If you’ve been following the cryptocurrency market for a while, you’ve heard the term token unlock. This process refers to the staggered release of a specific amount of crypto assets that have been frozen to prevent early investors and project team members from selling in bulk.

Unlocking is considered bearish as it frees up liquidity, but some observers believe that existingOnly highlight market trendssays that.

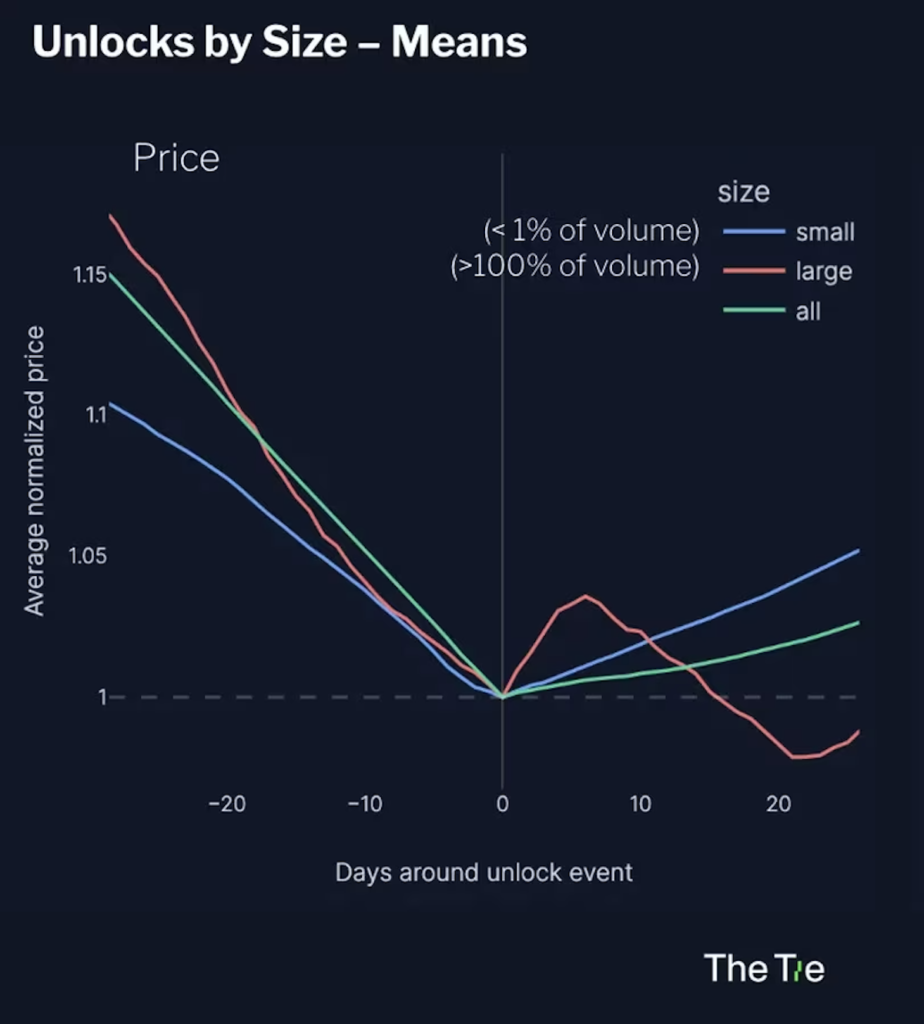

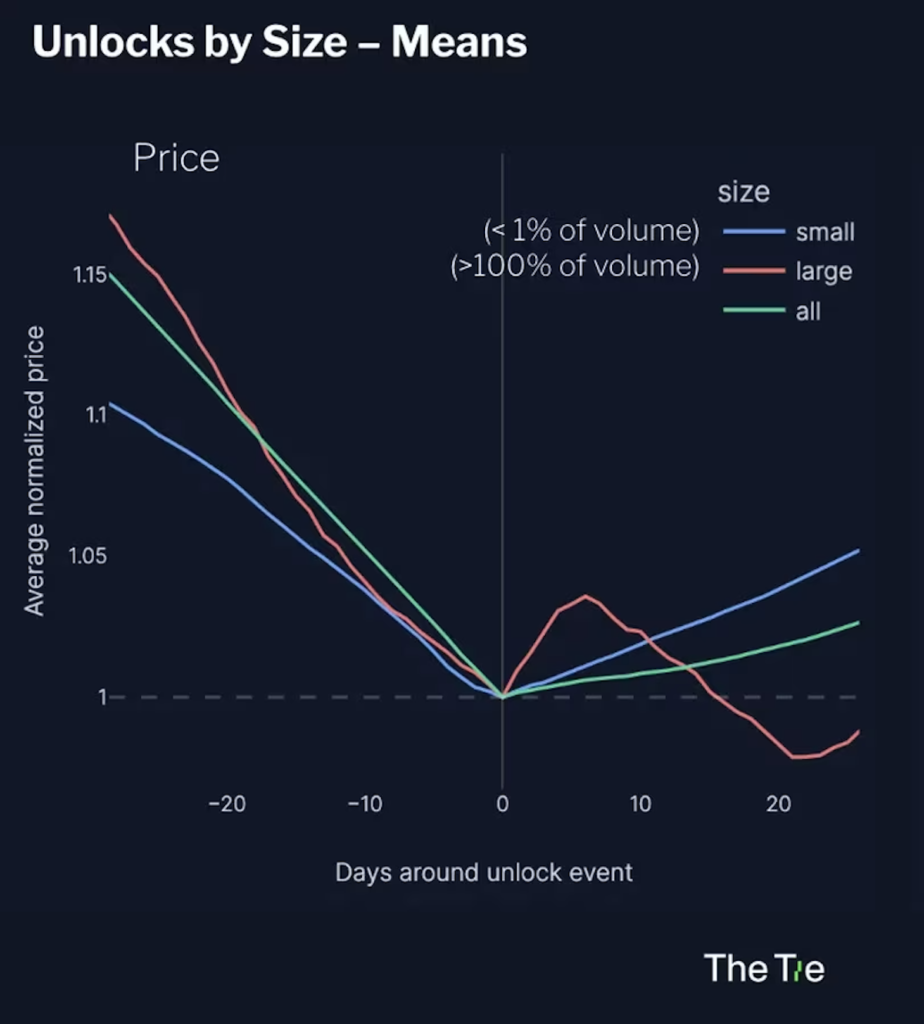

According to new research from analytics firm The Tie, the coin fell side by side ahead of the unlock event. However, once the liquidity released exceeded 100% of the average daily volume, the price quickly recovered. The company has researched over 350,000 unique unlock events involving over 100 tokens.

“If unlocks were above 100% of the average daily volume, the price tended to rebound faster, albeit for a short period of time. This is likely because traders were relieved that unlocks did not immediately flood the market with new tokens,” Lawrence Lewitinn, content director at The Tie, wrote in Wednesday’s newsletter.

“Nevertheless, in the face of such a significant unlock, the price of the token fell below the level at which it was unlocked within two weeks, which may suggest that holders waited several days before selling to the market,” he added.

The Tie’s research also showed an exponential growth in trading volume for coins facing major unlocks.

The chart shows that tokens facing large unlocks relative to average trading volume suffered deep losses within two weeks after the event. (The Tie)

The chart shows that tokens facing large unlocks relative to average trading volume suffered deep losses within two weeks after the event. (The Tie)|Translation: CoinDesk JAPAN

|Editing: Toshihiko Inoue

|Image: Shutterstock

|Original: Large Crypto Token Unlocks Drive Prices Lower Within Two Weeks, Research Suggests

The post Unlocking large-scale crypto assets lowers prices within two weeks: research report | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

1 year ago

171

1 year ago

171

English (US) ·

English (US) ·