June 16 (Friday) morning market trends (compared to the previous day)

- NY Dow: $34,408 +1.2%

- Nasdaq: $13,782 +1.1%

- Nikkei Average: ¥33,485 -0.05%

- USD/JPY: 140.2 +0.02%

- USD Index: 102.1 -0.7%

- 10-year US Treasury yield: 3.72 -2% per annum

- Gold Futures: $1,970 +0.08%

- Bitcoin: $25,667 +2.4%

- Ethereum: $1,673 +1.5%

traditional finance

crypto assets

NY Dow Nasdaq today

Today’s NY Dow sharply rebounded to +428 dollars. The Nasdaq also closed higher at +156 dollars. Optimism is spreading as yesterday’s FOMC meeting has been digested and the interest rate hike cycle is nearing its end.

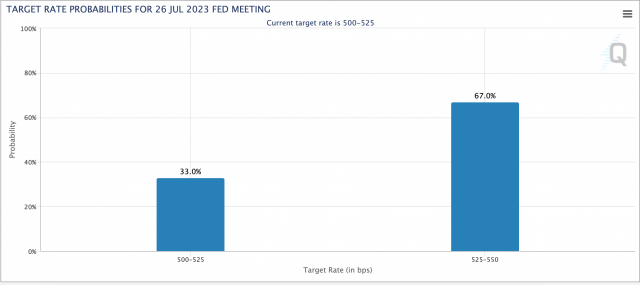

The FOMC policy announced on the 15th temporarily suspended further rate hikes, but there is a possibility of two more rate hikes by the end of the year. Markets seem to favor an additional 0.25% rate hike at the FOMC meeting in July, but the timing of the second rate hike is unknown. Fed Chairman Jerome Powell hinted at a cautious approach to the pace of future rate hikes at his press conference yesterday, raising the possibility of further intermittent and small rate hikes based on future economic data.

Source: CME

connection: What is the US monetary policy meeting “FOMC” that attracts the attention of global investors | Easy-to-understand explanation

US retail sales higher than expected

US retail sales announced last night rose 0.3% month-on-month in May, lower than the previous month’s 0.4% increase, but well above market expectations of a 0.2% decrease. Consumer demand is showing solidity.

Specifically, sales increased in 10 out of 13 categories, and it seems that increased spending on automobiles had a particular impact.

Also, core sales (excluding restaurants and car dealers, building material stores and gas stations), which is used to calculate gross domestic product (GDP), increased by 0.2%, slowing from the previous month’s 0.6% increase. On the other hand, retail sales statistics have only one category of service sector and are not adjusted for inflation, so it is said that it is difficult to accurately reflect the overall consumption environment.

U.S. initial unemployment claims also increased

Last night, the number of U.S. initial unemployment claims for the week ending June 10 (seasonally adjusted) rose to 262,000, surpassing expectations of 249,000. Last week it was 261,000. According to Reuters, the flattening of unemployment claims was due to “the availability of unemployment benefits for some teachers in Minnesota during the summer vacation.” However, layoffs are still on the rise despite these effects, and the previously tight situation appears to be easing.

connection: Bitcoin after FOMC, support line interrupted at $ 24,000 Market sentiment to fear level

dollar yen

The dollar/yen exchange rate is in the low 140 yen range to the dollar. The Bank of Japan is likely to continue the current monetary easing policy centered on the Yield Curve Control (YCC) policy in its monetary policy announcement to be carried out today on the 16th, and the yen is expected to continue depreciating.

economic indicators

- June 16 (Friday): Bank of Japan Monetary Policy Meeting Policy interest rate announcement

- June 16 (Fri) 23:00: University of Michigan Consumer Confidence Index Preliminary for June

- Wednesday, June 21, 23:00: Chairman Powell’s remarks

- Thursday, June 22, 21:00: U.S. unemployment claims for the previous week

- Thursday, June 22, 23:00: Chairman Powell’s remarks

US stocks rise

Hopes for a soft landing after the FOMC appear to have supported the stock market. The S&P 500 index continued its six-day gain, and the Nasdaq 100 index returned to its highest level since March last year. On the other hand, there are concerns that some stocks may be overbought.

Individual stocks compared to the previous day: Nvidia -0.8%, c3.ai +8.2%, AMD -2.4%, Tesla -0.3%, Microsoft +3.1% (six days in a row), Alphabet +1.1%, Amazon +0.5%, Apple + 1.1%, meta +3.1%.

connection: Top 3 rankings of ETFs (listed investment trusts) in Japan and overseas that can be purchased with NISA

Cryptocurrency-related stocks flat

- Coinbase|$54.2 (+0.6%/+1.8%)

- MicroStrategy | $277.9 (-1.7%/-1.6%)

- Marathon Digital | $9.3 (-3.4%/-0.2%)

connection: Litecoin Halving Scheduled Around August 7th, On-Chain Data Suggests Major Investor Trends

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

The post U.S. stocks rebound sharply nearing end of rate hike cycle, Bank of Japan meeting expected to continue monetary easing | appeared first on Our Bitcoin News.

2 years ago

103

2 years ago

103

English (US) ·

English (US) ·