February 15 (Wednesday) morning market trends (compared to the previous day)

- NY Dow: $34,089 -0.4%

- NASDAQ: $11,960 +0.5%

- Nikkei Stock Average: ¥27,602 +0.6%

- USD/JPY: 133 +0.5%

- USD Index: 103.2 -0.11%

- 10-year US Treasury yield: 3.75 +0.9%

- Gold Futures: $1,866 +0.1%

- Bitcoin: $22,227 +2.8%

- Ethereum: $1,557 +4.8%

traditional finance

crypto assets

Today’s New York Dow fell after last night’s CPI announcement, but the extent of the decline is limited. The Nasdaq continued to rise. It became an inflation indicator that exceeded expectations, and the speculation that the FRB would continue to raise interest rates increased, and the dollar exchange rate and US Treasury yields surged.

【preliminary report】

US January CPI data release

・CPI (vs. previous month): This time +0.5% Last time +0.1% Forecast +0.5%

・CPI (year-on-year): This time +6.4% Last time +6.5% Forecast +6.2%

・Core (vs. previous month): This time +0.4% Last time +0.4% Forecast +0.4%

・Core (YoY): This time +5.6% Last time +5.7% Forecast +5.5% pic.twitter.com/Ql96JsxeIu

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

January’s US CPI was largely in line with expectations, but hinted at continued inflationary pressures. Year-on-year growth slightly exceeded expectations for both the composite and core indices. Inflation continues to slow down compared to the previous month, but the pace of deceleration is the lowest since autumn last year. Rising housing costs and petrol were the main drivers of CPI.

Speculation about a halt to interest rate hikes has receded since May, but after the US CPI was announced, Philadelphia Federal Reserve Bank President John Harker said, “In my personal opinion, the series of rate hikes has not ended yet, but they will end soon. It’s very likely,” he said. Also, there seems to be a view that the Fed has not changed its stance before the CPI announcement.

As for the view of big companies, Goldman Sachs CEO Solomon said yesterday that the consensus among CEOs has turned somewhat dovish in the last few months, amid a series of predictions that the economy is headed for recession. He commented that he also showed the view that the sentiment of CEOs of each company is improving.

The US Department of Labor’s Bureau of Labor Statistics (BLS) has now updated the weights used in its calculations from the January CPI. The weight of housing has been increased, but the weight of both transport and food has been reduced. The BLS will also use consumer spending data from 2021 to update the CPI weights annually based on one calendar year of data. It will change the traditional practice of updating the weights every two years using two years of spending data.

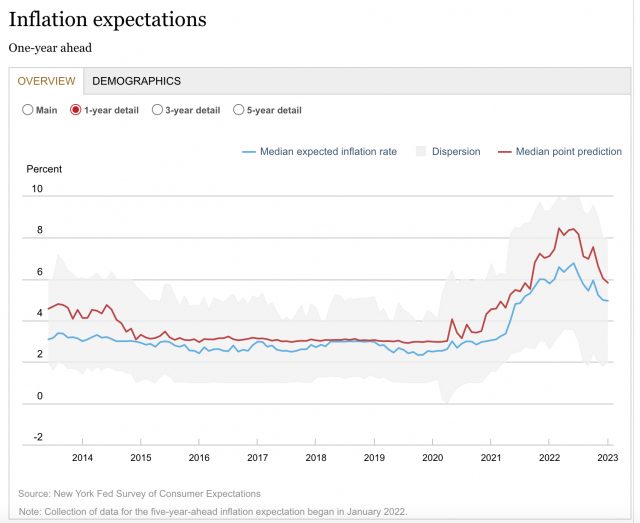

In addition, according to the New York Fed’s survey of US consumers’ inflation expectations for January, released on the evening of the 13th, the rate of inflation expectations one year ahead fell from the previous month for the third month in a row. The expected value for the next three years also decreased from the previous time, reaching the lowest level since October 2020. The slowdown in inflation appears to have contributed to an improvement in investor sentiment.

Source: New York Fed

Meanwhile, a University of Michigan survey released last Friday showed inflation expectations one year ahead, up from January but still well below levels seen in the first half of last year.

Key economic data dates for February

- 15th 22:30 (Wednesday): US January retail sales

- 16th 22:30 (Thursday): US January Producer Price Index

- 23rd 22:30 (Thursday): U.S. October-December Quarterly GDP Personal Consumption and Core PCE Revised Values

- 24th 22:30 (Friday): US January Personal Consumption Expenditure (PCE deflator)

- 24th 24:00 (Friday): University of Michigan Consumer Confidence Index February Confirmed value

connection: What is the CPI (Consumer Price Index) that attracts attention in the virtual currency market?

US stocks

It was reported yesterday that US IT giant Microsoft will cut more than 617 jobs in its hardware division, including Xbox, HoloLens and Surface. A company representative declined to comment specifically, but said the company remains committed to its mixed reality business. In addition, the company’s business-specific SNS “LinkedIn” also reported a reduction in personnel in the recruiting department.

Microsoft has announced that it will lay off the equivalent of 10,000 workers in January. Against the background of layoffs at Meta, Amazon, and others, there seems to be growing concern about a recession in the performance of major IT and high-tech companies this year. Based on Refinitiv IBES data, earnings for major companies in the S&P 500 index are now expected to fall 2.8% year-on-year, according to Reuters.

Nvidia, a major GPU manufacturer, continues to grow. Analysts have raised their price targets on the grounds that artificial intelligence (AI) could drive long-term growth in data centers. Since AI tools such as chat GPT need to process large amounts of data instantly, high-performance GPUs and data center-related products provided by the company are attracting increasing attention.

Compared to the previous day for individual stocks, NVIDIA +5.4%, c3.ai +10.2%, Big Bear.ai +5.8%, Tesla +7.5%, Microsoft +0.3%, Alphabet +0.07%, Amazon +0.16%, Apple -0.42% , Meta +0.02%, Coinbase +4.6%, Silvergate Capital +18.1%.

connection: Recommended for cryptocurrency investors, advantageous shareholder benefits “10 selections”

next GM radio

connection: “GM Radio” Ethereum L2 developer Scroll will participate next time

The 6th GM Radio will be held from 12:30 this Thursday. Sandy Peng, co-founder of the zk rollup development company “Scroll”, will be invited as a guest to ask questions about competition between L2 and future plans under the theme of “ZK competition in EVM equivalence”. .

Our next #GMRadio will feature @Scroll_ZKPa native zkEVM scaling solution!

Our next #GMRadio will feature @Scroll_ZKPa native zkEVM scaling solution!

Our guest will be co-founder Sandy Peng (@SandyPeng1)

Our guest will be co-founder Sandy Peng (@SandyPeng1)

Tune in to hear what sets Scroll apart from other rollups, both zero-knowledge and optimistic!

Tune in to hear what sets Scroll apart from other rollups, both zero-knowledge and optimistic!

See you there! https://t.co/d1dehYPP1k pic.twitter.com/NFKODI0xZn

— CoinPost Global (We’re hiring!) (@CoinPost_Global) February 10, 2023

GM radio last week

The 5th GM Radio was held last Thursday. Guest speaker Rahul Sethuram, co-founder of Connext, talked about US VC-related trends, the public launch of Connext, the benefits of xApps, and future plans.

https://t.co/SvfiT0Zviy

— CoinPost Global (We’re hiring!) (@CoinPost_Global) February 9, 2023

The post US CPI continues to slow down Nasdaq continues to rise, dollar soars | 15th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

137

2 years ago

137

English (US) ·

English (US) ·