Beta release of UniswapX

On the 17th, the largest decentralized exchange (DEX) launched the liquidity aggregator function “UniswapX (beta version)” on the Ethereum mainnet.

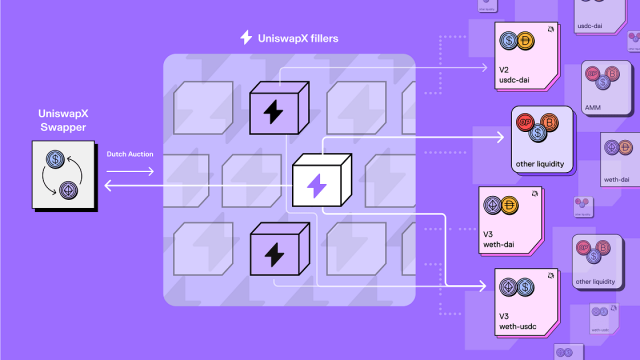

This new feature incorporates an auction method that allows trade processing to be outsourced and optimal trades arranged from liquidity resources, including AMMs (Automated Market Makers).

UniswapX is a stepping stone to the upcoming Uniswap V4. After Uniswap V4, thousands of customized liquidity pools are expected to be implemented, further increasing the complexity of order processing (routing) between pools.

Source: Uniswap

Therefore, UniswapX entrusts the complex routing of closing deals at optimal prices to an open network of competitive fillers. This principle is expected to combine on-chain liquidity such as AMM pools and fler’s own private vaults to provide a more convenient trading experience for users.

connection:Uniswap v4 development plan announced, expected to significantly improve capital efficiency and gas efficiency

Gasless transaction, MEV protection benefits

End-users, on the other hand, will still be able to trade through the Uniswap user interface.

In UniswapX, for orders signed by swappers (end-users), fillers act on behalf of the work to be submitted on the blockchain and payment of gas (fees) for transactions. Swappers do not need the blockchain’s native tokens (eg ETH, MATIC) to trade, nor do they bear the costs of failed trades. This will help simplify transactions and reduce costs.

More importantly, UniswapX offers protection from “maximum extractable value” (MEV). MEV is a major problem with on-chain swapping, and refers to the problem of users losing assets due to arbitrage transactions.

Fillers use private transaction relays in routing orders to on-chain liquidity sources. This allows transactions to be submitted to the blockchain without exposing the transaction information, thus protecting orders executed by fillers from “sandwich attacks” in which other actors intervene.

What is a sandwich attack?

A combination of front-run and back-run, the practice of unfairly profiting from looking at other users’ orders and then inserting your own large buy orders, followed by sell orders.

Cryptocurrency Glossary

Cryptocurrency Glossary

The new system is currently in beta, and many orders will still be processed via traditional routing. However, as more fillers enter the system and parameters are adjusted, we expect the majority of transactions to go through UniswapX.

Uniswap plans to launch cross-chain-enabled UniswapX later this year, combining swapping and bridging into a single action.

connection:Commentary on Sandwich Attacks and MEV, Threats to Decentralized Trading Markets and Countermeasures

The post Uniswap releases liquidity aggregator function “UniswapX (Beta)” appeared first on Our Bitcoin News.

2 years ago

88

2 years ago

88

English (US) ·

English (US) ·