June 29 (Thursday) morning market trends (compared to the previous day)

- NY Dow: $33,852 -0.2%

- Nasdaq: $13,591 +0.2%

- Nikkei Average: ¥33,193 +2%

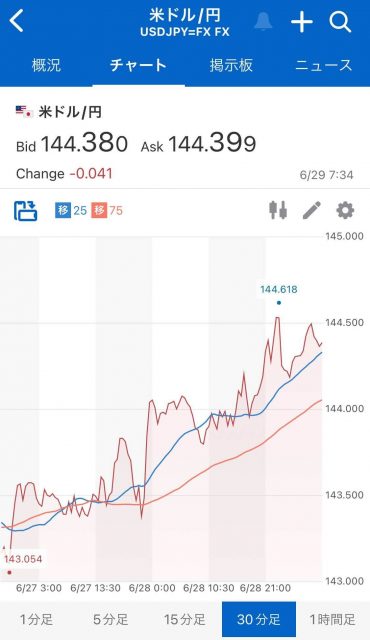

- USD/JPY: 144.3 -0.04%

- USD Index: 103 +0.5%

- 10 year US Treasury yield: 3.7 -0.05% annual yield

- Gold Futures: $1,916 -0.3%

- Bitcoin: $30,152 -1.8%

- Ethereum: $1,831 -3.3%

traditional finance

crypto assets

NY Dow Nasdaq today

Today’s NY Dow fell slightly to -74. The Nasdaq closed at +36 dollars.

US Fed Chairman Jerome Powell said at the ECB forum that he would not rule out the possibility of raising interest rates two more times, but he had made similar remarks after the FOMC meeting two weeks ago, so the reaction from the US stock market was limited. was.

connection: Bitcoin stays within range, GBTC discount shrinks to -31% level

At the ECB Forum, which was also attended by dignitaries such as ECB Governor Lagarde, BOJ Governor Ueda, and Bank of England Governor Bailey, Chairman Powell said, “The policy is constraining, but it may not be constraining enough. In order to curb persistent inflation and calm the still-tough labor market, the FOMC should hold down the policy rate at its July and September meetings. He showed a hawkish attitude that there is a possibility of raising the

The day before, ECB President Christine Lagarde said, “We need a more aggressive policy to deal with persistent inflation.” I was talking about continuing.

Due to the commitment of each country to curb inflation to 2%, there are high expectations that the interest rate hike cycle is not over yet, and it is almost certain that the interest rate will be raised in July, including in the United States, and the direction is toward another interest rate hike in September. It seems to be growing.

dollar yen

The dollar/yen continued to drop against the dollar at 144.3 yen, hitting new lows every day since the beginning of the year.

Source: Yahoo! Finance

According to Bloomberg and other sources, Bank of Japan Governor Ueda said at the ECB forum on the 28th that monetary policy will continue, saying, “We believe that the underlying inflation rate is still slightly below 2%.・We haven’t changed the control.” He also said that if the latest inflation outlook slows for a while and then rises again next year, it would be enough reason for the BOJ to reverse monetary policy.

economic indicators

- Thursday, June 29, 21:30: Jan-Mar Quarterly Real Gross Domestic Product (GDP, Final)

- Friday, June 30, 21:30: May Personal Consumption Expenditure (PCE deflator)

- July 3 (Monday) 8:50: April-June Quarterly Bank of Japan Tankan Forecasts for Large Enterprises in Manufacturing

Semiconductor export restrictions to China US stocks

Tech stocks such as AI-related stocks such as Nvidia were sold first. Yesterday, it was reported that the Biden administration would strengthen the export control policy announced in October last year in order to restrict the sale of some semiconductors for artificial intelligence to China.

The WSJ reported that the U.S. Department of Commerce said chip makers such as Nvidia manufactured semiconductors without prior licenses when exporting them to customers in restricted countries such as China, a strategic competitor. Exports of goods may be blocked as early as early July. To limit the impact of the October 2022 restrictions, NVIDIA manufactured the A800 AI semiconductor for the Chinese market, which is below the performance requirements indicated by the Department of Commerce, but the new regulations the Department of Commerce is considering will require licensing. Without it, the sale of the A800 would be banned.

Individual stocks compared to the previous day: Nvidia -1.8%, c3.ai +6.2%, AMD -0.2%, Tesla +2.4%, Microsoft +0.3%, Alphabet +1.5%, Amazon -0.1%, Apple +0.6%, Meta- 0.6%.

In addition, Apple’s US price continued to rise after last week’s highest price of 182.94 dollars at the time of 2021. It closed at a high of $189.25 on 28th.

Source: Tradingview

connection: Top 3 rankings of ETFs (listed investment trusts) in Japan and overseas that can be purchased with NISA

Virtual currency stocks

- Coinbase|$70.7 (+1.2%/+15.1%)

- MicroStrategy | $325.6 (+0.2%/-1.1%)

- Marathon Digital | $13.1 (-1.6%/+3.5%)

connection: MicroStrategy buys more Bitcoin KuCoin requires KYC for all users | Summary of important bulletins on the morning of the 29th

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

The post US Apple continues to update high prices Stricter export restrictions on US semiconductors to China affect AI-related stocks | 29th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

133

2 years ago

133

English (US) ·

English (US) ·