4/28 (Friday) morning market trends (compared to the previous day)

- NY Dow: $33,826 +1.5%

- Nasdaq: $12,142 +2.4%

- Nikkei Stock Average: ¥28,457 +0.1%

- USD/JPY: 133.9 +0.2%

- USD Index: 101.4 +0.01%

- 10-year US Treasury yield: 3.5 +2.8% annual yield

- Gold Futures: $1,996 +0.05%

- Bitcoin: $29,669 +5%

- Ethereum: $1,919 +3.7%

traditional finance

crypto assets

Today’s NY Dow sharply rebounded to +524 dollars. The Nasdaq closed at +$287.8. The positive financial results of the meta announced after the close of the previous day seemed to support the market.

connection: NY Dow First Republic continues to decline, significantly higher due to favorable financial results

U.S. January-March quarter real GDP

- Real GDP: result 1.1% forecast 2.0% previous 2.6%

- Private consumption: Result 3.7% Forecast 4.2% Previous 1.0%

- GDP deflator: result 4.0% forecast 3.7% last time 3.9%

- PCE core deflator: result 4.9% forecast 4.6% previous 4.4%

The U.S. Department of Commerce announced on the evening of the 27th that the real GDP for the January-March quarter was up 1.1% from the previous quarter, down from 2.6% in the fourth quarter of last year and well below the forecast of 2.0%.

Personal consumption, which accounts for more than two-thirds of U.S. economic activity, was 3.7%, up from 1.0% in the previous survey. Concerns about recession risk appear to be growing. The U.S. GDP fell into negative growth for the second consecutive quarter in the first half of 2022, but personal consumption remained strong, and although it turned to positive growth at 3.2% in the July-September quarter last year, it rose to 2.6% in the October-December quarter. % slowed down.

In addition, the personal consumption expenditure (PCE) price index, which the Fed pays attention to as an indicator of inflation, rose 4.2% quarter-on-quarter in the aggregate, and 4.9% in the core, exceeding the market forecast of 4.6% and the previous 4.4%. It was the highest growth in 12 months.

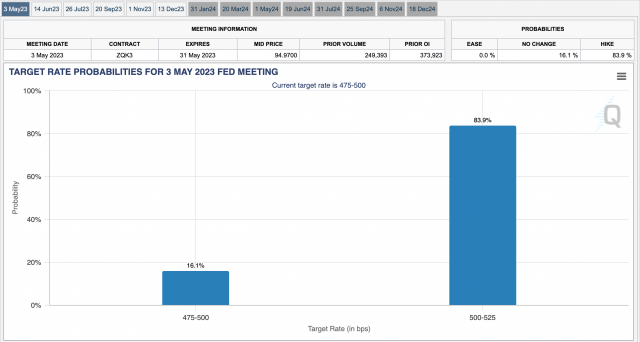

Based on this data, etc., there is a high possibility that the FOMC (Federal Open Market Committee) on May 4 will announce an interest rate hike of 0.25 points. The March Personal Consumption Expenditure/PCE deflator will be released tonight.

Source: CME

Economic data from this week onwards

- April 28, 21:30 (Friday): U.S. March Personal Consumption Expenditure/PCE deflator

- May 1, 23:00 (Monday): US April ISM Manufacturing Index

- May 4, 3:00 (Thursday): US Federal Open Market Committee (FOMC) policy interest rate announcement

connection: What is a real estate investment trust “REIT?” Explaining the main advantages and disadvantages

US stocks

U.S. IT/tech stocks rose across the board, driven by a significant rise in the meta. Individual stocks compared to the previous day: NVIDIA +1%, c3.ai-0.5%, Tesla +4.1%, Microsoft +3.2%, Alphabet +3.7%, Amazon +4.6%, Apple +2.8%, Meta +13.9%.

meta closing

Meta rose 13.9% after the results announced the day before. It expects sales to reach a maximum of $32 billion in the second quarter from April to June, surpassing analyst expectations of $29.5 billion. is.

However, the Metaverse division’s “Reality Labs” posted an operating loss of $3.99 billion in the January-March quarter, with sales of $339 million, down 51% year-on-year. fell below

In the earnings announcement this time, CEO Zuckerberg mentioned strengthening the AI business, but this does not mean that he has shifted the focus from the development of the Metaverse, which has continued to lose money, to AI efforts. We’ve been and will continue to focus on both, and the Metaverse.They are also related.”

Source: Tradingview

Cryptocurrency/Blockchain-related Stocks (Year-on-Year Change/Year-to-Week Change)

- Coinbase|$54.1 (+0.5%/-8.2%)

- MicroStrategy | $318.6 (+6.4%/+9.4%)

- Hat 8 Mining | $1.8 (+4.6%/+7.6%)

Bitcoin and Nasdaq rebounded, and virtual currency-related stocks also rose across the board.

As for Coinbase, it was reported that CEO Armstrong sold $1.6 million worth of Coinbase shares on April 24. Armstrong owned $25 billion in stock.

The reason for the sale is believed to be to support the science and technology fields to solve various problems facing humanity. In October last year, he said he expected to sell about a 2% stake by the end of the year.

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

The post U.S. Stocks Rebound Meta +14%, U.S. GDP Slows for Second Consecutive Quarter | 28th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

117

2 years ago

117

English (US) ·

English (US) ·