2011 1Q financial results announced

Coinbase, a major US crypto asset (virtual currency) exchange, announced its financial results for the first quarter of 2023 (January to March) on the 4th.

In a letter to shareholders, Coinbase explained that this quarter was a turning point for Coinbase as its efforts to reduce costs, manage risk, and develop products began to pay off. He also said he sees the Wells Notice from the U.S. Securities and Exchange Commission (SEC) as an opportunity to clarify U.S. crypto regulation.

connection: U.S. SEC investigates Coinbase on suspicion of violating securities laws Sends Wells notice

The company’s Q1 operating costs fell 24% QoQ, while net profit increased 22%. The result was a net loss of $79 million (approximately ¥10.6 billion), but adjusted EBITDA turned into a profit of $284 million (approximately ¥38.2 billion).

What is EBITDA

Abbreviation for Earnings Before Interest Taxes Depreciation and Amortization. Refers to profit calculated by adding interest expenses and depreciation expenses to profit before tax. (From SMBC Nikko Securities)

Cryptocurrency Glossary

Cryptocurrency Glossary

As for adjusted EBITDA, some forecasted a deficit of $36 million (about 4.8 billion yen). Following the announcement, Coinbase shares are up more than 18% from the previous day.

A Coinbase executive told cryptocurrency media The Block that this growth was driven by revenue from subscriptions and services.Subscription and service earnings include interest income such as staking

In addition, cryptocurrency trading-related revenue in 1Q increased 16% year-on-year to $375 million (approximately ¥50.5 billion). Meanwhile, trading volumes were flat.

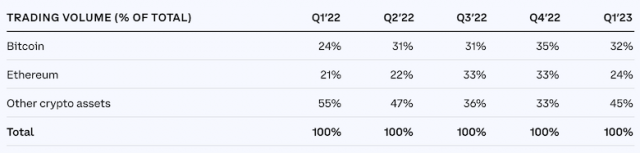

Looking at transaction volume by issue, Bitcoin (BTC) accounted for 35% to 32% and Ethereum (ETH) decreased from 33% to 24% compared to the previous quarter. “Other stocks” increased from 33% to 45%.

Source: Coinbase

Outlook for 2Q

Going forward, Coinbase said it will strive to improve adjusted EBITDA for the full year compared to 2022.

In 2Q 2023, we expect revenue from subscriptions and services to decline, mainly due to the decline in the market capitalization of the stablecoin USDC. He also said he expects costs to increase due to litigation costs. Litigation costs are believed to refer to litigation with the SEC.

“We want to avoid lawsuits, but we will defend ourselves and the industry as a whole if necessary,” the letter said of the SEC’s crackdown.

connection: U.S. Court of Appeals Orders SEC to Respond to Coinbase Petition

The letter to shareholders concludes with an explanation that although the cryptocurrency industry is volatile due to uncertainties in the banking industry and regulations, the company will continue to strive to increase revenue while reducing costs. .

connection: What is the virtual currency exchange Coinbase | Information and points to note for investors

The post US Coinbase, 2023 1Q performance exceeds forecast Stock price also rises appeared first on Our Bitcoin News.

2 years ago

92

2 years ago

92

English (US) ·

English (US) ·