June 14 (Wednesday) morning market trends (compared to the previous day)

- NY Dow: $34,212 +0.4%

- Nasdaq: $13,573 +0.8%

- Nikkei Stock Average: ¥33,018 +1.8%

- USD/JPY: 140.2 +0.01%

- USD Index: 103.2 -0.3%

- 10-year US Treasury yield: 3.8 +1.6% per annum

- Gold Futures: $1,956.9 -0.6%

- Bitcoin: $25,835 -0.2%

- Ethereum: $1,738 0%

traditional finance

crypto assets

NY Dow Nasdaq today

Today’s NY Dow rose to +145 dollars for 6 consecutive days. The Nasdaq also closed at +111 dollars. Last night’s US CPI (Consumer Price Index) showed a slowdown in inflation, and the FOMC, whose results will be announced tomorrow, seems to be sure to suspend interest rate hikes.

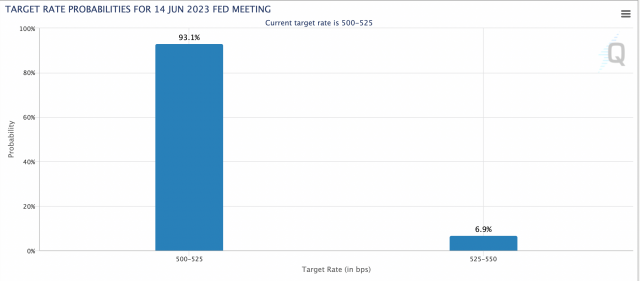

In response to the CPI result, the interest rate futures market’s expectations for a pause in interest rate hikes surged from yesterday’s 79% to around 93%. On the other hand, the likelihood of an additional interest rate hike at the July FOMC meeting remains around 60%.

Source: CME

May Consumer Price Index (CPI) Data

【preliminary report】

US May CPI data release

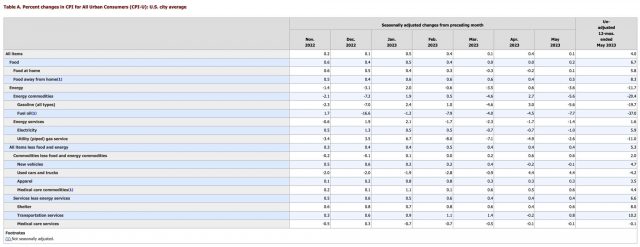

・CPI (vs. previous month): This time +0.1% Last time +0.4% Forecast +0.3%

・CPI (year-on-year): This time +4.0% Last time +4.9% Forecast +4.2%

・Core (vs. previous month): This time +0.4% Last time +0.4% Forecast +0.4%

・Core (year-on-year): this time +5.3% previous time +5.5% forecast +5.2%

— CoinPost Virtual currency media[WebX held in July](@coin_post) June 13, 2023

The year-on-year rate of increase in both the overall and core consumer price indexes in May fell below the previous month. The 4% year-on-year rise in the headline CPI has slowed significantly since the previous survey.

According to the details, improvement in inflation was seen in almost all items, but the decline in energy prices was the most affected. On the other hand, the core CPI, which excludes food and energy, increased by 0.4% from the previous month for the third straight month. The pace of slowing core inflation remains sluggish.

Source: bls.gov

Some economists say the results give the Fed room to hold off on a rate hike at tomorrow’s meeting, but core inflation remains high and the Fed is unlikely to cut rates later this year.

dollar yen

After the announcement of the CPI, the yen rose to the low 139 yen level against the dollar at one point, but there are high expectations that the current monetary easing measures will be continued at the Bank of Japan’s monetary policy meeting scheduled to be held on Friday, 16th. The dollar/yen had dropped to 140.30.

Source: Yahoo! Finance

economic indicators

- Wednesday, June 14, 21:30: May Wholesale Price Index (PPI)

- June 15, 3:00 (Thursday): US Federal Open Market Committee (FOMC) policy interest rate announcement

- June 16 (Friday): Bank of Japan Monetary Policy Meeting Policy interest rate announcement

U.S. stocks continue to rise

Today’s US stock market rose, mainly in IT and high-tech, on signs of slowing inflation. The S&P 500 stock index rose for the fourth consecutive day. Individual stocks compared to the previous day: Nvidia +3.9%, c3.ai +14.6%, AMD -3.6%, Tesla +3.5%, Microsoft +0.7%, Alphabet +0.1%, Amazon +0.07%, Apple -0.2%, Meta + 0.1%.

AMD AI Related Product Line Announced

At a briefing held on the 13th of US time, AMD, a major US semiconductor company, announced the “4th generation AMD EPYC 97X4 processor” with a maximum of 128 cores and the “4th generation AMD EPYC processor with 3D V-Cache” equipped with 3D V-Cache. Two new data center CPUs and the AMD Instinct MI300 series accelerator, which is a GPU/APU for generative AI, were announced at the same time. It is a stance to strengthen chips for AI and challenge the dominance of industry leader Nvidia’s GPU.

The company’s stock price turned to selling after rising for three days in a row, and finally fell -3.6%.

connection: Top 3 rankings of ETFs (listed investment trusts) in Japan and overseas that can be purchased with NISA

Cryptocurrency-related stocks overall high

- Coinbase|$52.4 (+3.6%/-1.7%)

- MicroStrategy | $283.8 (+2.2%/+0.5%)

- Marathon Digital | $9.6 (+3.7%/+3.2%)

Cryptocurrency-related stocks rise in response to CPI results. On the other hand, bitcoin showed volatile price movements.

Source: Binance

connection: Bitcoin weekly inflow of virtual currency exchange is the third largest in history, suggesting continuation of minor selling

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

The post US CPI, lowest growth since March 2021 US stocks continue to rise | 14th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

117

2 years ago

117

English (US) ·

English (US) ·