Transfers on hold at Silicon Valley Bank

Around noon on the 11th (Japan time), US company Circle, which issues the US dollar-linked stablecoin USDC, made an unprocessed wire transfer of approximately 445 billion yen ($3.3 billion) to Silicon Valley Bank (SVB). announced that they were left behind. $3.3 billion is about 8% of USDC reserves (about $40 billion).

1/ Following the confirmation at the end of today that the wires initiated on Thursday to remove balances were not yet processed, $3.3 billion of the ~$40 billion of USDC reserves remain at SVB.

— Circle (@circle) March 11, 2023

Silicon Valley Bank (SVB) is one of six banking partners that control about 25% of USDC’s cash holdings in its reserves, according to Circle.

SVB is causing a bank run for clients after its stock price plunged Monday. On the 10th, the US Federal Deposit Insurance Corporation (FDIC), the US government agency responsible for deposit protection in the event of a bank failure, suspended banking operations and placed deposits under control.

Circle said it confirmed late Wednesday that outstanding wire transfers issued on Wednesday totaled $3.3 billion.

Going forward, SVB’s banking services will resume on the 13th, with plans to respond to deposit withdrawals. Circle said it would “follow guidance provided by state and federal regulators.”

The total issued amount of USDC is 41,095,940,000 USDC, making it one of the top two stablecoins in the industry. Adoption is expanding not only for centralized exchanges, but also as collateral for DeFi (decentralized finance) and decentralized stablecoins.

connection:Circle to keep USDC reserves in minority banks

What is dipeg

A situation in which the price rate of a currency diverges from its reference price, aiming to peg it with a currency such as the US dollar.

Cryptocurrency Glossary

Cryptocurrency Glossary

Support for US Coinbase

With 8% of USDC’s reserves experiencing liquidity problems, the impact could spill over to the entire cryptocurrency market.

US cryptocurrency exchange Coinbase announced that it will temporarily suspend the exchange function of USDC with the US dollar after noon on the 11th (Japan time).

We are temporarily pausing USDC:USD conversions over the weekend while banks are closed. During periods of heightened activity, conversions rely on USD transfers from the banks that clear during normal banking hours.When banks open on Monday, we plan to re-commence conversions .

—Coinbase (@coinbase) March 11, 2023

Coinbase says that it is a “measure only on weekends when banks are closed”, but credit anxiety spreads and a dipeg occurs in the actual price of USDC. In the US Coinbase Tether (USDT) trading market, 1USDC is trading at $0.878, which is significantly below the reference value ($1).

Source: CoinGecko

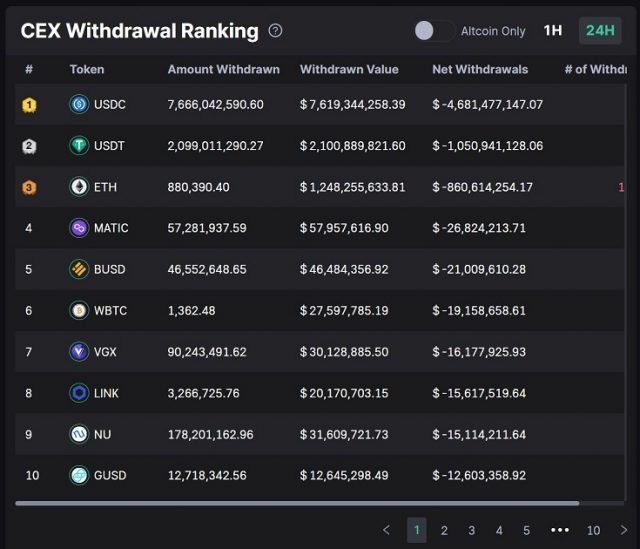

USDC is on the verge of a run, with 7.66 billion USDC withdrawn from cryptocurrency exchanges in the last 24 hours, according to statistics site Scope Protocol. According to another statistical site, DUNE, USDC supply has fallen 3.7% from 41.5 billion USDC on March 5 to 40 billion USDC at the time of writing.

Source: Wu Blockchain (Data: Scope Protocol)

According to Wu Blockchain, a cryptocurrency-related information provider, the redemption of USDC by major investment companies is accelerating, and 2.4 billion USDC is believed to have been burned in the past 24 hours. For large investment firms, there is a desire to avoid the risk of having a large amount of stablecoins that cannot be redeemed 1:1 with the value of the US dollar.

Currently, the top three stablecoins by market capitalization, Tether (USDT), USDCoin (USDC), and Binance USD (BUSD), all rely on “dollar reserves” held by banks. If access to dollar reserves is cut off due to regulatory developments or bank failures like this one, it will have a big impact on the cryptocurrency market.

The fourth stablecoin “DAI” uses a decentralized mechanism managed by smart contracts, but about 50% of the reserve is made up of “USCCoin (USDC)”. As a result, DAI is down -11% from the previous day and is trading at $0.889 (at the time of writing). The total issuance of DAI has reached $5.1 billion, and the impact may spread to the treasury of the DAO (Decentralized Autonomous Organization) that owns DAI, as well as the trading and rental market for stablecoins.

In February 2011, the New York State Department of Financial Services (NYDFS) just ordered Paxos National Trust (Paxos Trust Company) to suspend new issuance of the US dollar-linked stablecoin “BUSD”. In March, US-based Silvergate Capital announced plans to suspend banking services for cryptocurrency-related companies.

connection:BlockFi deposits billions of dollars at Silicon Valley Bank: Report

The post US Circle puts transfer of $3.3 billion USDC reserves pending at Silicon Valley Bank appeared first on Our Bitcoin News.

2 years ago

138

2 years ago

138

English (US) ·

English (US) ·