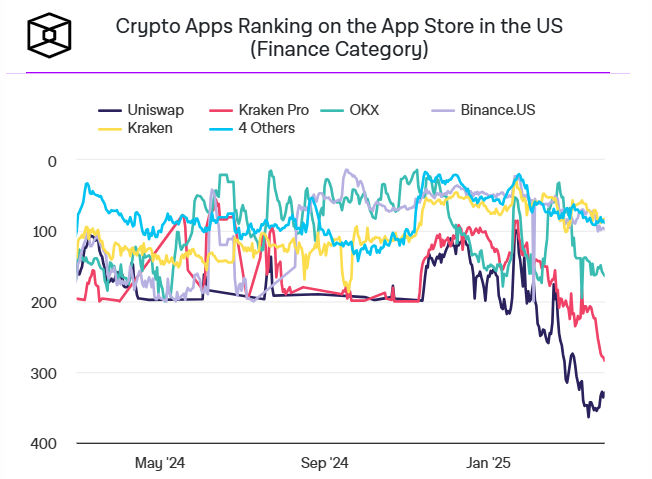

Decentralized crypto exchange Uniswap has slumped in the US App Store’s finance category rankings.

The block data shows Uniswap plunged from 99 to 364 in ranking within two months.

Source – The Block

Source – The BlockThe substantial shift came after the protocol soared to new heights following Donald Trump’s presidential victory.

The key development has grabbed investor attention, with many speculating about the native coin UNI and its short-term price actions.

Uniswap loses momentum after Trump-fueled growth

Uniswap displayed resilience throughout last year, ranking in the 190s.

However, magnified bullishness after the US election results propelled the platform to the 110s.

Cryptocurrencies rallied to record highs after Trump’s win due to the president’s pro-crypto attitude.

The optimism overflowed into 2025, with Trump’s inauguration pushing Uniswap to rank 99 in January.

The connection between Uniswap’s rising popularity and political developments confirms that enthusiasts expected a favorable environment for crypto business under the Trump administration.

Uniswap’s swift growth reflected similar trends in the digital assets market.

Cryptocurrencies flew to record peaks after Donald Trump’s inauguration, with Bitcoin holding above $100K.

The swift shifts in Uniswap rankings

Nevertheless, the market failed to keep the momentum.

Uniswap has gradually dropped in finance app rankings since January, even hitting lows not seen during its 2023 struggles.

Fading election-fueled optimism and a broad market correction catalyzed the significant plunge.

In addition, intensifying DEX competition, with PancakeSwap dominating, dented Uniswap’s market position.

While still a key player within the DeFi world, Uniswap’s declining app store ranking reflects the hurdles cryptocurrency platforms face after hype-driven surges.

Speculative interest, not solid adoption, fueled Uniswap’s growth, explaining the recent sharp plummets.

Also, the crypto market has slumped after the US election wave.

Sustained bearish pressure in recent months has pushed Bitcoin down to around $82,000 at press time.

The significant dips and market instability often affect DEXs as participants change their approaches according to broad-based trends.

UNI price outlook

The token trades at $5.90 following a 1.75% dip in the past 24 hours.

Chart by Coinmarketcap

Chart by CoinmarketcapUNI demonstrated robust bearishness after losing 13% and 22% in the past week and month, respectively.

Crypto trader TA highlighted Uniswap’s weakness.

The chart shows a sharp decline from UNI’s previous peak at around $18.98.

The nearly 70% price crash has triggered debates about whether the alt will hit new lows soon.

The steep drop matches the declines in app store rankings, confirming persistent Uniswap downtrends.

The altcoin lacks a reliable support barrier until $5.51 – 6.6% away from UNI’s current price.

$UNI holders, 360,526 strong, brace for chaos! As the downward spiral intensifies, watch for a potential breakdown. MCAP: 3.7B. Will it test new lows? t.me/TAnotepad_TG

Failure to retain the crucial foothold could welcome massive dips, leading to extended downsides or consolidation for the altcoin.

Uniswap’s revival will rely on various factors, including market stability, continued DeFi advancements, and regulations.

While politics could provide momentary catalysts, user engagement and lucrative fundamentals drive growth and competitiveness in decentralized finance.

The post Uniswap’s (UNI) finance app ranking hits record low: is $5.51 support at risk? appeared first on Invezz

English (US) ·

English (US) ·