4/20 (Thursday) morning market trends (compared to the previous day)

- NY Dow: $33,897 -0.2%

- Nasdaq: $12,157 +0.03%

- Nikkei Stock Average: ¥28,606 -0.1%

- USD/JPY: 134.6 +0.01%

- US dollar index: 101.9 +0.1%

- 10-year US Treasury yield: 3.59 +0.5%

- Gold Futures: $2,007.4 -0.6%

- Bitcoin: $29,162 -4%

- Ethereum: $1,965 -5.9%

traditional finance

crypto assets

Today’s NY Dow continues to fall slightly to -79.6 dollars. The Nasdaq was flat at +3.8 dollars. In response to the hawkish remarks of the FOMC members on the previous day and the full-scale entry into the accounting period of US companies, there was some risk-off movement.

connection: Nasdaq flat, Microsoft’s AI chip development, etc.

UK inflation persists

According to the UK consumer price index released on the 19th, the growth rate shrank for the first time in two months, but it still rose by more than 10% compared to the same month last year. It was the seventh consecutive month that the growth rate remained in the double digits, and it was disappointing that the inflation rate continued to be at a high level compared to the United States (+5.0%) and the Eurozone (+6.9%).

ECB chief economist remarks

The European Central Bank’s (ECB) chief economist Lane said on the 19th that a further interest rate hike in May was appropriate and that the size of the hike would be determined based on data to be released in the coming weeks. .

ECB policy committee members seem to be basically in agreement that rates should be raised again at the next meeting on May 3-4, but the previous 0.5 points will continue or slow down to 0.25 points. No consensus has yet been seen.

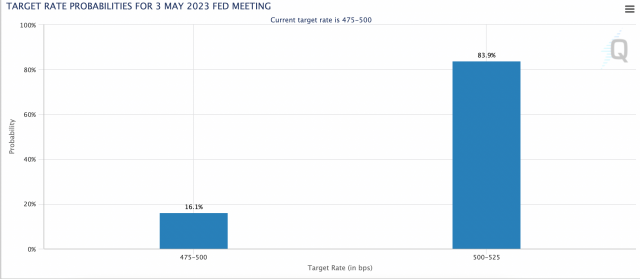

Members of the US Fed are also expected to announce rate hikes at the FOMC on May 4. At the moment, expectations for a 0.25 percentage point rate hike at the next FOMC have risen slightly to 85.5% again from yesterday’s 81.6%, but expectations for a 5-5.25% guide rate at the June FOMC are still high (62.4%). . Many market participants see the FOMC rate hike in May as the last rate hike of the cycle.

Source: CME

Economic data from this week onwards

- April 20, 21:30 (Thursday): Number of new unemployment claims for the previous week in the US

- April 21, 22:45 (Friday): US April Composite Purchasing Managers Index (PMI, preliminary figures)

- April 27, 21:30 (Thursday): U.S. January-March Quarterly Real Gross Domestic Product (GDP, preliminary figures), Core PCE

- April 28, 21:30 (Friday): U.S. March Personal Consumption Expenditure/PCE deflator

- May 1, 23:00 (Monday): US April ISM Manufacturing Index

- May 4, 3:00 (Thursday): US Federal Open Market Committee (FOMC) policy interest rate announcement

US stocks

This week, major US banks have completed their financial results announcements, and IT/high-tech and industry announcements have begun in earnest, including Tesla.

US IT Tech Stocks vs. Previous Day: NVIDIA +0.9%, c3.ai -0.2%, Tesla -2%, Microsoft -0.02%, Alphabet -0.3%, Amazon +1.9%, Apple +0.7%, Meta -1%, Coinbase -4.1%, Microstrategy -4.5%.

Tesla earnings

Tesla announced its financial results for the first quarter of 2023 on the 19th, revealing a 24% decline in profits. The decrease in profit was due to successive price cuts, and the company drastically lowered the minimum price of popular models just before the settlement of accounts.

The Model Y starts at $46,990, according to Bloomberg, a further 29% drop from the previous price cut in mid-January, while the Model 3 sedan will remain several years old. It is said that it was less than 40,000 dollars for the first time. In March, it had just implemented additional price cuts for the high-end models “Model S” and “Model X.” Shares fell -3.9% after hours.

Meanwhile, Tesla’s bitcoin holdings remained unchanged during the quarter, still holding 9,720 BTC.

connection: Earon Mask reveals the concept of AI language model “TruthGPT” against ChatGPT

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase|$64.4 (-4.1%/-7.8%)

- MicroStrategy | $314.7 (-4.5%/-5.7%)

- Marathon Digital Holdings | $10.6 (-8.7%/-11%)

Cryptocurrency stocks fell sharply on rising US interest rates and a drop in Bitcoin.

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

dollar yen

US dollar = 134.6 yen, up 0.01% from the previous day. On the 19th, the dollar/yen exchange rate was temporarily weakened by speculation reports that “cautious opinions are spreading within the Bank of Japan regarding the YCC (yield curve control) revision at the Bank of Japan’s monetary policy meeting on April 27-28 next week.” It hit a high of 135.13 yen.

Source: Yahoo! Finance

connection: Why did the Japanese government start promoting “Web3 policy”?Summary of important points and related news

connection: Commentary on the relationship between government bonds and interest rates, and the impact on the cryptocurrency market

The post U.S. stocks flat, risk-off moves in response to high inflation in the U.K. | 20th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

91

2 years ago

91

English (US) ·

English (US) ·