The post UK FCA Rejects 87% of Crypto Firm Applications appeared first on Coinpedia Fintech News

The United Kingdom Financial Conduct Authority has rejected 87% of registration requests from crypto firms under the UK Crypto Regulation framework. The UK FCA has only accepted 4 registrations out of 35 submissions in the last 12 months. This information has been revealed in the UK FCA annual report for 2024. But why did the UK reject so many registration requests, and are they against crypto in general? Let’s find out.

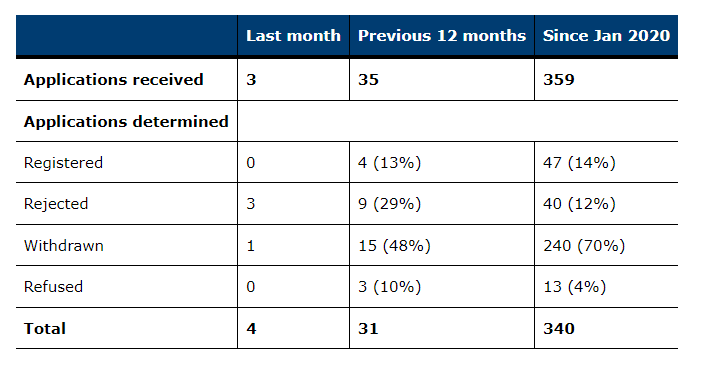

The UK FCA report shows that in the last 12 months, a total of 35 applications from various crypto firms were received. Out of these 35 license requests, 87% of crypto companies failed to win approval. Only 4 registrations were successful and received licenses to carry out their crypto work in the UK region. BNXA- Payment partner of Binance in the UK, a PayPal UK unit and a Nomura based crypto custody joint venture Komainu were able to secure a license for them.

The authorities received a total of 35 requests; they confirmed 4, rejected 9, had 15 withdrawn by the companies, and refused another 3. Since 2020 the UK FCA has received a total of 359 licensing requests. Only 19 were able to win a license.

They rejected submissions missing key components and invalidated those with poor quality components, refusing to accept them. Major companies withdrew their application as they were not able to comply with the UK regulations.

Why is the rejection rate so high? The Financial Conduct Authority takes all relevant matters into account when accessing these applications. They have anti-money laundering and counter-terrorist laws in place that every crypto organization have to be compliant with.

They have laid out various steps for businesses related to crypto that seek to register with them. The organization must understand and comply with the AML regulations and appoint a Money Laundering Reporting Officer. The MLRO must have relevant knowledge of UK regulations, experience and training. He should have a level of authority, sufficient access to resources and independence to monitor and manage the compliance.

It is great to see that the UK has a clear regulation framework laid out for crypto businesses willing to spread their wings into the UK. However, not all companies want to become expendable and make changes in the process of their working, this is very concerning. It would be interesting to see how the future unfolds for crypto business in the United Kingdom.

Also Read: Tornado Cash Used in $42.7 Million Crypto Hacks: Key Details Revealed

11 months ago

41

11 months ago

41

English (US) ·

English (US) ·