce a halt to rate hikes in June, Dallas Fed President Logan said the rationale for halting rate hikes in June was not yet clear.

Logan, a voting member at this year’s FOMC meeting, said: “There is a chance that the data coming out in the coming weeks will justify keeping rates on hold, but at this point we haven’t reached that point yet.” bottom.

After Logan’s remarks, interest rate swap markets priced in expectations that the June interest rate hike would be halted significantly. (89.3% last week ⇒ 63.8% now)

Source: CME

connection: What is the US monetary policy meeting “FOMC” that attracts the attention of global investors | Easy-to-understand explanation

connection: What is a real estate investment trust “REIT?” Explaining the main advantages and disadvantages

U.S. Initial Unemployment Insurance Application

U.S. initial unemployment claims fell by 22,000 from the previous week to 242,000 in the week ending May 13, below the forecast of 254,000.

In addition, the number of continuous receipts for the week ending March 6 decreased by 8,000 to 1,799,000, the lowest level since early March. The labor market remained firm.

economic indicators

- Friday, May 19, 24:00: Chairman Powell of the Federal Reserve Board remarks

- May 23, 22:45 (Tuesday): US May Manufacturing Purchasing Managers Index (PMI, preliminary figures)

- May 25, 3:00 (Thursday): Federal Open Market Committee (FOMC) Minutes

- May 25, 21:30 (Thursday): U.S. January-March Quarterly GDP Personal Consumption (revised value)

US stocks overall high

IT/Tech stocks are high across the board. The inflow of funds seems to be continuing. Individual stocks compared to the previous day: NVIDIA +4.9%, c3.ai-0.4%, Tesla +1.7%, Microsoft +1.4%, Alphabet +1.6%, Amazon +2.2%, Apple +1.3%, Meta +1.8%.

Virtual currency-related stocks fall

- Coinbase|$60.2 (-1.2%/+5%)

- MicroStrategy | $287.5 (-1%/+6%)

- Marathon Digital | $9.3 (-7%/+5%)

Coinbase launched a subscription service called “Coinbase One” on the 19th. The service will initially be available in the US, UK, Germany and Ireland.

3/ For a limited time, Coinbase One members can claim this exclusive Founding Member NFT.

Sign up for your free trial before next Thursday, May 25 at 9am PT and access the mint on your homepage within 20 minutes! Pro tip: make sure you have the latest version of the app  pic.twitter.com/YEKA4BMYQZ

pic.twitter.com/YEKA4BMYQZ

— Coinbase  (@coinbase) May 18, 2023

(@coinbase) May 18, 2023

The Coinbase One beta is set at a cost of $29.99/month. It offers commission-free trading, enhanced staking rewards, access to cryptocurrency data such as Messari, 24/7 customer support, and more.

The service will start in the four countries mentioned above, but it is said that it plans to offer it to users in 31 countries in the future.

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

The post U.S. stocks continue to rise USD/JPY hits year-to-date high | 19th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

130

2 years ago

130

English (US) ·

English (US) ·