The US House of Representatives voted in favor of the Fiscal Responsibility Act, which includes a debt ceiling agreement. First, let’s review the current situation.

The words “crypto” and “cryptocurrencies” were not included at all in the first draft of the bill. I was debating if that was a good thing or a bad thing, but since the Digital Asset Mining Energy (DAME) tax wasn’t included, I think it’s a plus for the industry, and I’ve come to the conclusion that it’s a good thing. Calm down.

The DAME tax imposes a 30% tax on crypto asset mining operators. It was proposed because of concerns about the use of fossil fuels in mining and the associated environmental burden.

Avoiding taxes on mining companies

Ironically, the debt ceiling deal could be seen as a triumph for the fossil fuel pro-fossilists. It also includes provisions for the early completion of a natural gas pipeline between West Virginia and Virginia. The pipeline will deliver natural gas extracted from shale gas fields to markets in the mid- and southern US Atlantic coasts.

On the surface, this clause may be a plus for Bitcoin (BTC) mining operators (miners). Some Bitcoin miners use surplus natural gas as an energy source, so some companies are building facilities near shale gas fields.

If the infrastructure for natural gas is strengthened, production is likely to increase, and surplus natural gas will increase. This means more energy sources for minors in the region. You could call this an indirect benefit, and definitely an unintended benefit.

Despite the indirect benefits, Bitcoin reacts positively to the debt ceiling deal. The day after President Biden and Speaker of the House McCarthy reached a basic agreement on the 27th, it rose 4%.

The rise appears to be at least related to increased certainty and the relief that crypto-hostile clauses were not included.

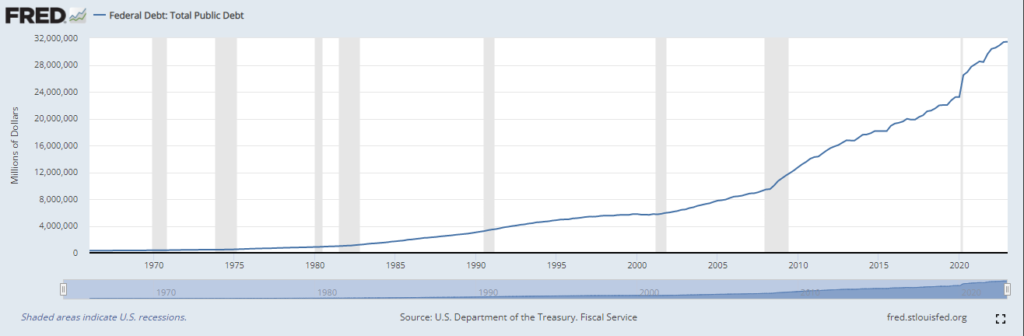

Bitcoin trend indicator (CoinDesk)

Bitcoin trend indicator (CoinDesk)The rally was the 10th biggest single-day move in 2023.

Future outlook

What will happen next?

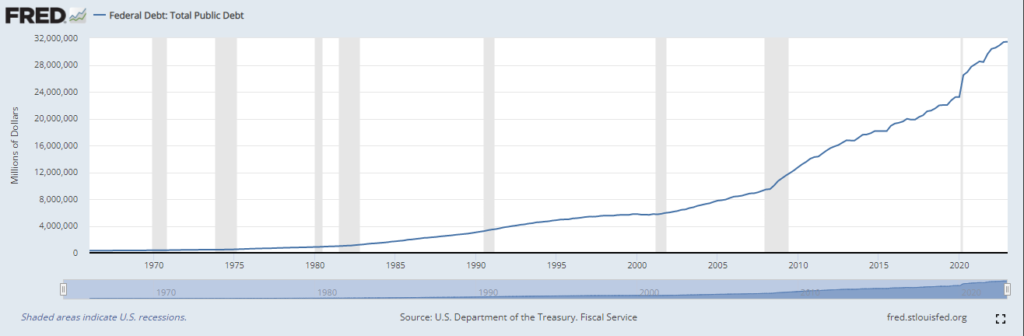

Public debt, such as government bonds, will undoubtedly increase, and so will the interest paid by the government.

Total federal debt (St. Louis Fed)

Total federal debt (St. Louis Fed)With short-term interest rates higher than long-term interest rates, the yield gap between 2-year and 10-year Treasuries remains negative. Such an “inverted yield” problem cannot be ignored. It’s like declaring that you believe you’re more likely to be repaid in 10 years than in 2 years, and it’s not a statement of the current strength of the economy.

Government bond issuance could increase to restore balances in government deposit accounts (TGA). The resulting loss of liquidity from financial markets could be a headwind for the Bitcoin price.

Another interpretation is that borrowing and spending by governments can be seen as the reason why cryptoassets have value. This is especially the case with Bitcoin, which has a limited supply. Ethereum (ETH) proponents will also highlight its deflationary nature.

don’t use it as a political tool

Going forward, it will be interesting to see to what extent cryptocurrencies are used as a means to win political battles. Both Democrats and Republicans have people who support and oppose cryptocurrencies. Over the past year, it has clearly become more partisan, and I see that as a problem.

The removal of the tax on cryptocurrency mining gives the administration room to argue that it did not take a hostile stance against bitcoin, avoiding a still-unsolved problem.

Going forward, it will be important to keep an eye on what people say about crypto assets in the political world. However, as far as the debt ceiling agreement is concerned, nothing was said at all.

|Translation and editing: Akiko Yamaguchi, Takayuki Masuda

|Image: Shutterstock

|Original: Washington Ignored Crypto for Now. That’s Good for Bitcoin.

The post US Debt Ceiling Agreement Does Not Include Crypto Assets ── Bitcoin Plus[Column]| coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

135

2 years ago

135

English (US) ·

English (US) ·