3/16 (Thursday) morning market trends (compared to the previous day)

- NY Dow: $31,874 -0.8%

- NASDAQ: $11,434 +0.05%

- Nikkei Average: ¥27,229 +0.02%

- USD/JPY: 133.3 -0.6%

- US dollar index: 104.7 +1.1%

- 10 year US Treasury yield: 3.46 -4.8% annual yield

- Gold Futures: $1,923 +0.6%

- Bitcoin: $24,555 +0.3%

- Ethereum: $1,663 -1.8%

traditional finance

crypto assets

The New York Dow turned down today to close at -$280. Credit concerns for Swiss bank Credit Suisse reported on the 15th weighed on the market.

Credit Suisse, a major Swiss financial group, announced in a financial report on the 14th that there were problems with internal controls in its financial reports for 2021 and 2022 and that there were “significant weaknesses”, and foreign media on the 15th. reported that the company’s largest shareholder, a Saudi financial institution, does not intend to make additional investments. Concerns about management are rising, and with the company’s share price plummeting by more than 30%, major French banks BNP Paribas and Société Générale also fell by more than 10%.

The STOXX Europe 600 index fell by more than 3% at one point, and the S&P 500 stock index fell by more than 2% at one point as European bank stocks plunged across the board. The chain reaction of financial risks caused by the recent failure of Silicon Valley Bank in the United States has spread to Europe.

The day before, US authorities such as the FDIC and Fed launched aggressive financial measures, and inflation indicators (CPI) were within the expected range. Globally, concerns about the financial system have reignited since 2008. Meanwhile, the Swiss National Bank said it would provide liquidity to Credit Suisse if needed. The U.S. Treasury Department is monitoring the situation at Credit Suisse.

US February PPI

On the other hand, the market reacted positively to the PPI slowdown announced last night.

connection: U.S. stocks and Nasdaq rebound CPI growth slowdown | 15th Financial Tankan

The US Producer Price Index fell unexpectedly in February, suggesting easing inflationary pressures. On a month-on-month basis, it unexpectedly turned negative for the first time since December, and year-on-year growth has contracted more than expected since January, reaching its lowest level since March 2021. The February CPI, released the day before, still showed persistent inflation, but the improvement in the supply chain and falling commodity prices were behind the slowdown in the PPI.

【preliminary report】

U.S. February Producer Price Index (Wholesale Price Index)

・PPI (vs. previous month): This time -0.1% Last time +0.7% Forecast +0.3%

・PPI (year-on-year): This time +4.6% Last time +6.0% Forecast +5.4%

・Core (vs. previous month): This time +0.0% Last time +0.5% Forecast +0.4%

・Core (year-on-year): this time +4.4% previous time +5.4% forecast +5.2%

Bitcoin surge pic.twitter.com/gVSiKXHg3Y

— CoinPost-virtual currency information site-[app delivery](@coin_post) March 15, 2023

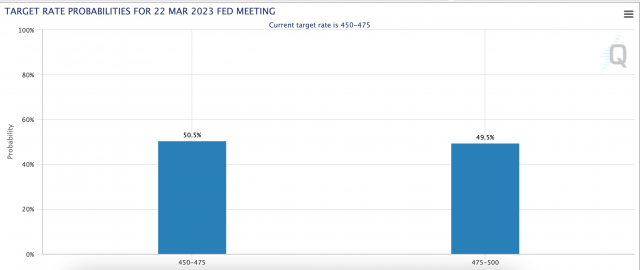

At the same time, the U.S. Department of Commerce announced that February retail sales fell 0.4% month-on-month, as expected, falling from +3.2% in January. Expectations for a 0.25% rate hike by the FOMC next week have receded to about 50:50 with expectations of a halt to rate hikes on signs of slowing inflation. In addition, the US Treasury market rose.

Source: CME

Economic indicators for March (Japan time)

- March 23, 3:00 (Thursday): US Federal Open Market Committee (FOMC) interest rate announcement, chairman’s regular press conference

- March 30, 21:30 (Thursday): U.S. October-December Quarterly Real Gross Domestic Product (GDP, Final Value) (Quarterly Change Annual Rate)

- March 31, 21:30 (Friday): U.S. February Personal Consumption Expenditure (PCE Core Deflator) (MoM/YoY)

connection: What is the CPI (Consumer Price Index) that attracts attention in the virtual currency market?

US stocks

U.S. bank stocks fell across the board, but were bought back in the final stages, mainly in IT and high-tech stocks, in response to the results of the PPI.

Compared to the previous day for individual stocks, NVIDIA +0.7%, c3.ai -1.2%, Big Bear.ai -4.8%, Tesla -1.5%, Microsoft +1.8%, Alphabet +2.3%, Amazon +1.4%, Apple +0.3% , Meta +1.9%, Coinbase +2.9%, Silvergate Capital +0.8%.

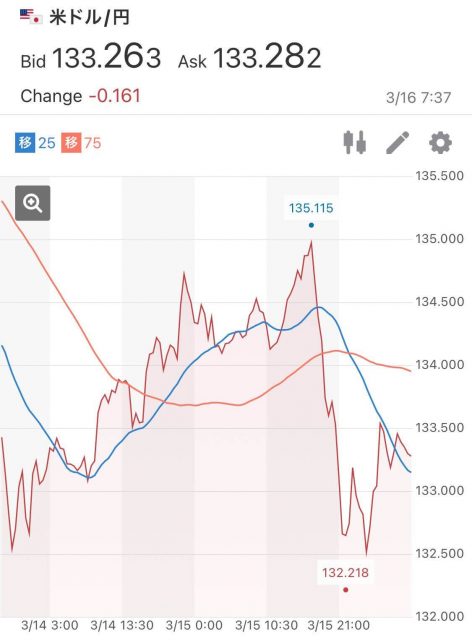

dollar yen

The dollar-yen exchange rate is 133.3 yen per dollar, down 0.6% from the previous day. In the dollar/yen market, concerns about the financial crisis of Credit Suisse spread, and as the flow of risk aversion accelerated, the dollar was sold and the US Treasury bonds were bought. After that, it was bought back after the Swiss financial authorities secured liquidity and showed a stance to maintain stability.

Source: Yahoo! Finance

connection: Why did the Japanese government start promoting “Web3 policy”?Summary of important points and related news

connection: Commentary on the relationship between government bonds and interest rates, and the impact on the cryptocurrency market

GM radio of the week

The 13th GM Radio will be held this Friday, March 17th at 12:00. Evan Cheng, co-founder and CEO of Mysten Labs, the developer of the L1 blockchain “Sui,” has been invited.

connection: “GM Radio” Next time, Mysten Labs, the developer of Diem’s L1 “Sui” will participate

Click here for last week’s radio archive.

https://t.co/K2cQ03YNgK

— CoinPost Global (We’re hiring!) (@CoinPost_Global) March 9, 2023

https://t.co/SOPA9HkAzd

— CoinPost Global (We’re hiring!) (@CoinPost_Global) March 8, 2023

The post U.S. stocks fluctuate due to slowdown in U.S. PPI and credit uncertainty at Credit Suisse | 16th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

199

2 years ago

199

English (US) ·

English (US) ·