Tokenized US Treasuries to Aptos

Ondo Finance, an institutional-class on-chain fund that invests in U.S. bonds, announced on the 23rd a strategic partnership with the Aptos Foundation, which supports the layer 1 blockchain Aptos (APT). As a first step in the collaboration, the USDY token issued by Ondo will be integrated into the Aptos blockchain.

The USDY token is a real asset (RWA) stablecoin backed by short-term U.S. government bonds and bank deposits, and token holders can expect stable yields.

Nathan Allman, CEO and co-founder of Ondo Finance, said of the partnership with Aptos, “Aptos has built strong relationships with institutional investors and has a clear vision for the future of blockchain. By working together, we can further increase the value of the innovative financial products we offer to the market.”

Since announcing its breakthrough product to tokenize U.S. Treasuries on Ethereum in January 2023, Ondo Finance has also expanded into other blockchains. Last December, it expanded to Solana (SOL), and earlier this month it expanded to Sui (SUI), which uses the same programming language Move as Aptos.

connection: U.S. Ondo Finance issues USDY backed by U.S. bonds and bank deposits to compete with stablecoins

What is RWA?

Abbreviation for “Real World Asset.” RWA that is tokenized on the blockchain includes real assets such as real estate, artwork, trading cards, and securities such as stocks and bonds.

Virtual currency glossary

Virtual currency glossary

connection:Why investors are interested in real asset tokenization and what is Real World Assets (RWA)?

Collaborate on onboarding of tokenized assets

According to RWA.XYZ data, the market value of US Treasury-backed tokens currently stands at $863 million, and Ondo's total locked-up assets (TVL) is $125 million, ranking third in the industry. occupies the market share.

With this partnership, Thala, the leading DeFi protocol on Aptos, announced that it will incorporate USDY tokens as collateral assets on its Collateral Debt Position (CDP) platform. Additionally, Thala plans to support USDY in its Automated Market Maker (AMM).

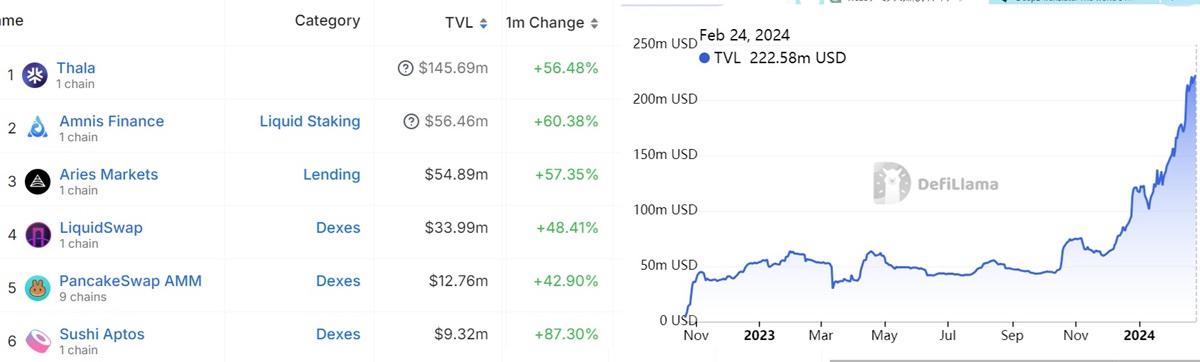

Source: DeFillama

According to DeFillama, total assets locked (TVL) on Aptos reached $222 million, of which Thala held the top share with $144 million.

Beyond the USDY integration, Aptos Foundation and Ondo Finance aim to develop “staking and restaking processes to utilize tokenized assets and increase the capital efficiency of the supporting platform” in the future. ing.

connection:Ondo Finance launches on Ethereum to invest in US Treasuries with stablecoin

The post U.S. Treasury bond-backed tokens will be distributed on Aptos, with onboarding possible appeared first on Our Bitcoin News.

1 year ago

80

1 year ago

80

English (US) ·

English (US) ·